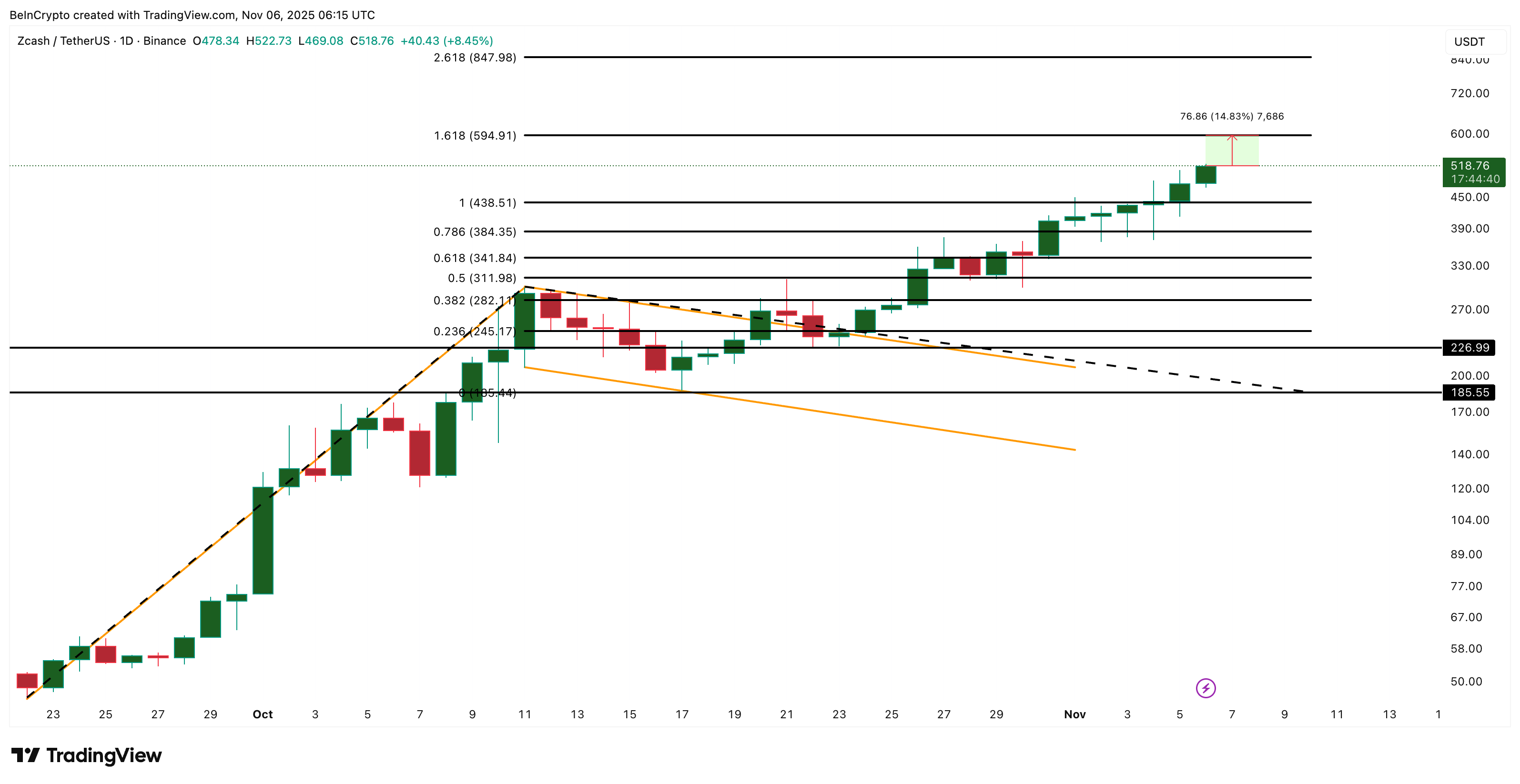

Zcash (ZEC) continues to lead the market recovery, posting one of the strongest runs of this cycle. The Zcash price has gained more than 230% month-on-month. The token is up nearly 1,200% in the last three months, breaking decisively out of its flag pattern on October 24.

Despite brief pauses, there’s still no sign of exhaustion — the uptrend looks alive, backed by volume and strong inflows.

Retail Selling Slows as Large Wallet Inflows Dominate

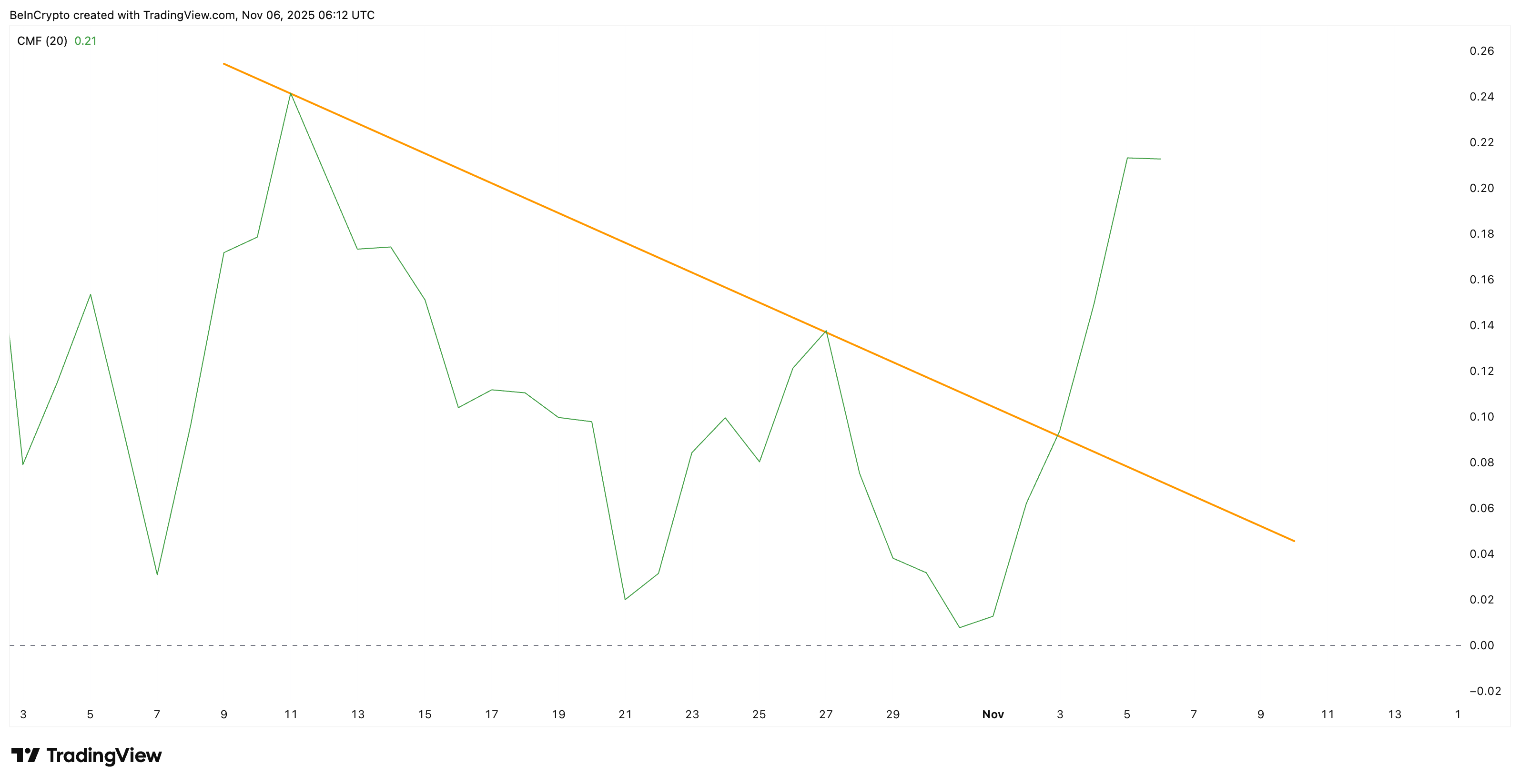

The Chaikin Money Flow (CMF), which tracks whether money from large wallets is entering or leaving an asset, confirms that the Zcash price rally is far from over. The indicator broke out of its downtrend line on November 3, marking renewed buying momentum from large investors and whales.

CMF currently stands at +0.21, indicating strong inflows above the zero line, a pattern often observed in continuation phases of rallies.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Supporting this, spot netflow data shows a massive drop in exchange selling. On November 4, nearly $41.79 million worth of ZEC was sold, compared to just $3.66 million on November 6.

The steep decline (over 91%) in exchange inflows indicates that retail-driven selling pressure has subsided. This might have allowed larger buyers to drive prices higher without resistance.

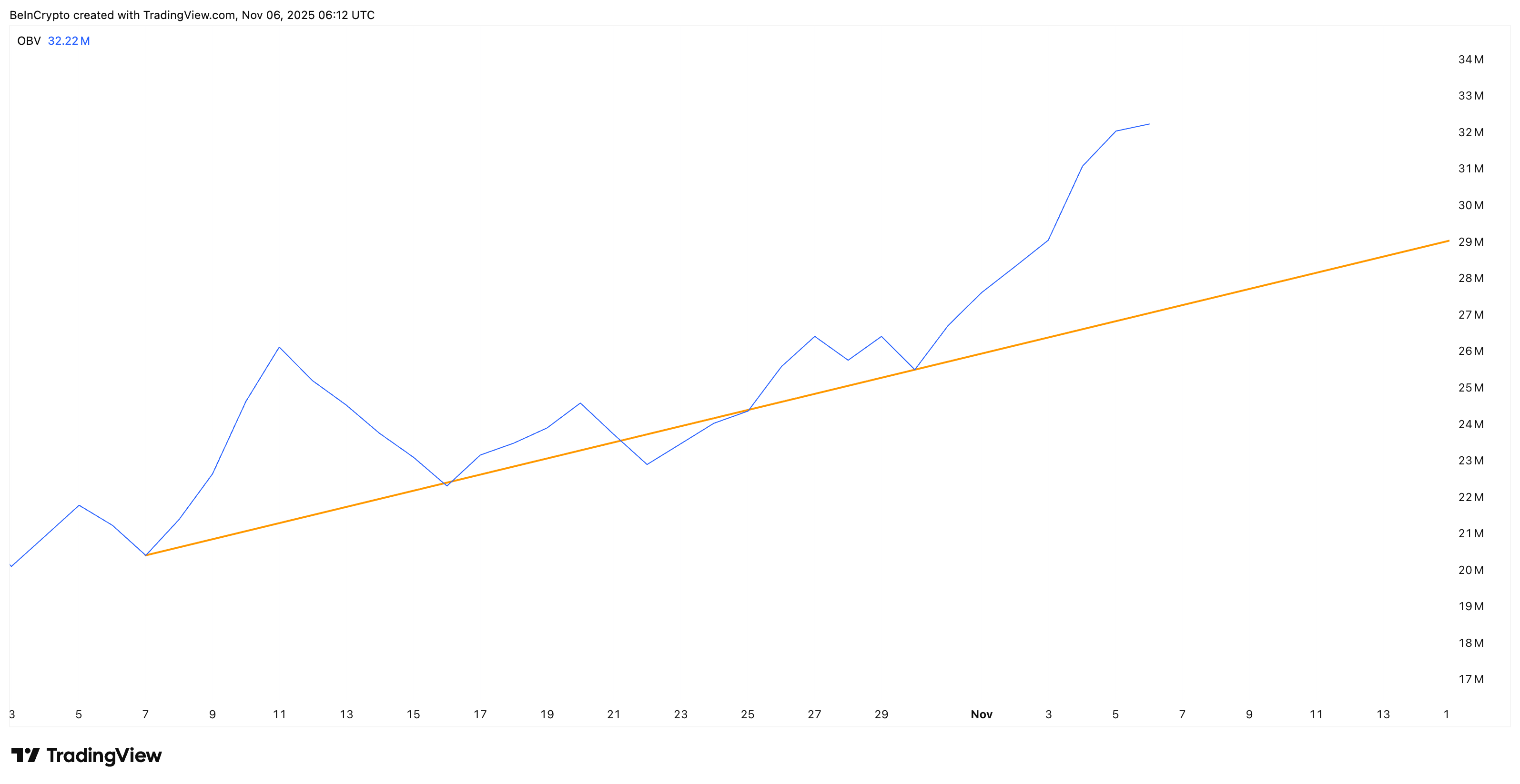

The On-Balance Volume (OBV), which adds volume on up days and subtracts it on down days to gauge accumulation, adds weight to this picture. OBV has maintained an upward trendline since early October.

It has taken support around October 30, and has never broken below it since, even during minor Zcash dips.

The rising OBV, alongside rising prices, confirms that this rally is backed by genuine volume rather than speculation.

With CMF trending higher, spot inflows plunging by 91%, and OBV maintaining its uptrend, the data together signal that big money continues to drive this move, leaving little room for a meaningful pullback — at least for now.

Flag Breakout Leaves Zcash Price Eyeing Higher Fibonacci Targets

From a technical structure perspective, Zcash’s flag breakout on October 24 marked the beginning of this newest rally leg. Since then, the token has extended gains without any consolidation, now trading near $518, up 18% in the last 24 hours.

The next key resistance lies at $594, aligned with the 1.618 Fibonacci extension level. A breakout above this level could open the way toward $847, the 2.618 target – a potential 60% rise from current prices.

On the downside, $384 acts as the strongest Zcash support level. It has consistently absorbed selling pressure since November 1. Only a sustained drop below that would invite a deeper pullback.

But given the current structure and volume-backed inflows, that scenario remains unlikely for now.