Data platform CryptoSlam found that approximately 95% of activity on the NFT marketplace LooksRare stems from wash trading. LooksRare is an NFT marketplace launched by two anonymous developers.

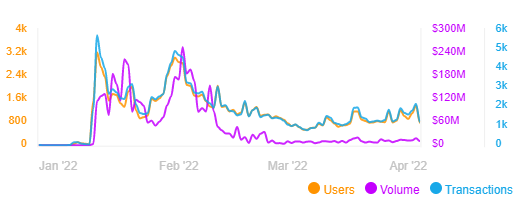

Reports have emerged that the trading activity on the popular NFT marketplace LooksRare largely comes from wash trading. The platform has seen a total of $22.2 billion in trading volume, with around 106,000 transactions.

Data platform CryptoSlam had previously stated that about 95% of the total activity on the platform is wash trading.

Wash trading is considered “fake trading.” It happens when funds are moved around between users in a rather meaningless way. They are not actual sales but rather funds simply moving back and forth between an individual or group who is on both the buyer’s and seller’s side.

Individuals make an unethical profit from wash trading through artificial inflation in price, as NFTs give the appearance of value as they are traded around. Furthermore, with more transactions taking place, the platform gets more in revenue fees.

LooksRare was launched by two anonymous developers in Jan. 2022 and has quickly grown to become an alternative to NFT marketplaces like OpenSea. NFT sales have declined this year, but it still finds many users who are seeking to make a profit — ethical or not.

The implications of this activity could be severe, especially as regulators look more closely at the market. In other markets, wash trading is considered illegal, and ever-growing regulation could clamp down instances in the crypto market.

NFT markets experience heavy wash trading

Blockchain analysis and security firm Chainalysis has reported on wash trading in the NFT market, noting that it has resulted in artificial price increases. In its report from February 2022, Chainalysis found that 262 users had sold NFTs to addresses they were associated with. In addition, the firm observed that money laundering often took place through NFTs.

Interestingly, however, the majority of NFT wash trades have not been making profits. Those who have been profitable have made incredible profits, though, putting overall profits in the millions.

Their success might not last long, though, as Chainalysis points out that authorities are turning their attention to the crypto market. The firm recommends that marketplaces discourage such activity, for the betterment of the industry as a whole.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.