BeInCrypto looks at the five biggest altcoin losers in the entire crypto market this week, specifically from May 26 to June 3.

The underperforming cryptos that saw prices falling the most in the entire cryptocurrency market this week are:

- Optimism (OP) price decreased by 13.40%

- Pepe (PEPE) price decreased by 12.96%

- Flare (FLR) price decreased by 9.61%

- Toncoin (TON) price decrease decreased by 6.10%

- Conflux (CFX) price decreased by 6.04%

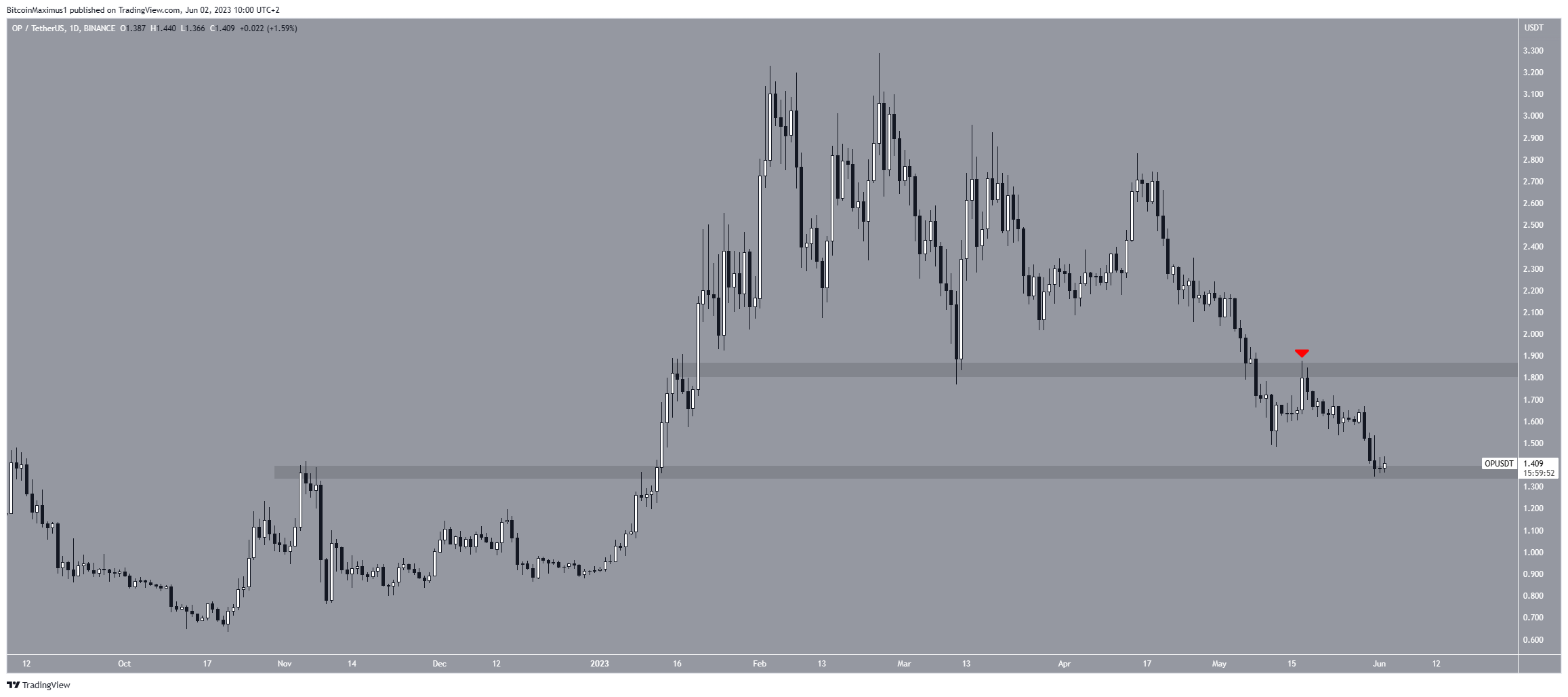

OP Price Leads Bearish Cryptos

The OP price has decreased since February 24. The downward movement led to a low of $1.34 on May 31.

During the downward movement, OP fell below the $1.85 horizontal area and validated it as resistance on May 17 (red icon). Afterward, the price fell to the aforementioned low.

If the OP price bounce, it could reach the $1.85 area again. However, if a breakdown ensues, the price could decrease to the next support at $1.

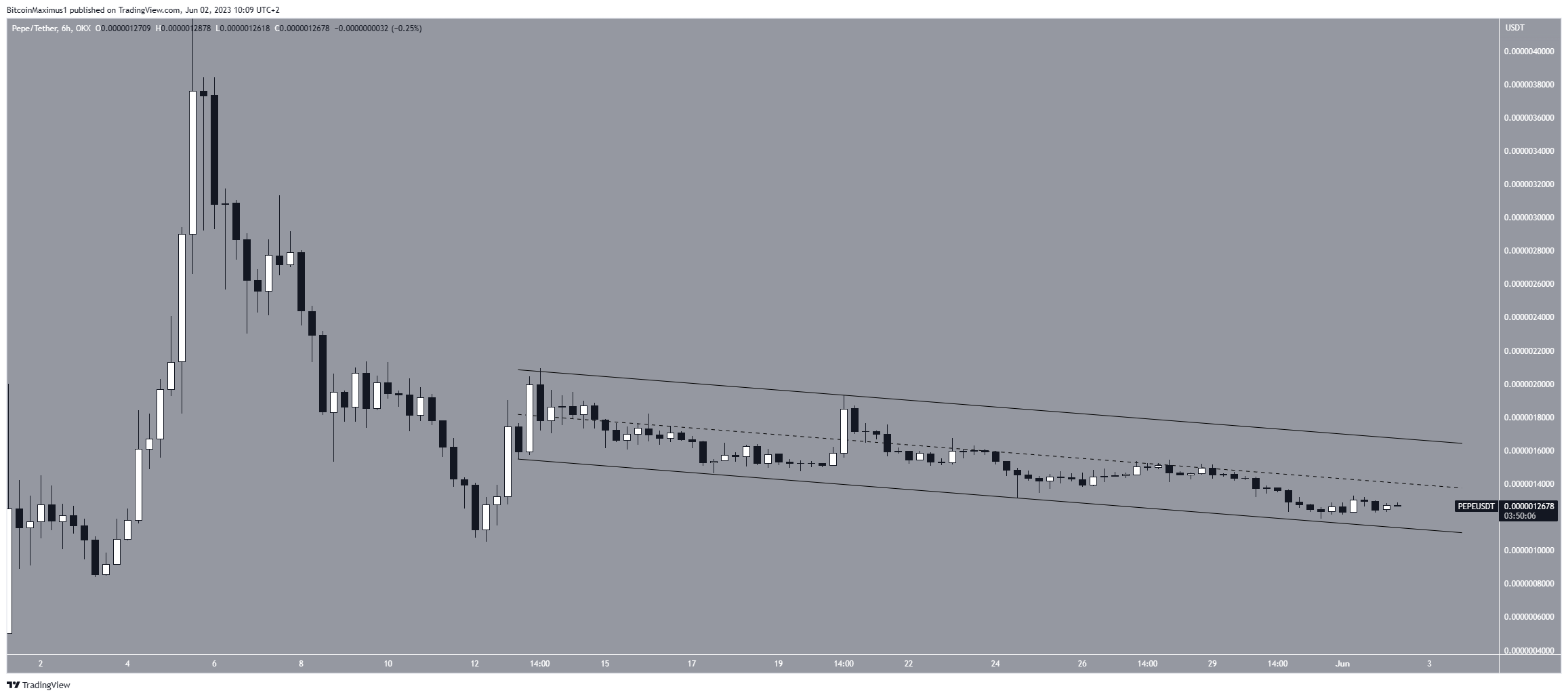

PEPE Price Trades in Corrective Pattern

Memecoin PEPE also joins the list this week. The PEPE price has decreased inside a descending parallel channel since May 13. The channel is considered a corrective pattern, meaning that it leads to breakouts most of the time.

Read More:

On May 31, the price bounced at the channel’s support line and has seemingly begun an upward movement.

The price can reach the channel’s resistance line if the increase continues. However, if a breakdown follows, the price can drop to the closest support at $0.0000008.

Flare Network (FLR) Risks Massive Sell-Off

The FLR price has fallen under a descending resistance line since January. The line has caused numerous rejections, more recently on April 14 (red icon).

Currently, the FLR price is at risk of breaking down from the $0.024 horizontal support area. If this occurs, a sharp plunge to $0.016 could follow.

However, if FLR bounces, the price can reach the resistance line at $0.030.

What is Flare token?

Toncoin (TON) Price Trades in Bullish Pattern

The TON price has decreased in a descending wedge since December 2022. The descending wedge is considered a bullish pattern, meaning it usually leads to breakouts.

Currently, the TON price trades at the confluence of the $1.80 horizontal support area and the wedge’s support line.

If the price bounces from there, it can reach the resistance line at $2.0.

However, if TON breaks down instead, a drop to the next closest support at $1.37 will be expected.

Conflux (CFX) Price Concludes Bearish Cryptos

The CFX price has decreased under a descending resistance line since March 19. The drop led to a low of $0.22 on May 12. This seemingly caused a breakdown from the $0.27 horizontal area.

However, the price reclaimed the area shortly afterward and made an attempt at breaking out from the line.

It can move to the next resistance at $0.43 if the price breaks out. However, if a breakdown ensues, CFX could decrease to the next support at $0.14.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.