BeInCrypto looks at the five biggest altcoins losers in the entire crypto market this week, specifically from March 24 to 31.

The cryptocurrency prices that have fallen the most in the entire altcoin market are:

- Stacks (STX) price decreased by 20.21%

- Mina (MINA) price decreased by 16.90%

- SingularityNET (AGIX) price decreased by 15.04%

- Aptos (APT) price decreased by 13.37%

- Dash (DASH) price decreased by 12.13%

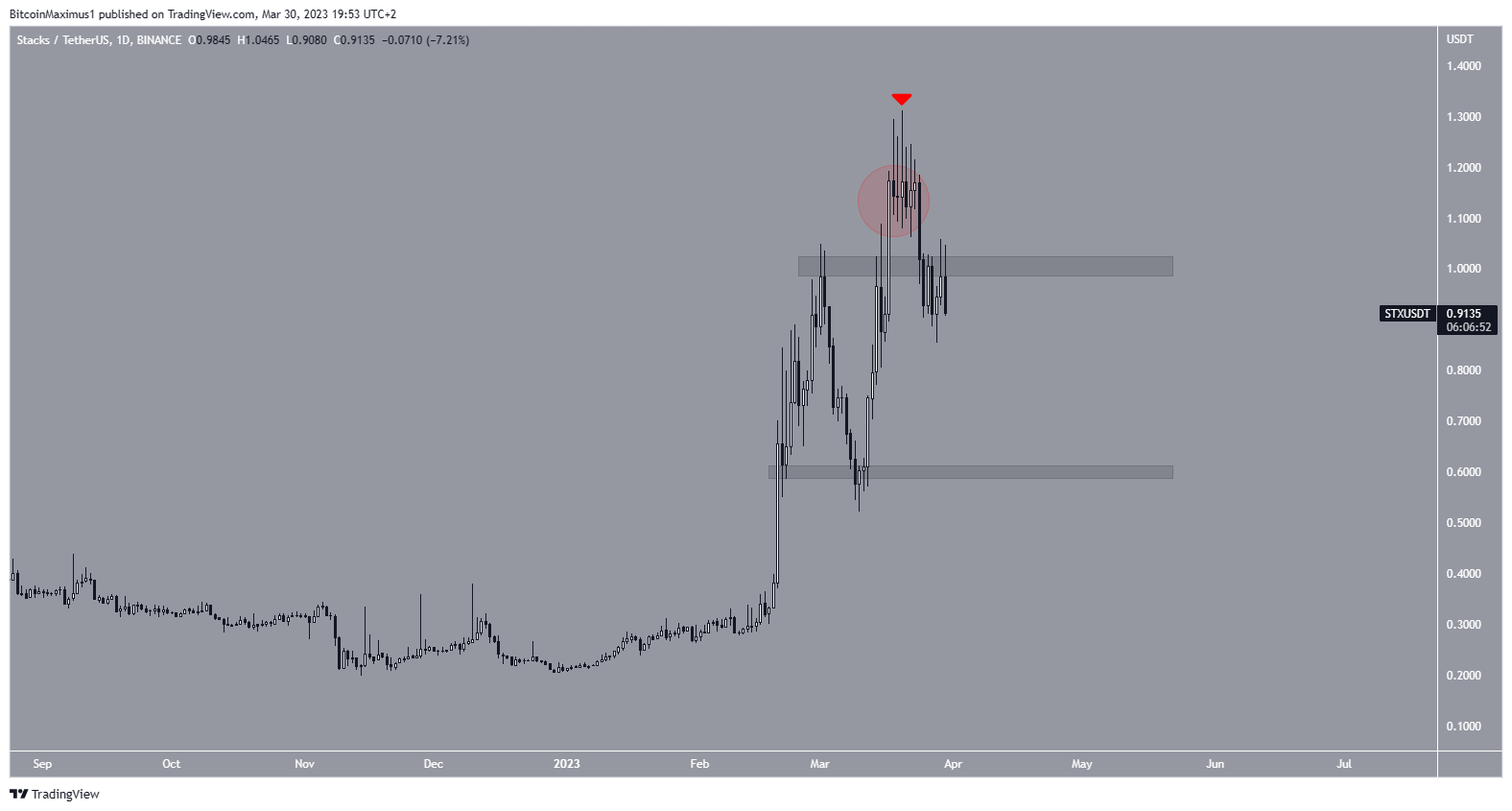

Stacks (STX) Price Leads Crypto Market Loses

The STX price has fallen since reaching a yearly high of $1.31 on March 20. The same day, it created a bearish candlestick with a long upper wick.

On March 30, the price broke down from the $1 horizontal area and validated it as resistance (red icon). This renders the previous breakout a deviation (red circle).

If the decrease continues, the next closest support would be at $0.60.

However, if the STX price reclaims the $1 area again, it could increase to $1.30.

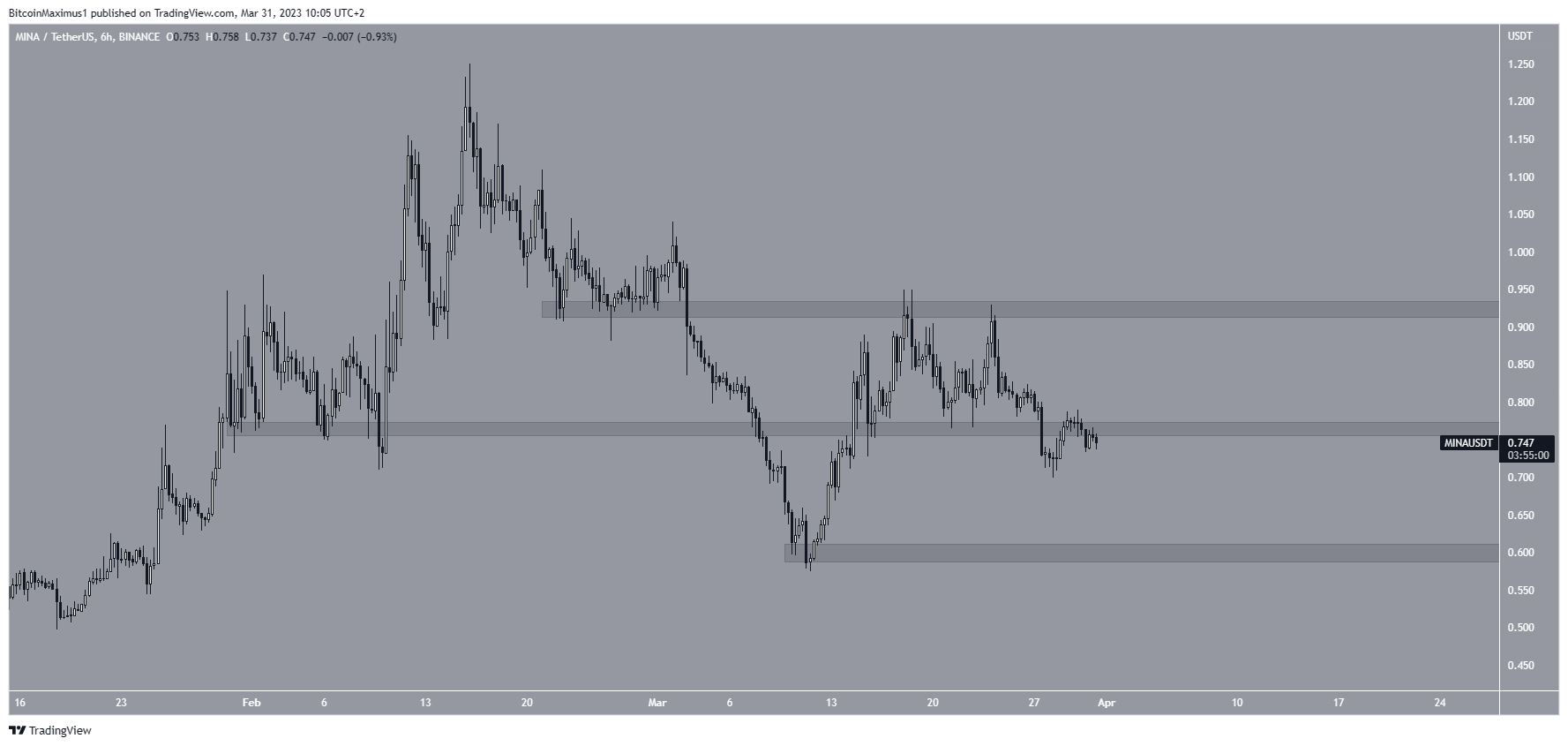

Mina (MINA) Falls Below Resistance

The MINA price has fallen since March 18. It created a lower high on March 24 and accelerated its rate of decrease afterward. On March 28, the price validated the $0.75 area as resistance (red icon)

If this leads to another drop, the MINA price could fall to $0.60.

However, if the price reclaims the $0.75 area, it could increase toward $0.90.

SingularityNET (AGIX) Attempts to Find Support

The AGIX price broke out from a descending resistance line on March 14. However, it failed to sustain its increase and fell to the line once more on March 28 (green icon). It is unclear if this will initiate another bounce.

In case it does, the closest resistance would be at $0.57.

However, if the AGIX price closes below the confluence of support levels at $0.35, it could break down toward $0.20.

Aptos (APT) Returns to Crucial Support

The Aptos price has increased since March 10, when it bounced at the $10 horizontal support area (green icon). However, the bounce was weak, and the price has nearly returned to the area once more.

Whether the digital asset breaks down from the $10 area or breaks out from the current descending resistance line will likely determine the future trend.

A breakdown could lead to lows near $7 while a breakout could lead to an increase toward $14.

Dash (DASH) Crypto Struggles After Breakdown

The DASH price broke down from an ascending support line on March 9, reaching a low of $43.53 two days later.

While the price bounced afterward, it failed to reclaim the ascending support line.

If the rejection continues, the digital currency could fall to the $48.30 support area again. However, an upward movement to $76 could occur if it reclaims the line.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.