Auction house Sotheby’s will auction non-fungible tokens (NFTs), which are part of the bankrupt crypto hedge fund Three Arrows Capital’s assets.

Sotheby’s will sell NFT art from 3AC’s GRAILS collection live, online, and through other sales channels, considering the art’s context and format.

3AC Liquidators Tap Sotheby’s to Auction NFTs to Raise Creditor Funds

They will auction the first batch of seven ‘hand-picked’ works during the Marquee Sale Week at Sotheby’s New York, starting May 19. Bidders can buy:

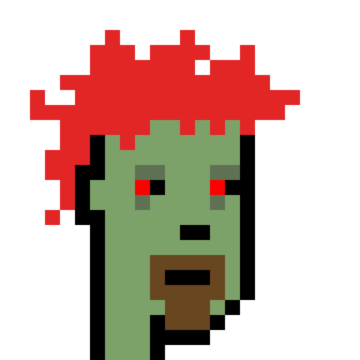

- CryptoPunk #6649:

- Dmitry Chernyak’s Ringers #879:

- Tyler Hobbs’ #216 Fidenza:

- Autoglyphs:

The Zerion platform has valued the tokens at a $6.4 million base price for the auction. Sotheby’s will pay creators royalties for secondary sales.

A British Virgin Islands court ordered the liquidation of 3AC in June 2022 after leveraged bets on rising crypto prices fell through following the high-profile collapses of TerraUSD and Celsius.

Teneo filed papers to sell the NFTs in February to recover funds for 3AC creditors. The tokens form part of 3AC’s assets, which include investments in crypto firms. After the liquidation order, the hedge fund filed for Chapter 15 bankruptcy in the U.S. to protect its U.S. assets.

BeInCrypto reported last year that over 300 NFTs from a wallet belonging to 3AC’s NFT fund Starry Night Capital were moved to a Gnosis Safe. 3AC founders Kyle Davies and Su Zhu intended to buy sought-after NFTs using the fund.

3AC Founders Indifferent to Liquidation

Davies and Zhu have not responded to a subpoena by a U.S. court. The order compelled them to turn over financial records and other corporate information.

The pair recently launched a new project, OPNX, to trade bankruptcy claims of failed crypto firms. These firms include FTX, Celsius, and, ironically, Three Arrows Capital.

Currently, the platform offers spot and futures trading. Bankruptcy claims trading has not gone live.

Several prominent crypto personalities ridiculed the platform upon launch. They included crypto detective ZachXBT, Jeff Kirkedeikis of TrustSwap, and a researcher at Grayscale Investments.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.