XRP has managed to outperform every cryptocurrency in the top 100 coins by market cap gaining over 67% in the last week alone, but what’s behind these bullish waves?

After a long-drawn consolidation, Ripple (XRP) appears to be finally gaining momentum recovering from the months of battered price action. One reason behind this sudden price pump was the possibility of a final verdict and closure of the SEC v Ripple case in the upcoming days.

Settlement rumors aiding bullishness

Amid rumors of a Ripple and SEC settlement, a motion was granted to give deadlines to motions to seal requests that prevent evidence. The final deadline for any motion to seal by by third-parties is Dec. 9 and the final date to oppose any motion is Dec. 22.

In a recent interview, Ripple CEO Brad Garlinghouse stated that the Securities and Exchange Commission (SEC) had “lost its way” and was a “cuckoo for cocoa puffs.” Garlinghouse’s statements have further paved the way for the market’s raised expectations.

Apart from external news that heavily affects investor sentiment, certain technicals and on-chain indicators also painted a pleasant picture for XRP.

XRP whales back in action

The XRP price oscillated at the $0.536 mark at press time charting 27.27% gains on the 24-hours chart and almost 67% gains on the weekly price chart.

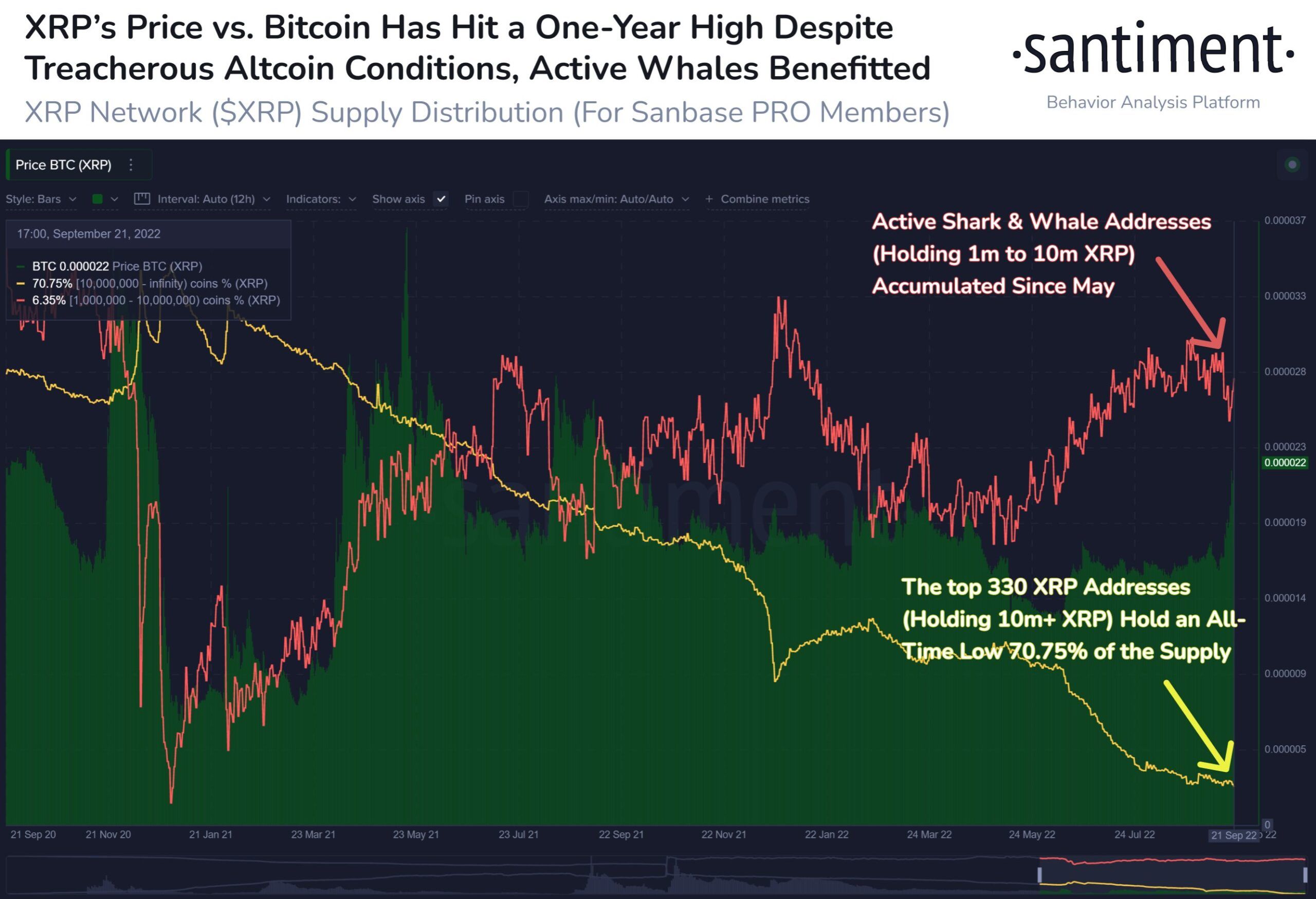

On-chain data from Santiment presented that active shark and whale addresses holding 1 million to 10 million XRP have been in an accumulation pattern since late 2020.

With active whales and sharks adding to their balances the same portrays a healthy long-term trend for XRP, which could give the price an added boost.

That said, the price ratio of XRP/BTC has hit a one-year high of ₿0.000025 breaking from the long-term downtrend that the ratio had followed.

Sentiment flipping positive

From a technical perspective, XRP’s price recovered from the long-term descending trendline resistance as trading volumes and open interest on futures contracts saw a major uptick.

Daily RSI noted highly overbought values indicative of a high buying pressure in the market as bulls dominated. Long-term signals also seemed to turn bullish as the weekly RSI broke out from its own descending resistance line.

Open interest in the future and perpetual markets rose by 65.43% in just 24 hours. On the other hand, $14.1 million worth of XRP shorts were liquidated after the bullish price action.

In the near term, looking at the saturated market if a short-term pullback takes place, XRP could revisit the $0.39 support.