A huge number of Bitcoin options are set to expire today, marking the largest mass expiry for months. Derivatives trading fever has been ramped up recently in light of multiple ETF filings, but will speculators get burnt?

On June 30, around $4.8 billion in notional value Bitcoin options contracts will expire. It is the largest batch expiry of BTC options contracts for several months and may induce some market volatility.

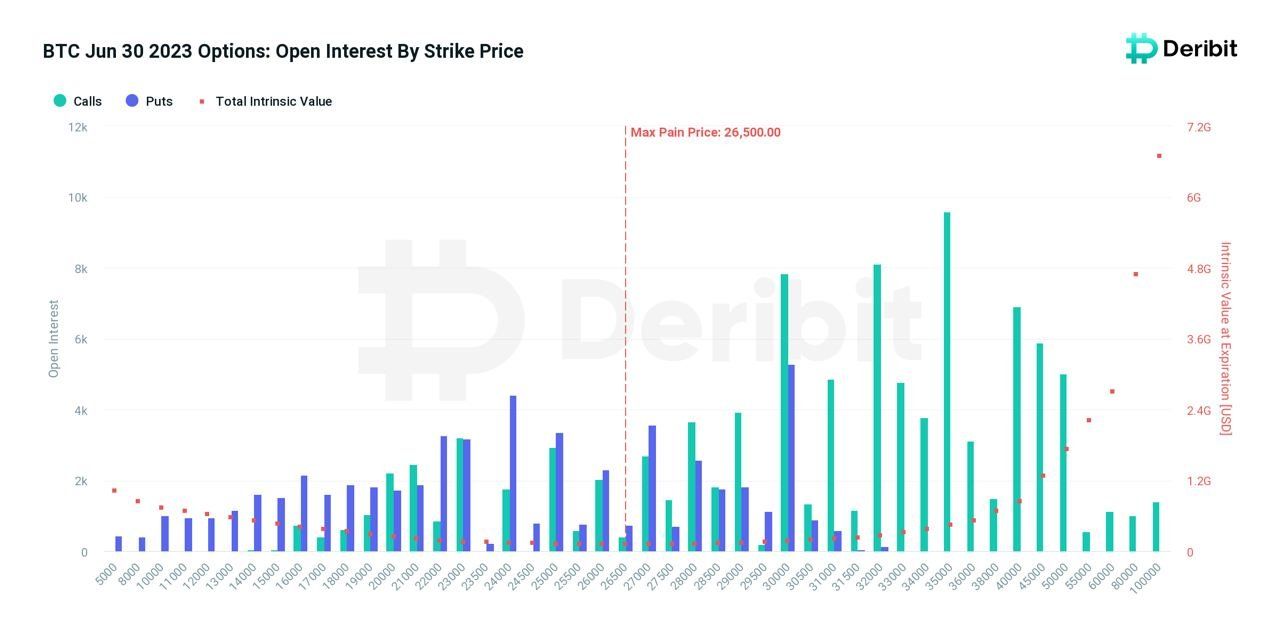

Bitcoin Options Max Pain

The put/call ratio is 0.56, meaning there are almost twice as many call (long) contracts as puts (shorts).

The ratio is calculated by dividing the number of put (short) contracts by the number of call (long) contracts. Values lower than 1 are considered bullish since more derivatives traders are trading in long contracts than shorts.

Additionally, the max pain point is $26,500. The max pain point is the price with the most open contracts. It is also the price at which the most losses will be made upon contract expiry.

Cinneamhain Ventures partner Adam Cochran commented that there could be some market volatility ahead:

“The max pain point on the BTC option expiry tomorrow is $26.5k?! Given how often crypto trends at least towards pain before expiry, could be a choppy few days…”

According to Deribit, open interest is currently 380,928. This refers to the number of unsettled contracts that have yet to expire.

Senior analyst Tom Dunleavy added:

“If these are rolled into more calls we should see spot buying from dealers to hedge their books; puts opposite story. Either way expect some volume.”

Learn more about crypto derivatives: What are Perpetual Futures Contracts in Cryptocurrency?

Additionally, there are around $2.3 billion in notional value Ethereum options also expiring on June 30. These have a similar put/call ratio of 0.58. The max pain point for the ETH contracts is $1,700.

Crypto Market Outlook

Crypto markets have been sideways since the big Bitcoin move on June 21. Overall market capitalization has been a 2.4% gain on the day, which is currently $1.23 trillion.

However, the BTC price has failed to break resistance at current levels for the second time this year. The asset was trading up 2% on the day at $30,758 at the time of writing.

Ethereum had gained 2.2% and was changing hands for $1,877 during the morning of June 30.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.