EOS (EOS) and Yearn.Finance (YFI) have broken out from descending resistance lines.

Dogecoin (DOGE) has broken out from the $0.062 resistance area.

Band Protocol (BAND) has reclaimed the previous all-time high resistance at $15.60.

Yearn.Finance (YFI)

YFI has been moving downwards since reaching an all-time high price of $52,880. It did so on Feb. 12.

Since then, it has been following a descending resistance line. Also, it has fallen below the $39,600 area, which is now expected to act as resistance.

Despite the ongoing decrease, technical indicators are bullish. This is evidenced by the bullish reversal signal in the MACD, the RSI cross above 50, and the bullish cross in the Stochastic oscillator.

YFI has already broken out from the descending resistance line and is expected to attempt moving above $39,600. If so, it could move towards a new all-time high.

Highlights

- YFI has broken out from a descending resistance line.

- There is resistance at $39,600.

EOS (EOS)

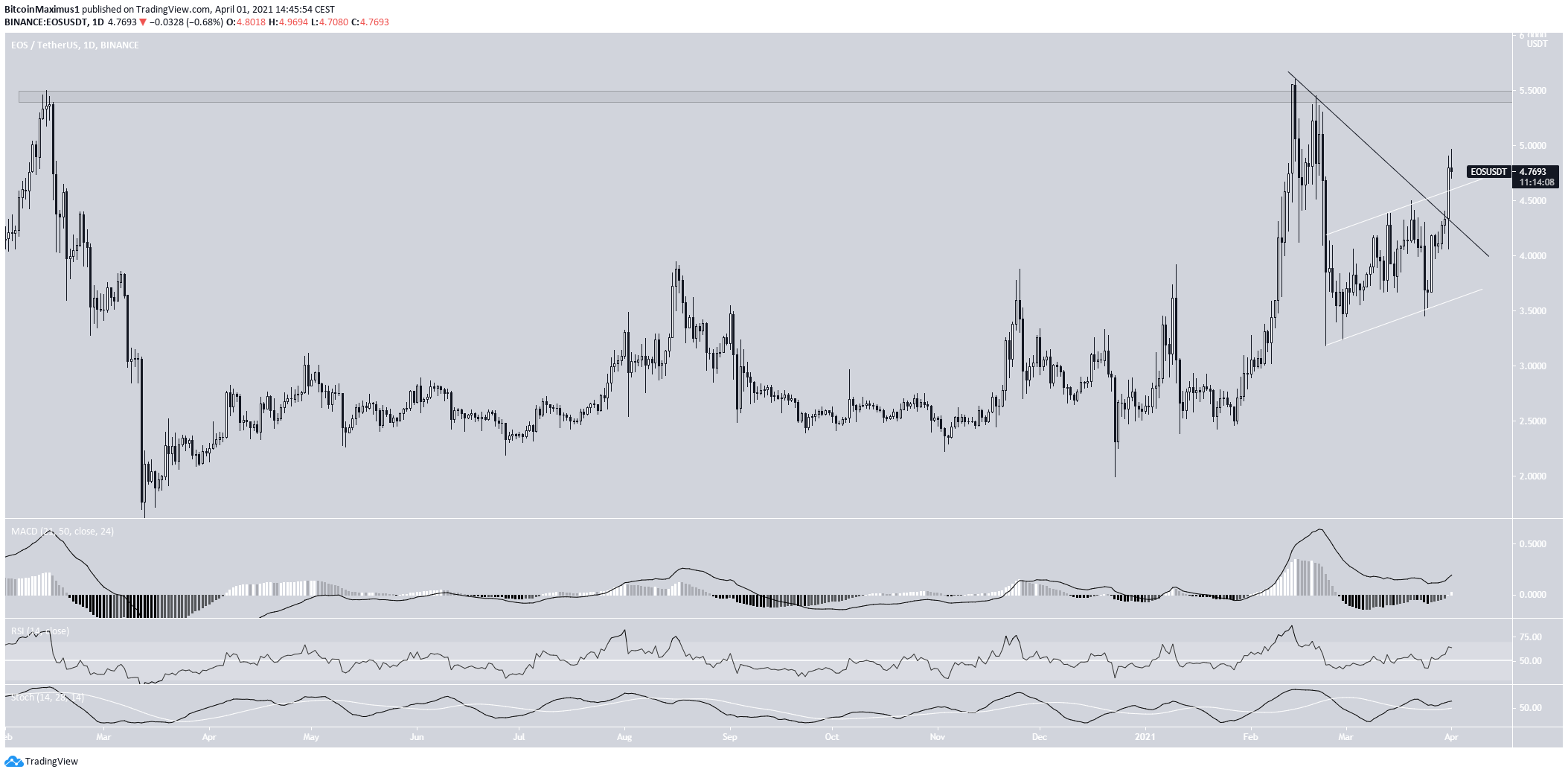

EOS has been moving downwards since Feb. 14, when it reached a high of $5.61. It decreased sharply afterward, settling on a low of $3.17 on Feb. 23.

Afterward, EOS began to trade in an ascending parallel channel for a month.

Therefore, EOS is expected to increase towards the $5.45 resistance area and potentially break out.

On March 31, EOS broke out from this channel (white) and a descending resistance line (black).

This signals the beginning of a bullish trend and is supported by the bullishness in technical indicators.

Therefore, EOS is expected to increase towards the $5.45 resistance area and potentially break out.

Highlights

- EOS has broken out from a descending resistance line.

- EOS has broken out from an ascending parallel channel.

Dogecoin (DOGE)

DOGE has been decreasing since Feb. 17, when it reached a high of $0.086.

However, it reversed the trend on Feb. 23 and broke out from the $0.062 area on April 1. As long as it is trading above the latter, the trend can be considered bullish. If so, DOGE would find the next resistance at $0.082.

While short-term indicators are bullish, the preceding parabolic increase makes DOGE a risky proposition.

Highlights

- DOGE has broken out from the $0.063 resistance area.

- There is resistance at $0.082.

Band Protocol (BAND)

On Feb. 13, BAND reached an all-time high price of $20.77. Since then, the price has been decreasing, it managed to reclaim the $15.60 area on March 31.

This area had previously acted as both resistance and support. Its reclaim is a bullish development that suggests BAND is likely to continue increasing.

Technical indicators are bullish, as evidenced by the MACD cross into positive territory and the RSI crosses above 50.

The next closest resistance areas are found at $18.90 and $27.

Highlights

- BAND has reclaimed the previous all-time high resistance at $15.60.

- The next resistances are found at $20.90 and $27.15.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.