The crypto sphere is alive with anticipation for the upcoming Bitcoin (BTC) halving. According to Coinbase analysts, this event is poised to be unlike any before, primarily due to the advent of US spot Bitcoin ETFs, active BTC supply, and their substantial impact on the market.

Analysts shared a detailed report with BeInCrypto, delving into these changes and offering insights illuminating the current cycle’s uniqueness.

What Would Impact the Current Bitcoin Halving Cycle?

Historically, halvings have reduced Bitcoin miners’ rewards. The 2024 halving will slash issuance from 6.25 BTC per block to 3.125 BTC. Though historical data offers some guidance, the limited number of past events restricts the ability to predict future price movements accurately.

The halving mechanism is designed to mitigate inflation and influence the market price of Bitcoin. However, to truly grasp Bitcoin’s potential post-halving, investors must examine the detailed dynamics of supply versus demand.

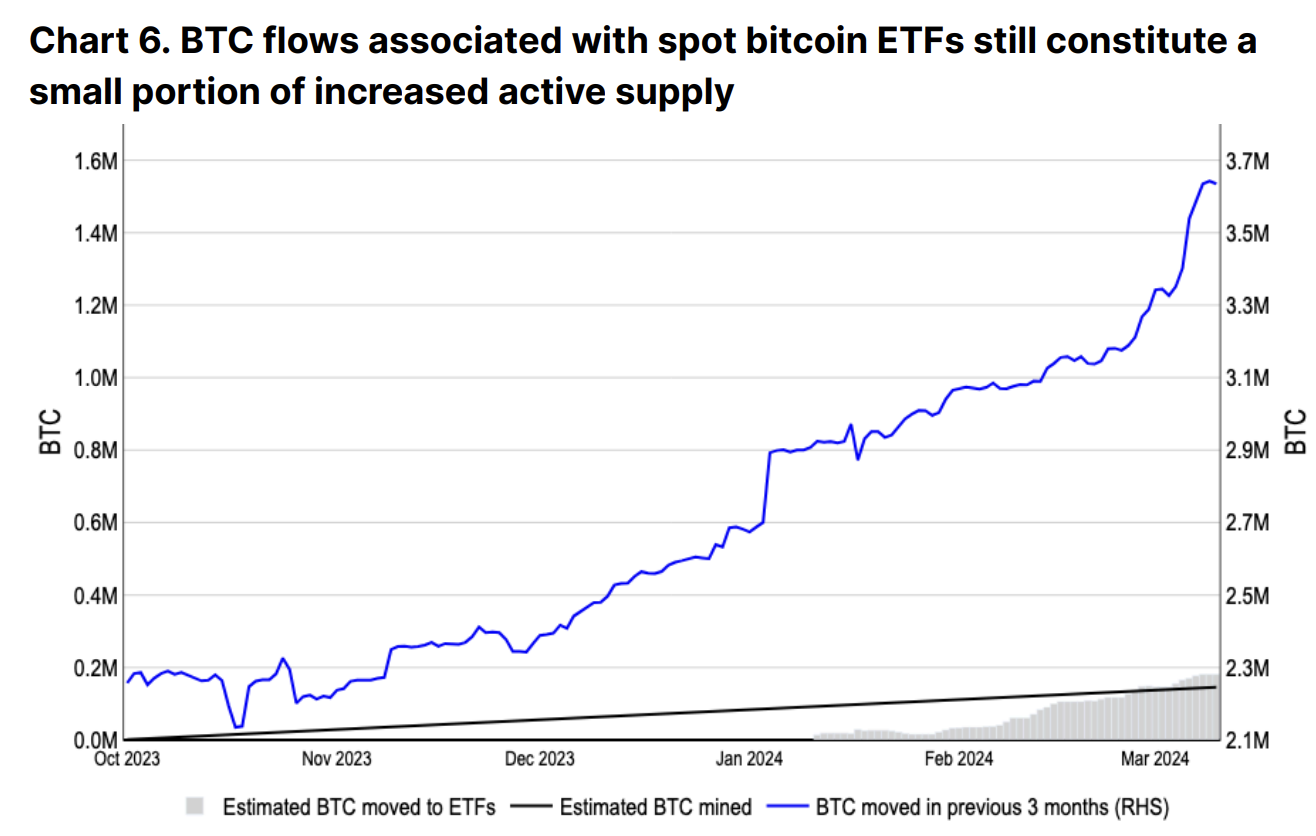

Remarkably, since early Q4 2023, there has been a significant increase in the active BTC supply, with a 1.3 million rise outpacing the cumulative ETF inflows. This shift suggests a deeper change in market behavior, especially with the presence of institutional investors through ETFs, adding a layer of complexity.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

The reduction in Bitcoin supply traditionally leads to speculations of a price increase. Yet, this cycle demands a reevaluation of such assumptions. The analysis must consider the nuances of miner selling activities, long-term holder actions, and liquidity from Bitcoin collateral usage.

“The post-halving miner economics could increase selling pressure on miners as margins narrow and less excess profit can be retained in Bitcoin. However, this may not immediately impact markets. As the rate of Bitcoin issuance drops, the absolute number of BTC that miners can sell also drops – even if they are selling a proportionally higher amount of mining rewards,” David Duong, head of institutional research at Coinbase, told BeInCrypto.

Nevertheless, the introduction of spot Bitcoin ETFs has drastically shifted the scenario. These financial products have seen massive inflows, fundamentally altering how investors approach this halving.

Hence, this cycle distinguishes itself with the steady influx of ETF investments contrasted against an expanding active Bitcoin supply. This scenario challenges the simple scarcity narrative, advocating a nuanced understanding of supply and demand.

“Truly, this cycle may be different. Consistent daily net inflows into US spot bitcoin ETFs continue to be a massive tailwind for the asset class. However, this doesn’t necessarily indicate that we’re about to embark on a supply crunch scenario where that demand will outpace the selling pressure in this market,” Coinbase analysts wrote.

Read more: How To Mine Cryptocurrency: A Step-by-Step Guide

Although this cycle may not necessarily trigger a supply crunch, it highlights Bitcoin’s evolution into a recognized digital asset class within mainstream finance. According to NiceHash, the Bitcoin halving is approximately 34 days away.