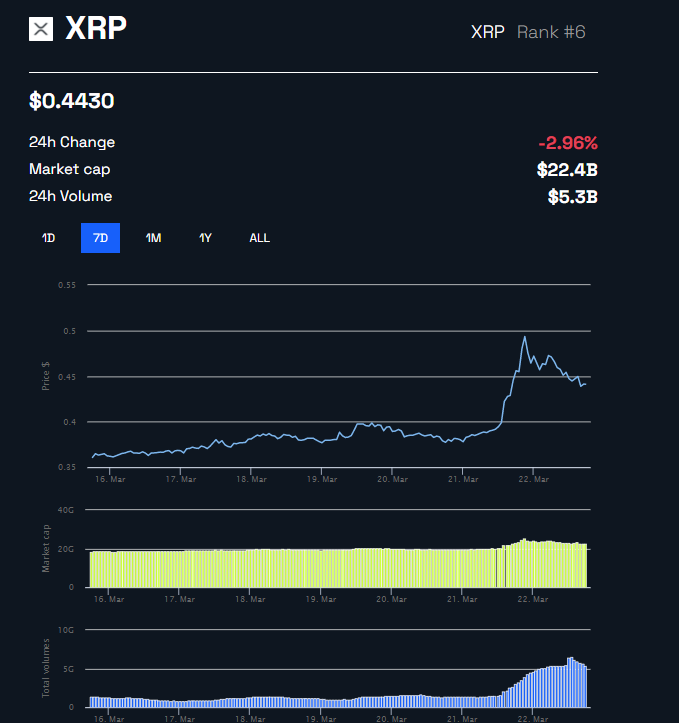

XRP rose to $0.45 at 8 a.m. Eastern Time, as the President of Ripple Labs expects the firm to win its case against the U.S. Securities and Exchange Commission.

Monica Long expects Ripple to win its case against the SEC in 2023 because the law and facts are on Ripple’s side.

Ripple Encouraged by Voyager Acquisition Ruling

The bullish movements also come after Ripple issued a supplemental notice on a judge’s approval of the assets of Voyager Digital to Binance.US.

The SEC opposed the sale, arguing that Voyager must prove that the VGX sale did not violate securities laws. Judge Michael Wiles dismissed the SEC’s objections. He pointed out that the agency did not provide guidelines on what Voyager was “supposed to prove.”

The SEC sued Ripple and executives Chris Larsen and Brad Garlinghouse in December 2020 for raising funds through an unregistered securities offering.

Ripple Labs and the SEC seek summary judgment from Judge Analisa Torres.

MiCA Disclosure Requirements

Long said that the crypto industry prefers clear guidelines such as those in the European Markets-in-Crypto-Assets regulation rather than the SEC’s regulation-by-enforcement approach.

She said that the European rules, due for debate in mid-April 2023, enable TradFi and crypto companies to operate in compliance.

Before MiCA, European countries defined securities based on the Markets in Financial Instruments Directive (MiFD II). Under this directive, EU member states exercised discretion on which crypto assets were classified as a “tradeable security,” leading to some crypto assets being classified as securities in one state but not the other.

The new MiCA bill does not interfere with assets such as security tokens already governed by MiFD or non-fungible tokens.

However, it requires issuers of new tokens through an initial coin offering or exchange listing to publish a detailed whitepaper that informs investors of the characteristics of a new token. MiCA sets out minimum standards for these white papers. These include crypto-asset risks and the impact of their consensus mechanisms on the environment. Issuers of these tokens will also be subject to advertising rules and the obligation to act with integrity.

Issuers of asset-referenced tokens like stablecoins must publish a whitepaper for approval by a National Competent Authority.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.