The Chainlink (LINK) price has increased considerably since Nov. 21. The rate of increase could accelerate further if the LINK price reclaims the $7.98 resistance area.

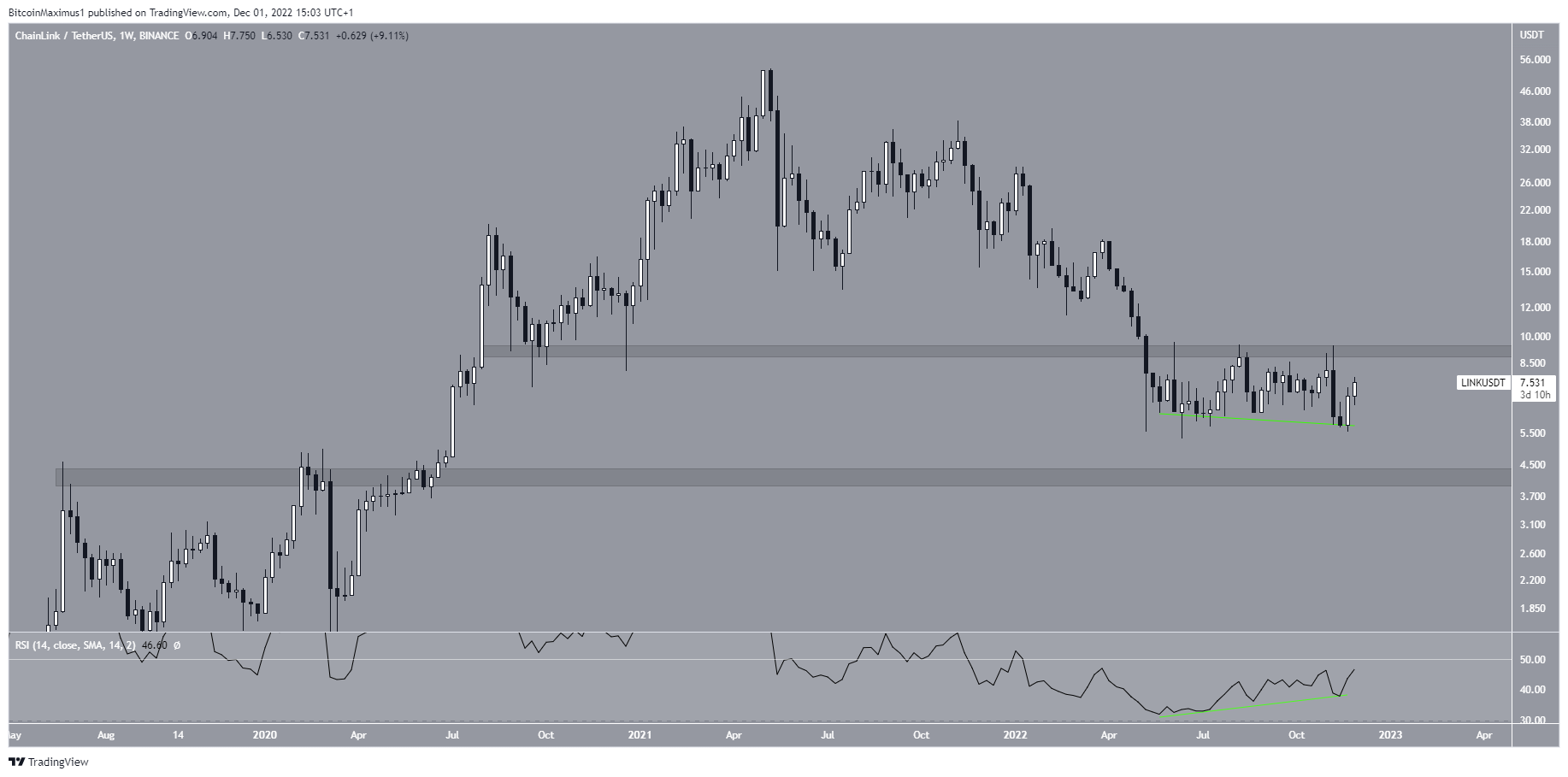

The Chainlink price has traded close to $6 since the beginning of May, when Chainlink reached a low of $5.53. During this period, the LINK price has been rejected by the $6 resistance area numerous times.

Despite being below resistance, the price chart does not seem entirely bearish. Each time the LINK token price fell below $6, it created long lower wicks, which are considered signs of buying pressure. There is only one weekly close below $6, and that was followed by a large bullish engulfing candlestick.

Moreover, the weekly RSI has generated bullish divergence. This is a bullish sign that bodes well for the future Chainlink price.

As a result, the Chainlink price forecast has yet to be determined. If another rejection from the $6 area occurs, a drop toward $4.40 would be the most likely scenario. However, a sharp upward movement could follow if the LINK price breaks out above $6.

Chainlink Price Prediction: Will a Breakout Happen?

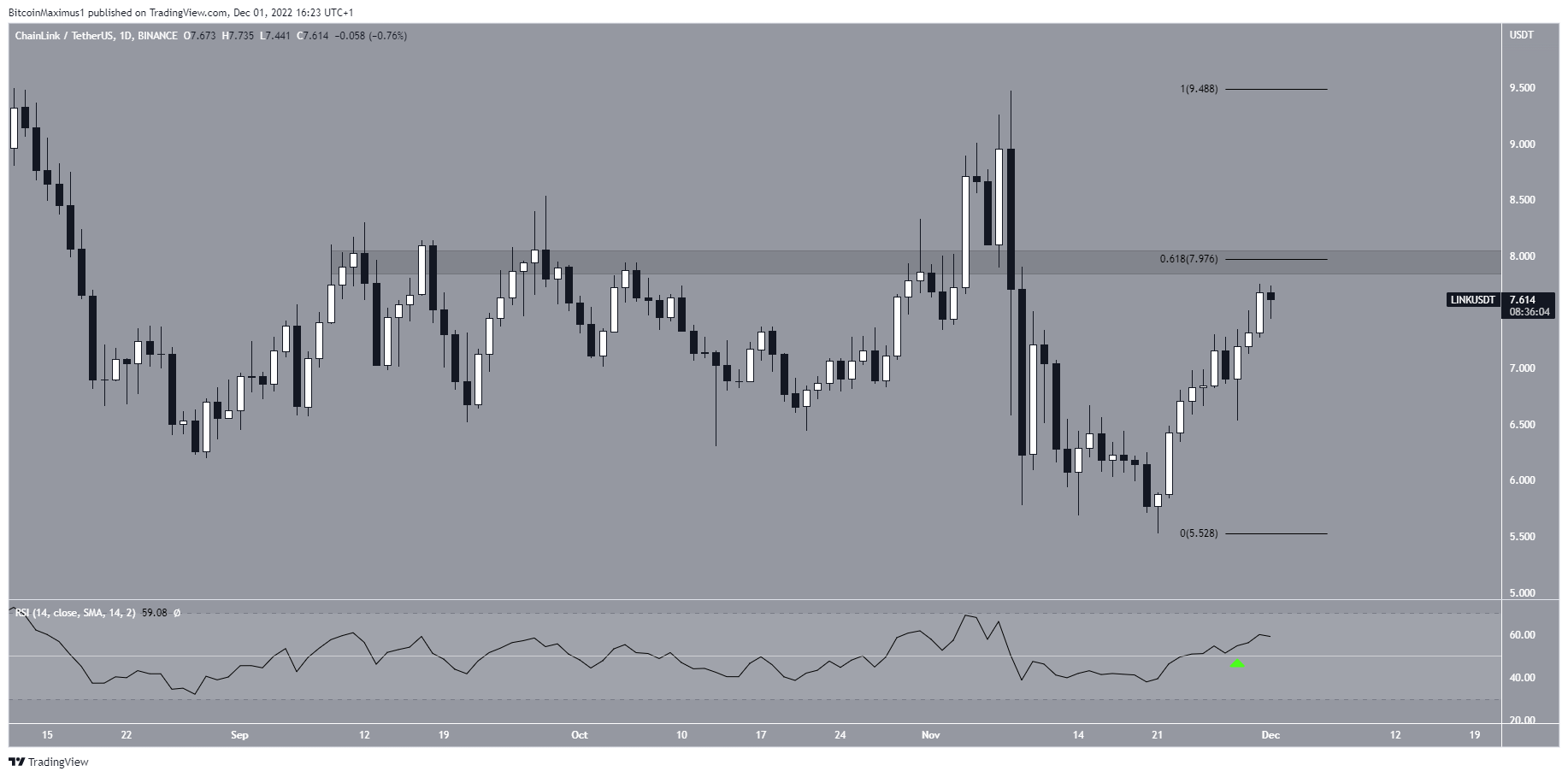

The Chainlink price analysis from the daily time frame is relatively bullish. The LINK price reached a high of $7.62, approaching the short-term resistance area at $8. Additionally, the recovery since Nov. 21 has been better relative to the rest of the crypto market.

Finally, the daily RSI has moved above 50 (green icon), another bullish sign.

Reclaiming the $7.98 resistance would likely lead to another re-test of the $9.20 resistance.

What Does the Wave Count Say?

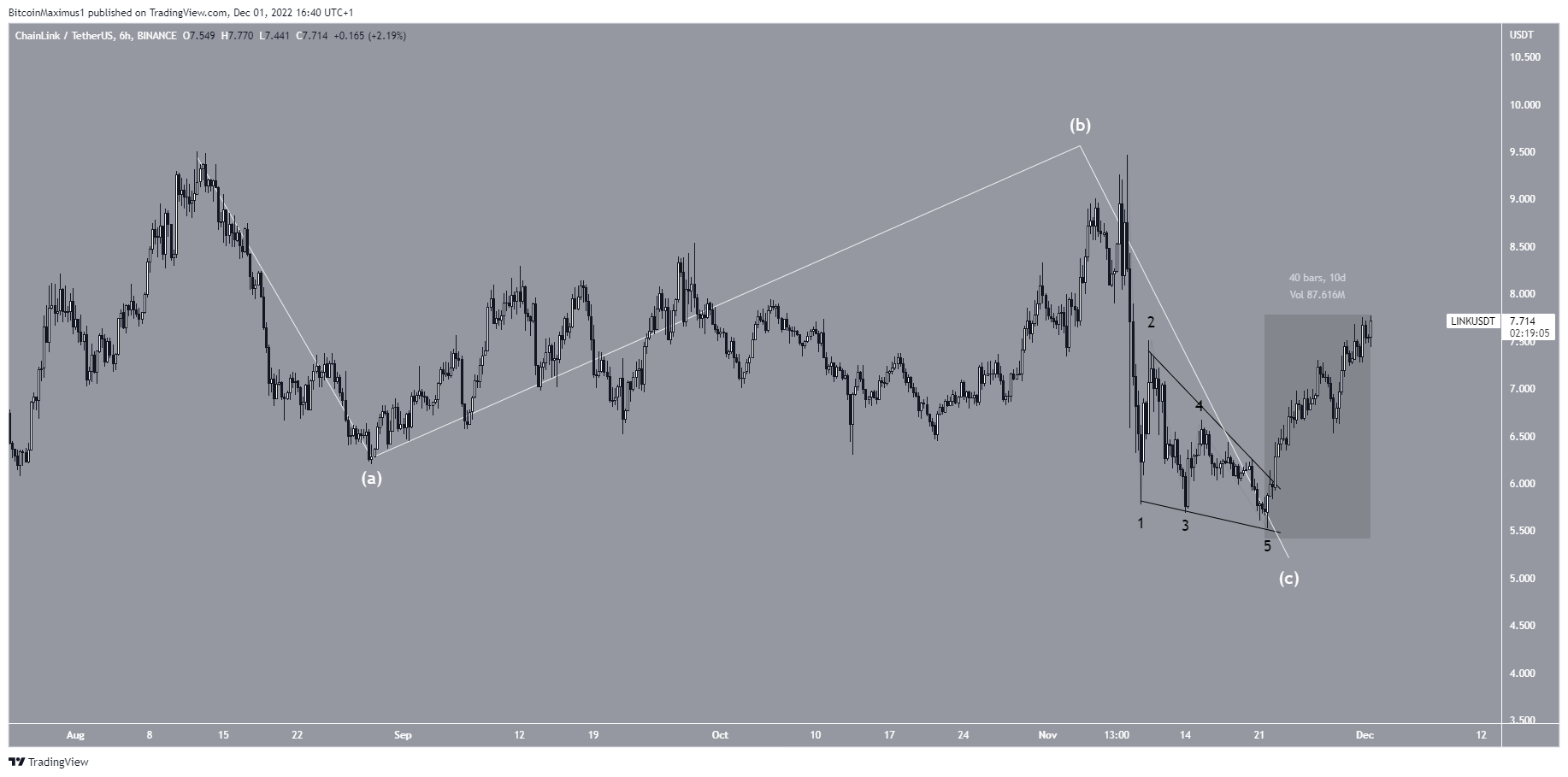

The most likely wave count is bullish. It suggests that the previous A-B-C correction (white) ended with an ending diagonal (black). If true, the Chainlink price began a new upward movement afterward (highlighted).

While a short-term retracement could occur, the count would indicate that an eventual breakout from the $9.20 area is expected. To conclude, three main reasons suggest the Chainlink price prediction is bullish:

- The bullish divergence in the weekly RSI

- Bullish wave count

- Several long lower wicks in the weekly time frame

Despite these signs, reclaiming the $9.20 area is required to confirm the bullish trend.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.