The latest decentralized finance platform to undergo an overhaul is crypto leverage protocol Alpha Homora. The team has launched the second version of the platform that focuses on leveraged liquidity.

The announcement added that the launch will begin the migration of existing liquidity pools to the upgraded version. Alpha Homora is a product from Alpha Finance Lab which allows leveraging positions in yield farming and liquidity providing pools.

Its v2 integrations include existing DeFi protocols such as Curve, Balancer, SushiSwap, and Uniswap for leveraged yield farming. It has also integrated Cream Finance’s Iron Bank for lending and borrowing. Alpha Homora recently added Yearn Finance to that list offering leveraged pools with the DeFi aggregator.

Leveraged Liquidity Provisions

By allowing leveraging, yield farmers are encouraged to hold on to their farmed tokens and reinvest them for better returns rather than just selling them on the market. Yield farmers can open up to 9x leveraged positions for selected pools.

There are four leveraged pools now available now on Alpha Homora v2. They include Curve’s 3pool (USDT, USDC, DAI) where users can farm CRV or take leverage on stablecoins. Balancer’s PERP/USDC will allow token farming and stablecoin leverage. The SushiSwap ETH/SUSHI pool can be used to farm SUSHI and leverage ETH, and Uniswap’s ETH/UNI pool offers only leverage on ETH.

Uniswap’s ETH/DPI and SushiSwap’s ETH/DPI pools will be migrated on Feb. 2.

Alpha Homora v2 uses a concept of collateral credit and borrowing credit with each asset having its own collateral or borrowing credit value. This value determined how much credit is gained from collateralizing or borrowing an asset.

The blog post explained;

“If an asset is volatile, the collateral credit will be low and the borrowing credit will be high. With this mechanism, Alpha Homora v2 can set parameters according to the volatility of each asset and set different buffer parameters for different assets to ensure security of the protocol.”

The platform added that to celebrate the launch of its v2 release, it was going to distribute Alpha Homora v2 NFTs (non-fungible tokens) to selected users.

ALPHA Price Update

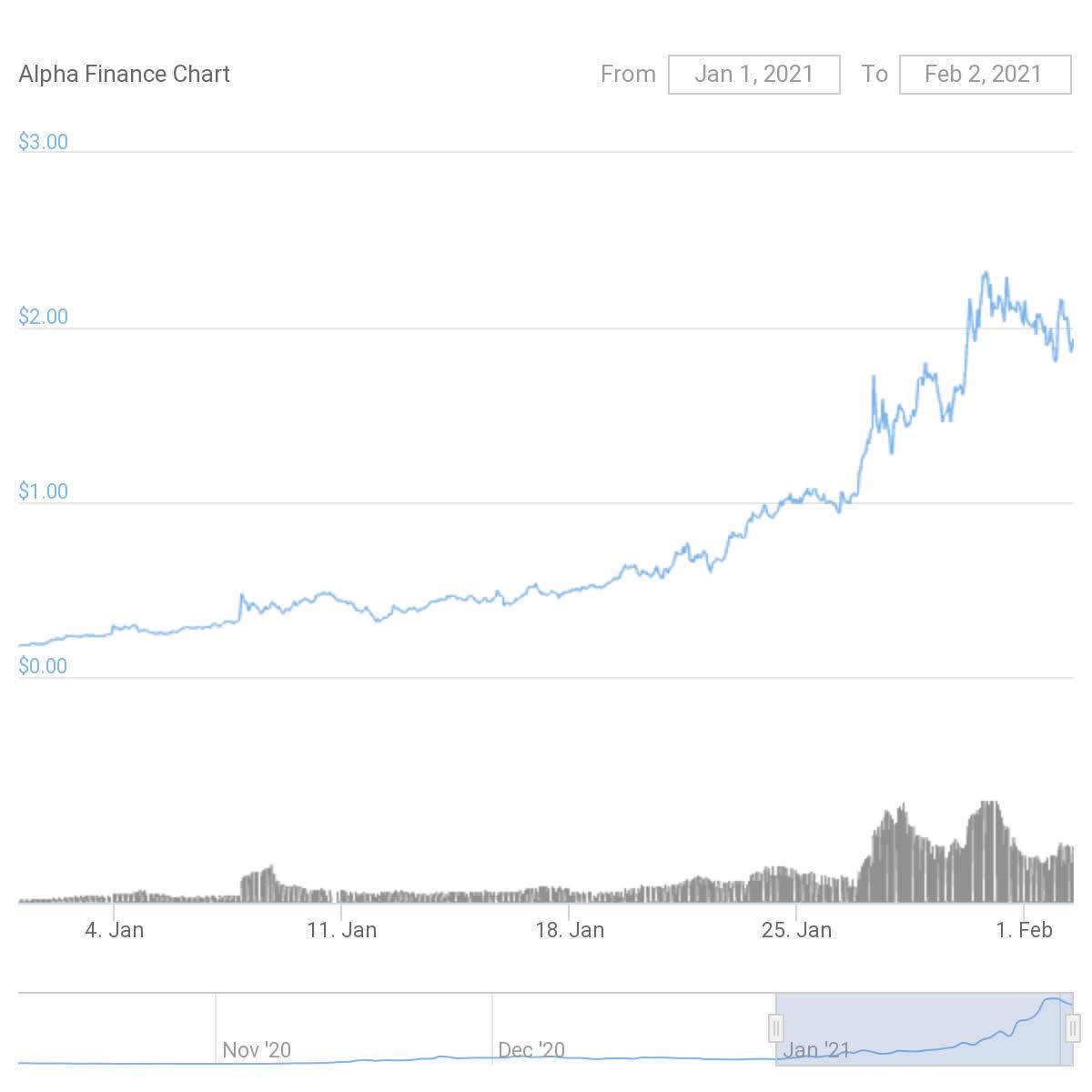

The protocol’s native ALPHA token has lost around 5% on the day in a retreat back to $1.93. Over the past seven days, however, it has doubled in price. Since the beginning of this year, ALPHA has surged a monumental 700% from the $0.18 it traded at on Jan. 1 according to Coingecko.

Total value locked has also surged from around $190 million on Jan. 1 to $690 million at the time of press according to DeFi Pulse. The 260% TVL pump has pushed the protocol up to the tenth rank in the DeFi charts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.