There is a fear that Ethereum (ETH), which is tied to the notorious PlusToken Ponzi scheme, will eventually be transferred to crypto exchanges. In fact, a small portion is already sent to crypto exchanges, possibly to cash out.

Due to this development, ETH prices have been down by around 4% from Wednesday’s highs. As of writing, it is trading near $2,400.

$1.3 Billion in ETH Potentially Up for Sale

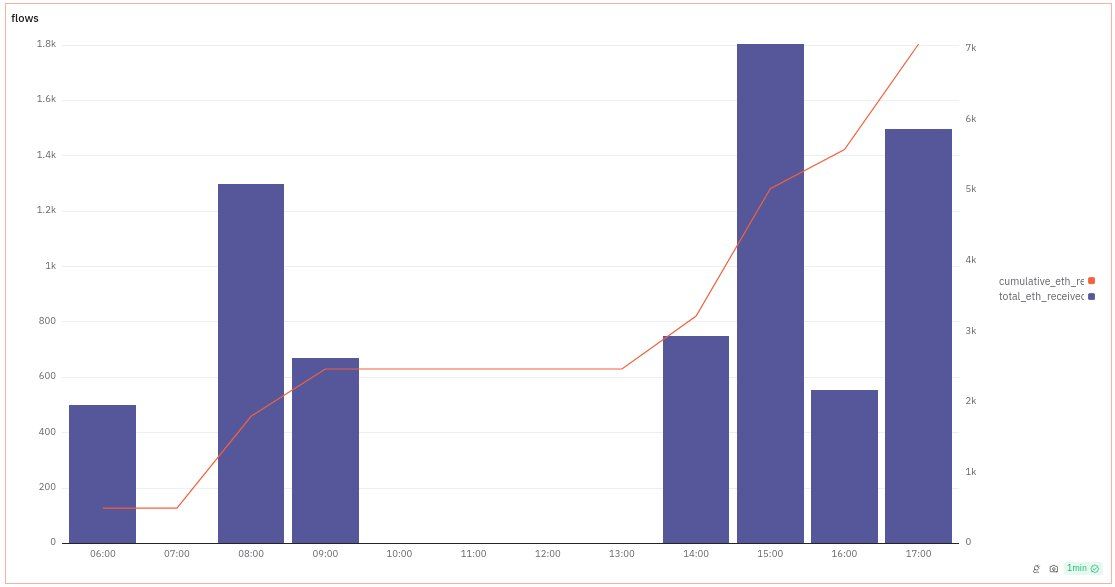

FreeSamourai observed that around 7,000 ETH out of the 542,000 ETH (worth $1.3 billion) seized from PlusToken had reached exchanges, including BitGet, Binance, and OKX.

The PlusToken scheme, a Ponzi structure similar to BitConnect, rose to prominence in China between 2018 and 2019. This Ponzi scheme attracted 2.6 million participants. Authorities eventually dismantled it, seizing massive amounts of cryptocurrency, including more than 194,000 Bitcoin (BTC) and over 833,000 ETH.

Read more: Top Crypto Bankruptcies: What You Need To Know

In a 2020 court document, officials reported transferring the seized assets to Zhifan Technology Beijing for liquidation, with the funds intended for reimbursement. At the time, officials were believed to have sold the BTC on exchanges, while some of the ETH was liquidated, leaving the remaining 542,000 ETH.

In early August, EmberCN observed that this ETH moved for the first time since 2021.

On October 9, FreeSamourai reported another 15,700 ETH moving from a tracked wallet, though it has not yet reached exchanges. FreeSamourai predicts this move could indicate an upcoming sale of the remaining ETH.

“Given the recent effort to re-obfuscate the ETH it is unlikely that the active distribution of the 15,700 ETH moved yesterday is the last of the 540,000 ETH supply distribution.” FreeSamourai said.

News of potential sell pressure from large entities often triggers investor concerns. In July, the German government liquidated $3 billion in Bitcoin, and BTC’s price dropped from $65,600 to $57,800. Recently, the US Supreme Court also permitted the sale of 69,370 BTC seized from Silk Road.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The crypto community remains fearful of the impact of the potential $1.3 billion sell pressure on ETH.

“This is why we cant have nice things.Potentially $1.3 billion sell pressure on ETH from PlusToken. Potentially $4 billion sell pressure on BTC from the US Gov’s silk road sales. Sadge.” a crypto investor said.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.