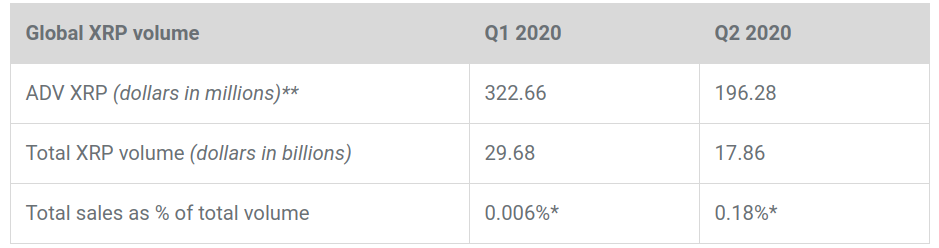

XRP trading volumes have declined in Q2 2020, falling from $29.6 billion to $17.8 billion.

Ripple has had a somewhat challenging second quarter according to a Q2 report published by the company on August 3. XRP daily average and total trading volumes dropped considerably compared with Q1 figures.

XRP’s Trading Volume Takes a Hit

The first quarter saw total volumes peak around $29.68 billion. However, Q2 saw only $17.86 billion in trading volume.

Ripple and the Secondary Market

The report also revealed that Ripple had been actively buying up XRP tokens. The purchases took place primarily in the secondary market, though no sales figures were made public. Ripple claims that it takes a “responsible role” in the liquidity process as a healthy XRP market is required for consumers. It also intends to continue buying tokens at future market prices, facilitated through its XRP II, LLC subsidiary. The leveraging of RippleNet’s ODL service adds more liquidity to the market, says the report. Ripple engages with the secondary market to minimize cost and risk for customers. Ripple released three billion XRP tokens out of escrow during the quarter. However, 2.6 billion XRP tokens were returned and subsequently put into new escrow contracts. The company has made significant progress with on-demand liquidity, which accounted for nearly 20% of RippleNet volume in the quarter. This is notable uptick when compared with the first half of 2019. By contrast, RippleNet “experienced a 11x year-over-year growth in ODL transaction volume” during that time. The report emphasized that Ripple is focused on “low-value, high-frequency” payments with ODL. As such, the firm will be reducing its focus on large treasury payments. Instead, small and medium transactions will take prominence.XUMM Wallet

In terms of other developments, internal testing is currently ongoing for XUMM, the upcoming crypto wallet. The first public non-beta “1.0” release is expected in the first quarter of 2021. Some of the upcoming features for the new release include fiat on and off-ramps, auto savings, and auto tipping.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored