Despite the recent downswing in the altcoin markets, Ripple (XRP) bulls have fiercely defended the $0.45 price support level. This week, bullish price momentum has been brewing across the Ripple (XRP) ecosystem. Is XRP set for a push to $0.60?

Ripple (XRP) has stayed above $0.40 for 30 consecutive trading days. Long-term holders are showing diamond hands while whales buy the dip. Could XRP see more bullish momentum heading into May?

Long-Term Investors Are Showing Diamond Hands

According to on-chain data, long-term holders of XRP are increasingly confident about XRP price prospects. Looking at the chart below, The Mean Coin Age of XRP tokens has increased considerably this month. Since the last drop around Mar. 31, it has risen steadily from 1,301 to 1,325 as of April 25.

Mean coin age evaluates the average time all coins in circulation have been held since their last transaction. An increase in Mean Coin Age can be a bullish signal that investors are hodling longer.

Hence, they may be unlikely to sell around the current prices. This typically suggests that despite the recent price downtrend, long-term network participants still have confidence in the future price prospects and utility of the XRP.

Hence, if the long-term investors continue to hold and the whales keep buying, XRP will likely deliver a positive growth performance in the coming weeks.

Whales Are Buying the Dip

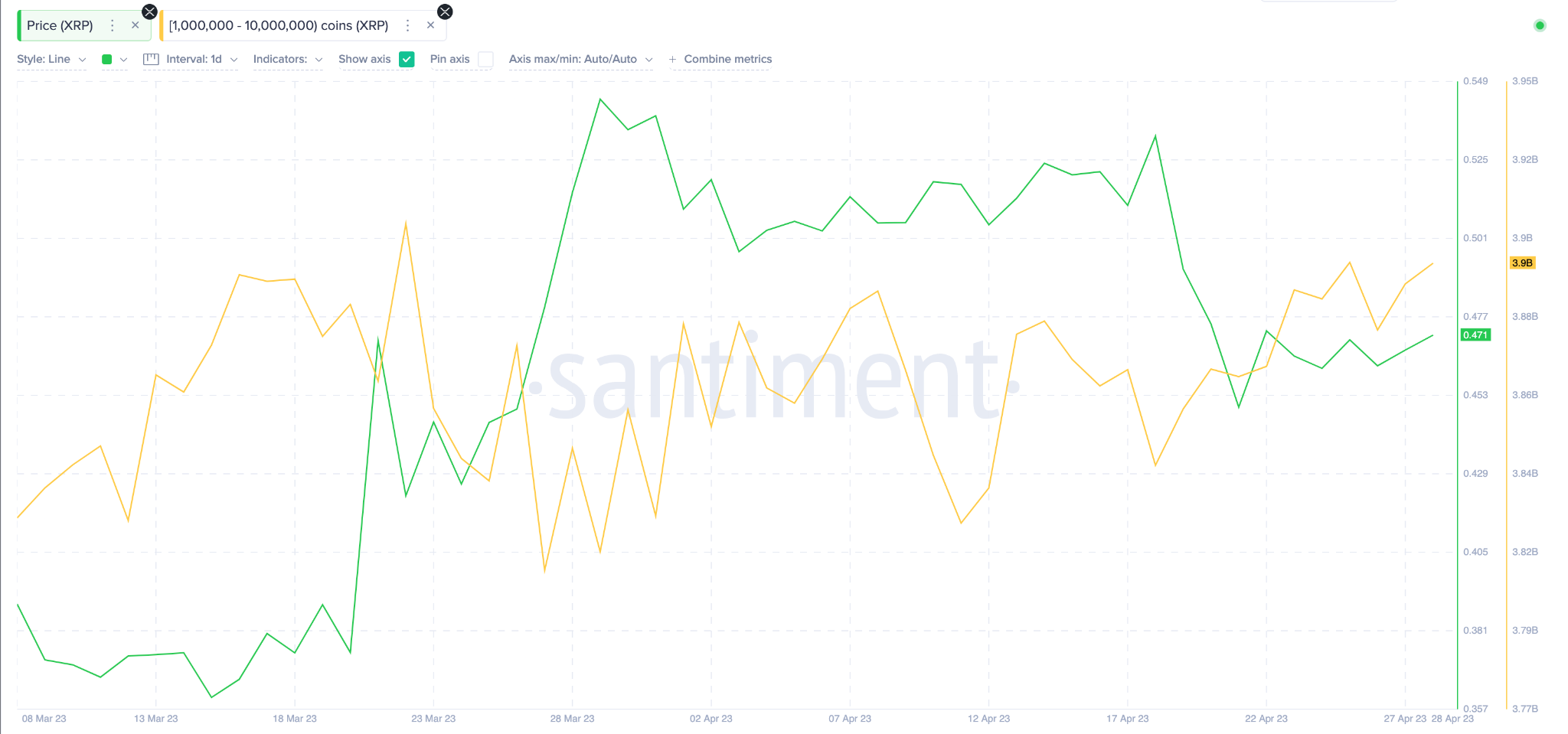

In addition, the accumulation wave among XRP whales also confirms the bullish momentum within the Ripple ecosystem.

The Santiment chart below shows how the cluster of whales holding one million to ten million units of XRP coins has been buying the dip since last week. The yellow line depicts that the whales intensified the accumulation around April 18. Since then, they have added 50 million coins worth nearly $23.5 million at a current market value of $0.47.

These whales’ recent buy/sell patterns have been closely correlated to XRP price actions. If this accumulation trend continues, investors can expect a possible bullish price upswing.

XRP Price Prediction: A Rebound Above $0.60 Is on the Cards

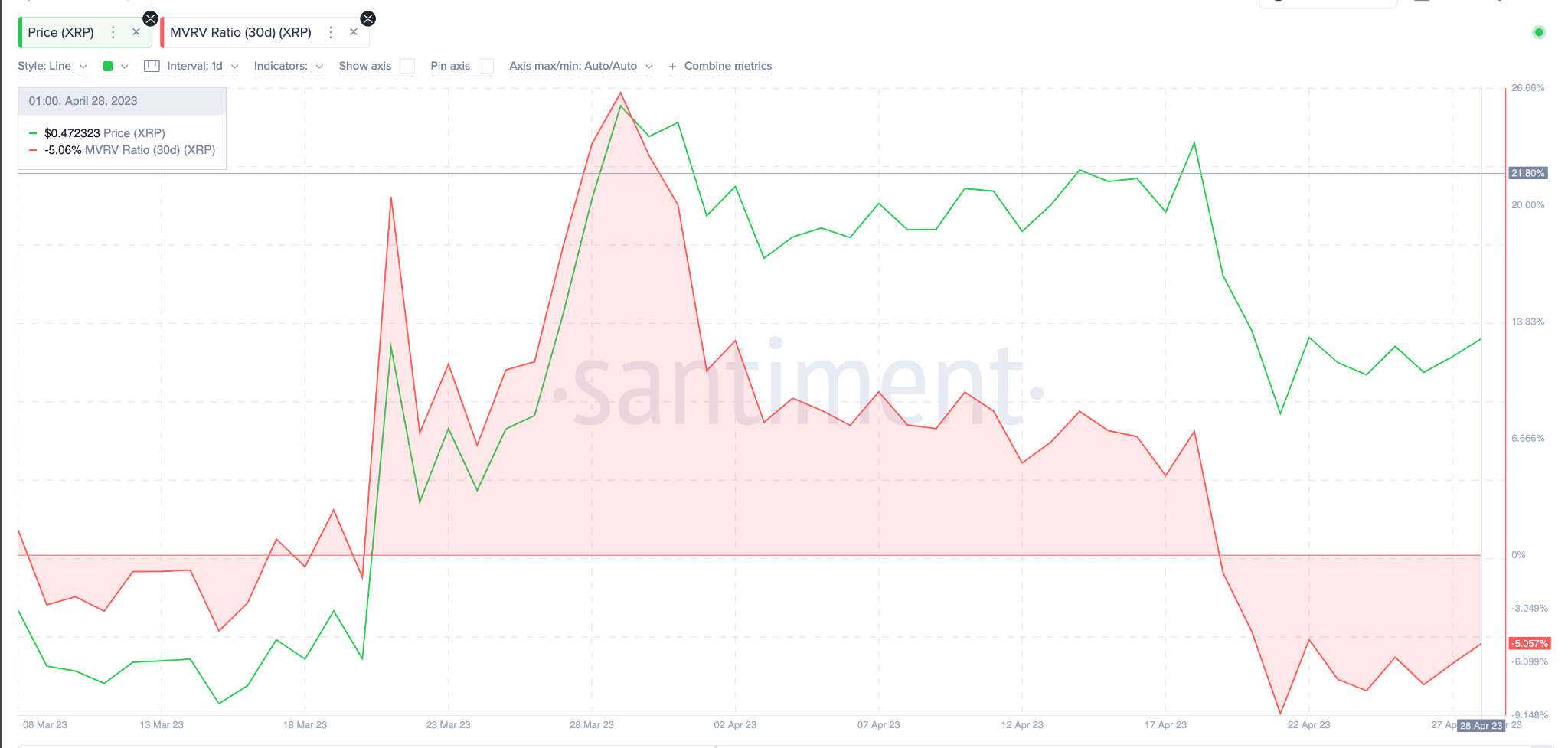

Over the past week, bullish XRP holders have defended the $0.45 support level. And according to Santiment’s Market-Value to Realized-Value (MVRV) data, a bullish rebound may now be on the cards

Notably, most crypto investors that bought XRP within the past month are sitting on unrealized losses of about 5%. Historical data suggests they are unlikely to sell until the price recovers by another 12% toward $0.52.

If XRP can break beyond that $0.52 resistance level, it could enter a prolonged rally toward the $0.60 zone before the bears begin to regroup.

Conversely, the bears could flip the narrative if XRP price drops below $0.45. Nevertheless, investors will likely offer bullish support at this level as they look to keep their loss position below 10%.

Otherwise, XRP could drop much further toward $0.40, which is the next significant support level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.