With the larger crypto market down once again, Lido DAO prices rebounded back to lower levels after charting a short-term recovery.

The news of FTX filing for bankruptcy led to another global crypto market fall reversing the recent gains that top cryptocurrencies had recorded.

Lido DAO LDO token showed a near 30% recovery over the last day, appreciating from the $0.95 level. However, the larger market’s bearish tones pulled LDO price down by 4.5% at press time as Lido DAO token traded at $1.13.

LDO price had retested the $1.25 mark, but macro market uncertainty pulled the token’s price action back to red.

Network Participants Shift Away from LDO

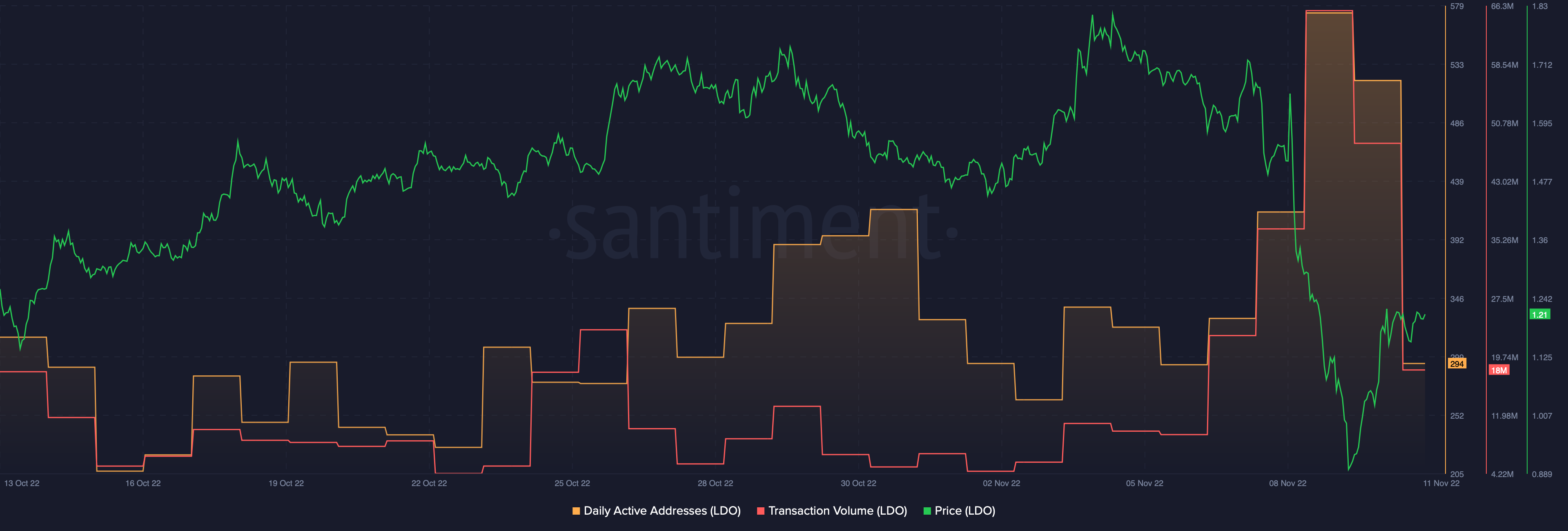

Despite LDO price’s short-term appreciation, there was a significant drop in daily active addresses (DAA) on Lido DAO. DAA noted an over 50% pullback on the last day.

Alongside DAA, transaction volumes also dwindled. Transaction volumes saw an over 70% fall from Nov. 10 to Nov. 11.

While the recent price appreciation brought some short-term relief to LDO prices, gains were hardly sustainable.

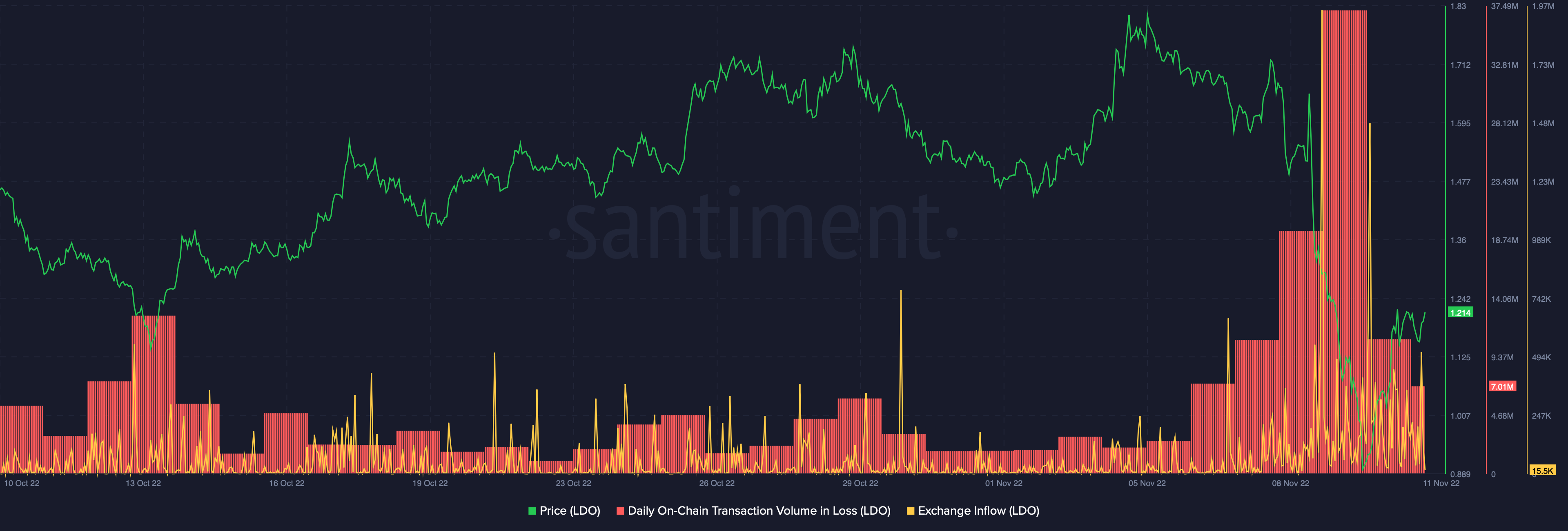

Notably, the daily on-chain transaction volume in loss rose to an all-time high on Nov. 9. With fear gripping LDO holders, the market saw considerable sell-offs, which could be seen in the high exchange inflows.

Exchange inflows spiked to almost four million LDO on Nov. 8, indicative of high sell-side pressure amid uncertainty.

Bigger Lido DAO Fish Exiting

Lido DAO short-term price momentum seemed mostly market driven. One reason behind the significant price appreciation LDO saw was the bullish momentum in ETH price.

Since Lido DAO is the biggest validator on the Ethereum network, the same aided short-term bullish price action for LDO. Nonetheless, the larger market’s sensitivity brought the LDO price down rather quickly.

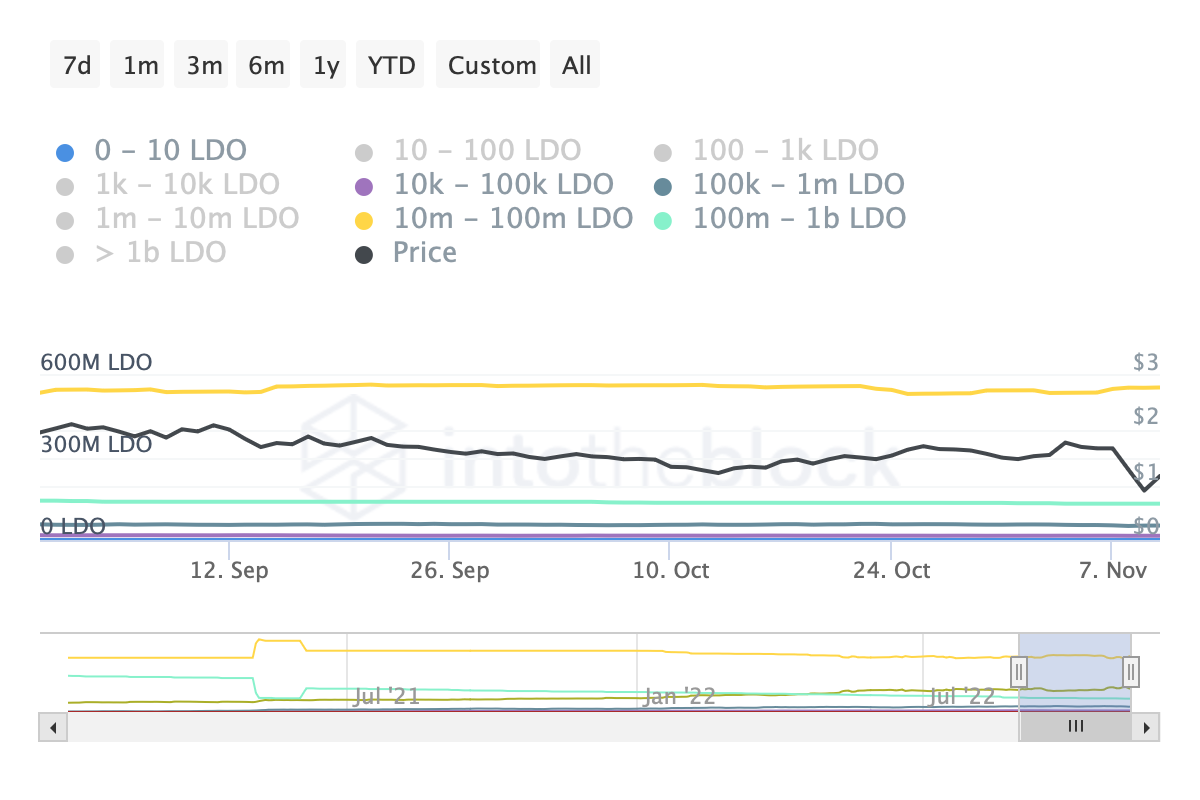

Another bearish long-term trend observed was that bigger fish holding a large chunk of LDO tokens were reducing their holdings. Addresses with 10,000 – 100,000 LDO dwindled by 2.87%, while addresses with 100,000 – 1 million LDO dropped by 7.22% over the last month.

Notably, addresses with 1 million – 10 million LDO noted an 8.00%. However, the same was largely balanced as 10 million – 100 million LDO addresses and 100 million – 1 billion LDO reduced their holdings by 1.64% and 2.44% over the last 30 days.

A look at Balance by Time Held for LDO showed that in the last 30-days, holder accounts reduced by 3.01%, while addresses saw a 4.04% drop. Noticeably, trader accounts rose by 32.14%, showing that the price action was largely at short-term holders’ mercy

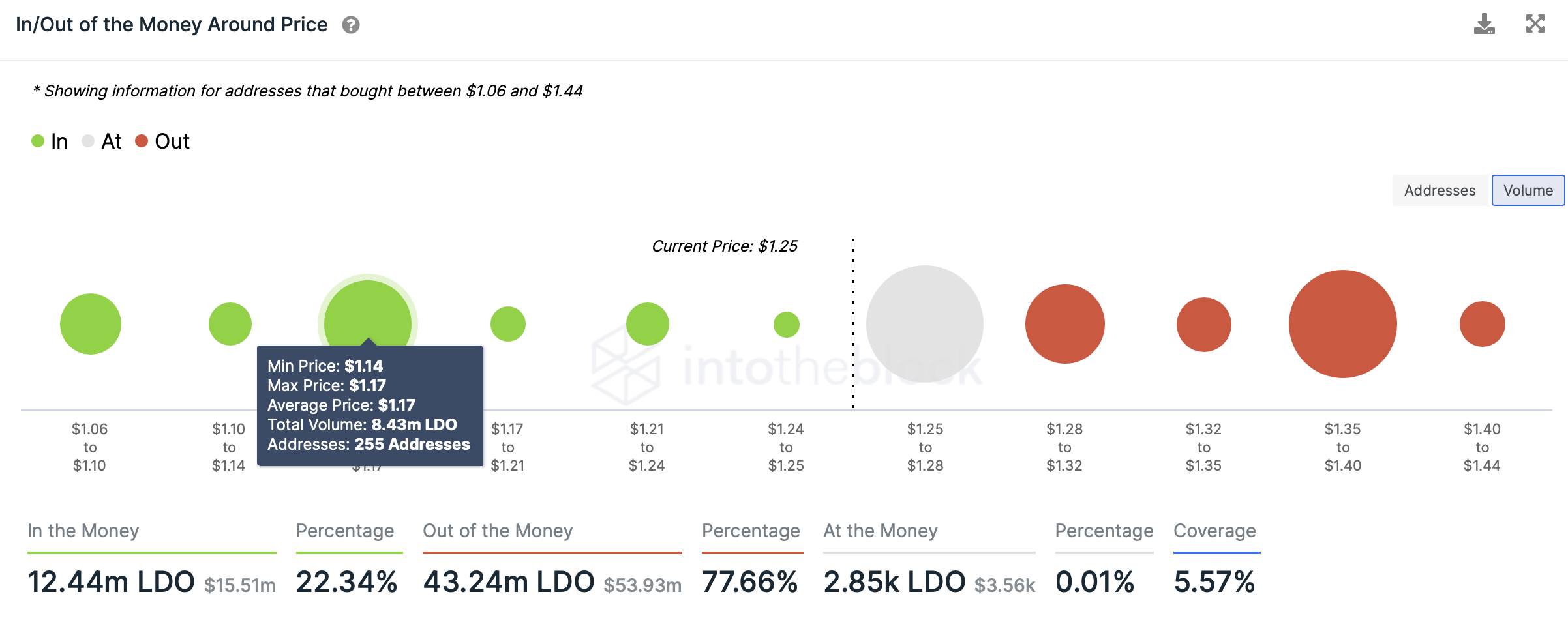

With the LDO price continuing its downward momentum, IntoTheBlock’s In and Out of Money Indicator around price suggested no significant supply barrier till $1.17. The $1.17 level could act as momentary support, with 255 addresses holding 8.43 million LDO tokens at that price level.

Going forward, while the market is too volatile for gains in case of the bearish invalidation, the next price resistance for LDO could be at $1.38.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.