A new Irish Banking and Payments Federation (BPFI) survey has revealed that crypto investments in Ireland are more popular with younger Irish citizens who consult online sources more than fund managers.

Roughly 16% of Irish adults aged 18-34 invest in cryptocurrencies, compared to only 3% of citizens aged 55 and over.

Authorities Caution Investing in Crypto in Ireland

Young crypto investors depend on informal investment channels, while older citizens rely on investment managers and banks. Older people prefer investing in bonds and investment funds, while stocks and shares are universally popular.

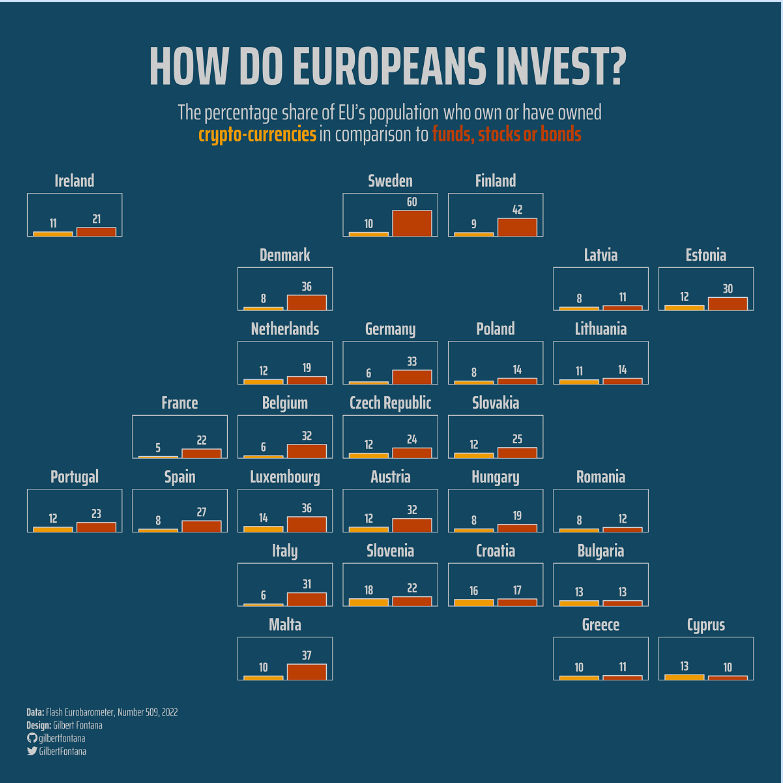

According to the World Economic Forum, the preference for stocks and bonds over crypto is seen in most European countries.

Last year, authorities arrested an elderly Irish woman for providing unauthorized financial advice violating the Investment Intermediary Act of 1995.

According to the law, entities cannot offer advice on crypto investments in Ireland without approval from the Central Bank.

Irish Central Bank Governor Gabriel Makhlouf recently challenged calling unbacked crypto an investment.

“The purchase of such products can be similar to purchasing a lottery ticket: you might win, but you probably won’t. And describing it as ‘investment‘ is, needless to say, an abuse of the word; ‘Ponzi schemes’ might be more accurate.”

However, he conceded that crypto is not “going away” and urged European Union policy action to protect consumers.

The BPFI advises investors to balance digital information sources with advice from banks or brokers to mitigate risks.

Last year, the bank authorized Coinbase to be a crypto custodian for institutional investors. The approval came after the bank approved Coinbase’s anti-money laundering and other compliance policies.

European Investment Firms Need Clear Rules, Says Bank

Investors differ from HODLers in that they include crypto in a diversified portfolio rather than holding large amounts of crypto they expect to appreciate in the long term.

However, fund managers can adopt HODL strategies for their clients. They can also create a fund investing in funds with crypto allocations, as is the case in Luxembourg.

According to Société Générale, European investment managers dipping into crypto need formal procedures and communication guidelines to define interactions between regulated players.

Last year U.S. lawmakers and the Labor Department criticized pension fund managers’ plans to include crypto in client portfolios.

Recent debate around pension reforms in France inspired some in the crypto community to advocate moving an entire portfolio to Bitcoin.

The European Union’s Markets in Crypto-Assets bill does not specifically address the fiduciary duties of fund managers investing in crypto.

It is, however, more advanced than U.S. crypto legislation, the lack of which, according to Kevin O’Leary, has discouraged institutional investment.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.