Friday is the expiration day of many Bitcoin options, and open interest is currently at around $700 million. Crypto markets have been moving higher during the week, but are they about to rally even higher over the weekend?

Around 15,100 Bitcoin options contracts will expire on February 9. This week’s expiry event is much smaller than last week’s, but it could still have an impact on spot market momentum.

Bitcoin Options Expiry

The notional value for this Friday’s batch of expiring Bitcoin options contracts is $700 million, according to Deribit. The put/call ratio is 0.82, meaning that there are slightly more calls or long contracts being sold as puts or short contracts.

The notional value for today’s expiry event is $700 million. Moreover, there is still a lot of open interest at the $50,000 strike price, with 15,447 call contracts at that level. They have a notional value of $714 million, according to Deribit.

Additionally, there are 11,600 call contracts now at the $60,000 strike price, signifying that derivatives traders are growing bullish.

Earlier this week, Greeks Live observed:

“A huge block was traded that could lead the next leg of the market.”

It added that a whale,

“Bet big on February to see a big shock of 10% or more, but not sure of the direction, which is relatively rare in whale investment.”

Read more: How To Trade Bitcoin Futures and Options Like a Pro

In addition to today’s expiring Bitcoin options, 193,000 Ethereum contracts will also be expiring. These have a notional value of $473 million and a put/call ratio of 0.39, according to Deribit.

There is $450 million in open interest at the $2,400 strike price, which was reached on spot markets on February 8.

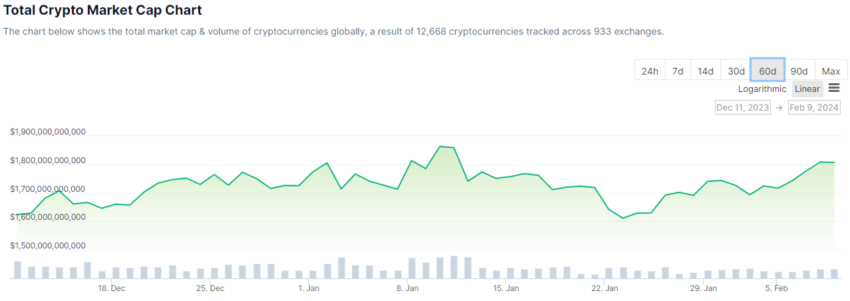

Crypto Market Outlook

Crypto markets are ending the week in the green with a 2.5% gain on the day, taking total capitalization to $1.83 trillion.

Bitcoin is leading the pack in terms of gain with 3.3%, and the asset topped $46,000 during the Friday morning Asian trading session. However, it encountered resistance at this level and has fallen back to $45,969 at the time of writing.

Ethereum prices were unmoved on the day, with the asset trading for $2,444 during the Friday morning Asian session.

Altcoins are a mixed bag at the moment, with Cardano (ADA), Litecoin (LTC), and Immutable (IMX) making gains. However, TRON (TRX) and Chainlink (LINK) are in the red at the moment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.