Crypto Price Predictions, March 2023: Ripple (XRP) price will likely experience volatility. Meanwhile, Ethereum (ETH) price could outperform Bitcoin (BTC) price. And the rapid increase in the Stacks (STX) price is expected to continue.

February 2023 has been a relatively bullish month for the crypto market, and March 2023 could provide more of the same. Here are BeInCrypto’s three biggest crypto price predictions for March 2023.

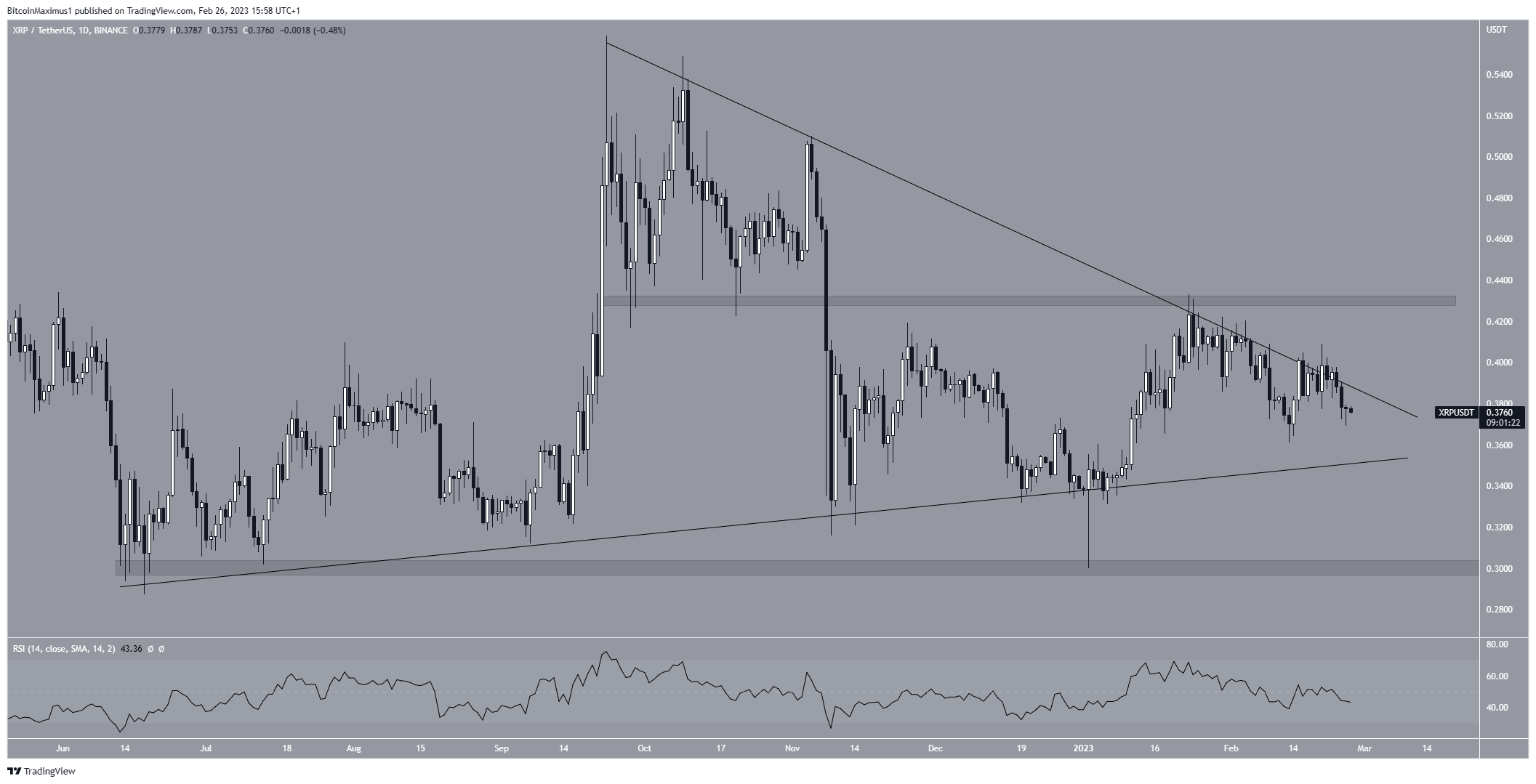

Ripple (XRP) Price Prediction: Volatility Will Return

XRP price has traded in a long-term symmetrical triangle since June 2022. Now, Ripple price is approaching the point of convergence between resistance and support.

At that point, a decisive movement outside the pattern is likely for XRP price. Since the consolidation has been going on for a long time, a significant movement is expected once Ripple is outside this technical formation.

If the Ripple price breaks out, it could increase to at least $0.43 and possibly $0.52. Nonetheless, a downswing to $0.30 could follow if it breaks down.

Since both technical indicators and the XRP price action are neutral, both remain possible.

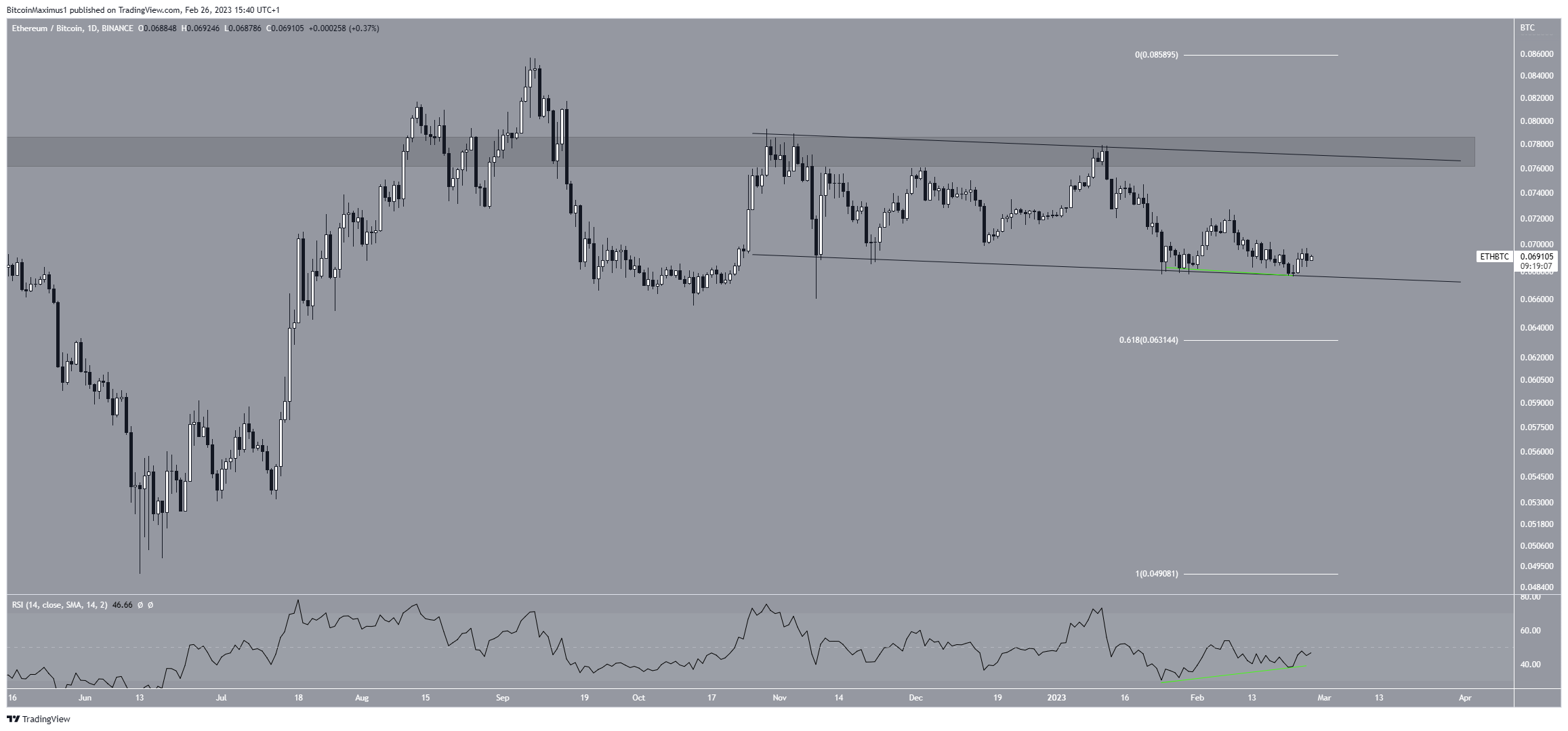

Ethereum (ETH) Price Prediction: Outperforming Bitcoin (BTC) Price

ETH is the native token of the Ethereum blockchain, created by Vitalik Buterin. Based on its market cap, it is the second largest cryptocurrency in the crypto market, trailing only Bitcoin. The ETH/BTC trading pair provides a bullish picture. This means that the Ethereum price is likely to outperform that of Bitcoin, and here is why:

Firstly, the ETH price has traded in a descending parallel channel since October 29. Such channels usually contain corrective movements, meaning an eventual breakout is expected.

Secondly, the Ethereum price has generated a bullish divergence over the past month (green line). The divergence occurring right at the channel’s support line further increases its significance. Since the divergence has been developing for more than a month, it would make sense that it catalyzes a month-long upward movement for ETH price.

Therefore, the most likely scenario is an increase toward at least the channel’s resistance line at ₿0.077. However, a breakdown from the channel would invalidate this bullish hypothesis. If that occurs, it could cause a fall for ETH price against BTC to the 0.618 Fib retracement support level at ₿0.063 (white line).

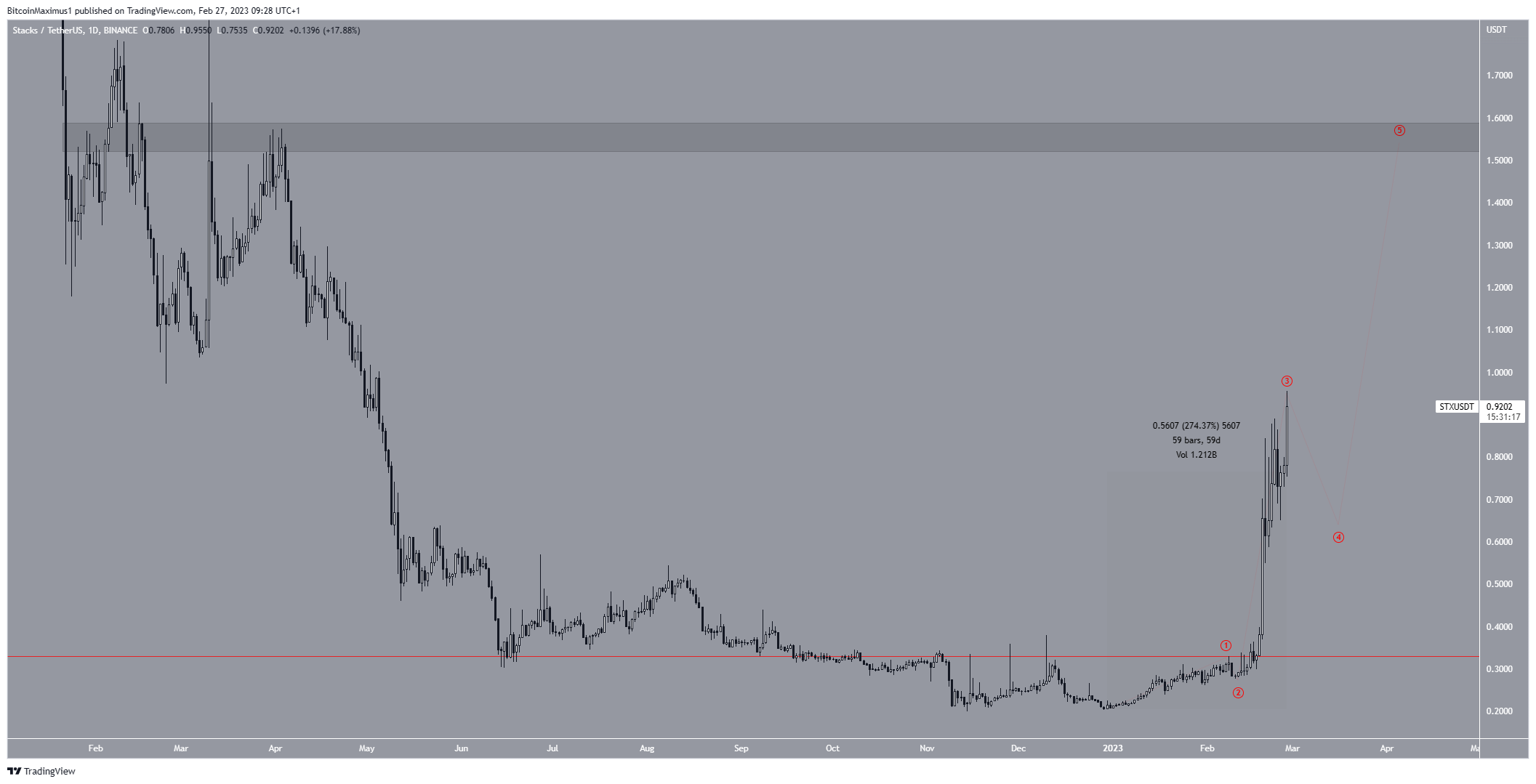

Stacks (STX) Price Prediction: Moving Above $1.50

Stacks price has been one of the year’s biggest gainers, increasing by 275% to date. Despite the massive increase and the completely parabolic rally, the upward movement might not yet be complete. This is visible in both the RSI and wave count. While the former is overbought, it has not generated any bearish divergence yet.

The shape of the increase is indicative of wave three. Therefore, while a short-term drop for STX price could occur, another increase is expected to complete the entire upward movement. If wave five also extends, the Stacks price could reach the $1.55 resistance area, which has not been reached since April 2022.

On the other hand, a fall below wave one high (red line) at $0.33 would invalidate this bullish wave count for STX price. In that case, the Stacks price could fall toward $0.20.

For BeInCrypto’s latest crypto market analysis, click here.