The Swiss Blockchain Federation has reported that up to 90 percent of cryptocurrency and blockchain firms in Switzerland could be bankrupt in six months without any government intervention. This is due to the ongoing COVID-19 situation which has severely hampered the industry’s activities.

The COVID-19 outbreak has had dire effects not just on the global economy but on various sectors of industry as well. British Airways has announced that they will be cutting tens of thousands of jobs over the next few months and many countries including the United States are predicted to face a recession.

While a global corporation like British Airways might have a difficult time bouncing back despite being a giant of the industry, smaller companies will find themselves even more vulnerable, especially if they are in an emerging industry.

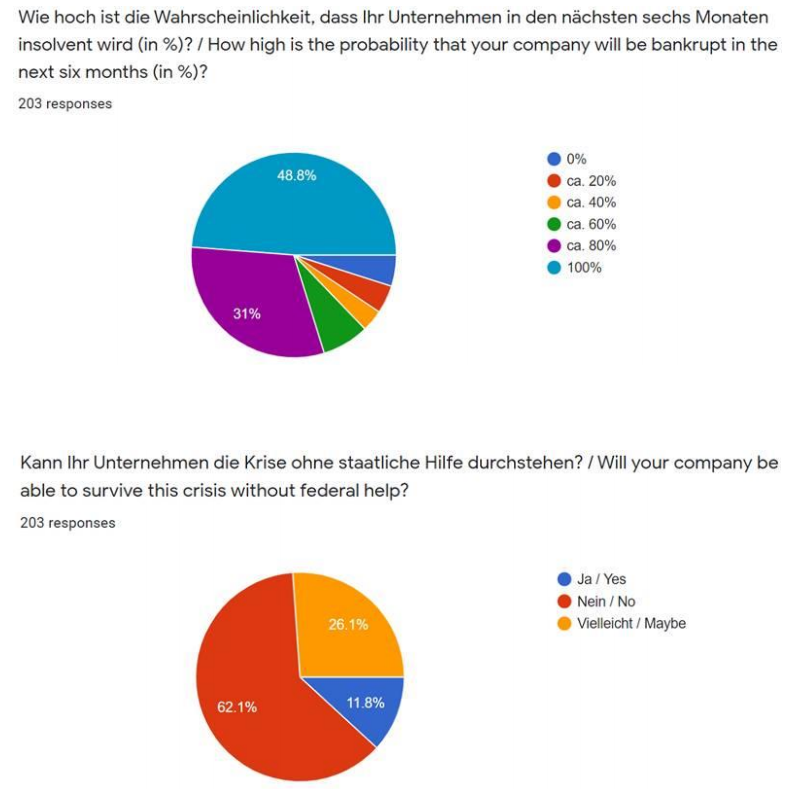

According to the Swiss Blockchain Federation, about 90 percent of firms in the crypto valley are at risk of going bankrupt due to the current situation.

Many Cryptocurrency Firms are at the Risk of Closure

This revelation means that thousands of jobs are at risk across the board. Lorenz Furrer, Vice President of the Swiss Blockchain Federation, said that the crypto valley could very well ‘become the death valley’ if change does not occur. This information was determined by the Federation from reaching out to the 800 cryptocurrency firms in Switzerland and asking them how the pandemic has affected their business.

Blockchain Startup Haven Takes a Hit

Switzerland has, in the last few years, become a haven for blockchain entrepreneurship. Its legislation has been favorable towards the industry, so much so that Facebook’s Libra project is based in the country. The burgeoning industry provides employment to up to 4,000 people, many of whom are facing employment insecurity. Blockchain and cryptocurrency startups might be more vulnerable because the pandemic has significantly reduced investments across the globe and young companies do not have enough revenue to fall back on or qualify for government loans. It is also worth noting that startups rely on networking events and the like for fundraising efforts as does the blockchain and cryptocurrency industry.

The Crypto Valley Association has already been forced to postpone its annual conference and a slew of similar events within the sector have been postponed or canceled in light of the outbreak.

It is also worth noting that startups rely on networking events and the like for fundraising efforts as does the blockchain and cryptocurrency industry.

The Crypto Valley Association has already been forced to postpone its annual conference and a slew of similar events within the sector have been postponed or canceled in light of the outbreak.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored