Up by 6% today, Ripple’s (XRP) price appears to be ending September on a strong note. But as October 2024 approaches, ongoing regulatory developments, institutional inflows, and some other factors will determine whether XRP will have an intriguing month or not.

With investors eagerly watching for clues on XRP’s price potential, this analysis examines key technical indicators, whale movements, and market sentiment, offering insights into what to expect from the token in the coming month

Ripple Looks Up to These Factors as Market Interest Rises

On a month-to-date basis, XRP’s price has increased by 10%, starting at $0.55 this month. At press time, the altcoin’s value is $0.62. This positive return could be linked to the broader market recovery, particularly Grayscale’s launch of the XRP Trust two weeks ago.

For some investors, the trust appears to be the first step toward an XRP ETF despite its current regulatory challenges. Some also believe that the development will positively affect XRP’s price in October.

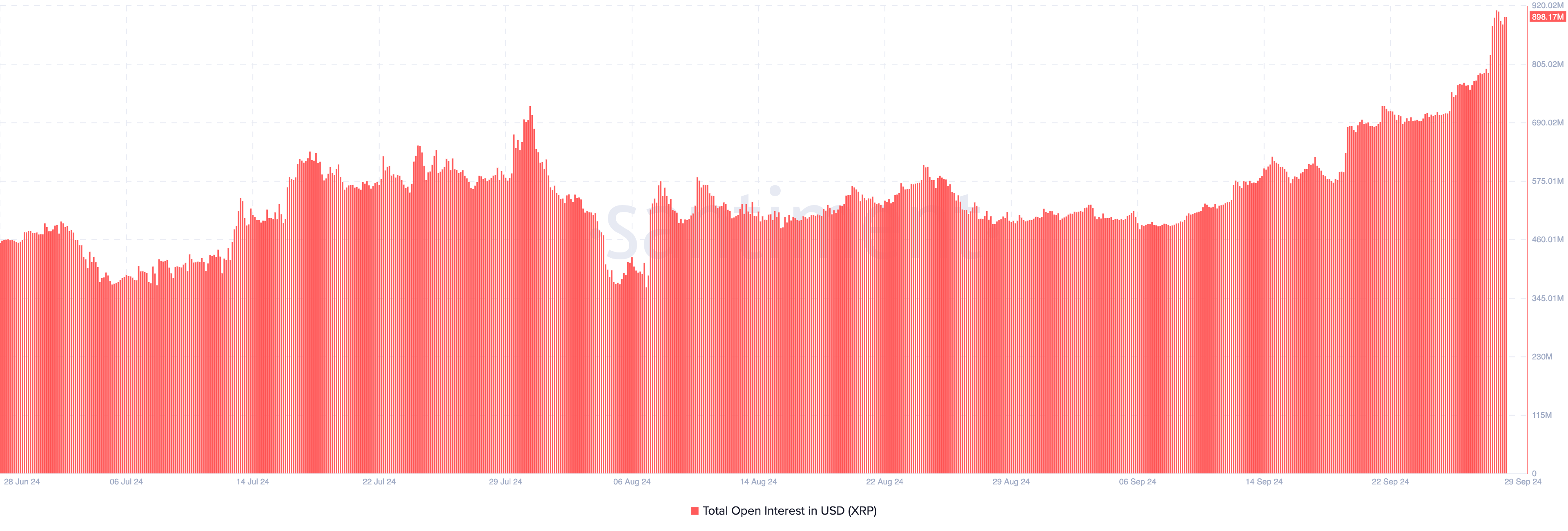

Furthermore, the surge in the token’s Open Interest (OI) seems to align with this sentiment. As of this writing, XRP’s Open Interest is almost $900 million. This indicates a notable rise in speculative activity around the token.

Price-wise, an increasing OI indicates that more money is flowing into the derivatives market. When this occurs during an upswing, it gives more strength to the trend. As such, XRP’s price might continue to climb into next month.

Read more: XRP ETF Explained: What It Is and How It Works

However, Juan Pellicer, Senior Researcher at IntoTheBlock, disagrees with the potential XRP ETF effect. According to him, Ripple’s stablecoin launch and integration with Decentralized Finance (DeFi) should have more impact in October 2024 and beyond.

“While the launch of an XRP Trust and potential transition to an XRP ETF are significant developments to monitor, the primary catalyst for XRP in Q4 2023 is expected to be the launch of their RLUSD stablecoin and its integration into the DeFi ecosystem,” Pellicer told BeInCrypto in an exclusive interview.

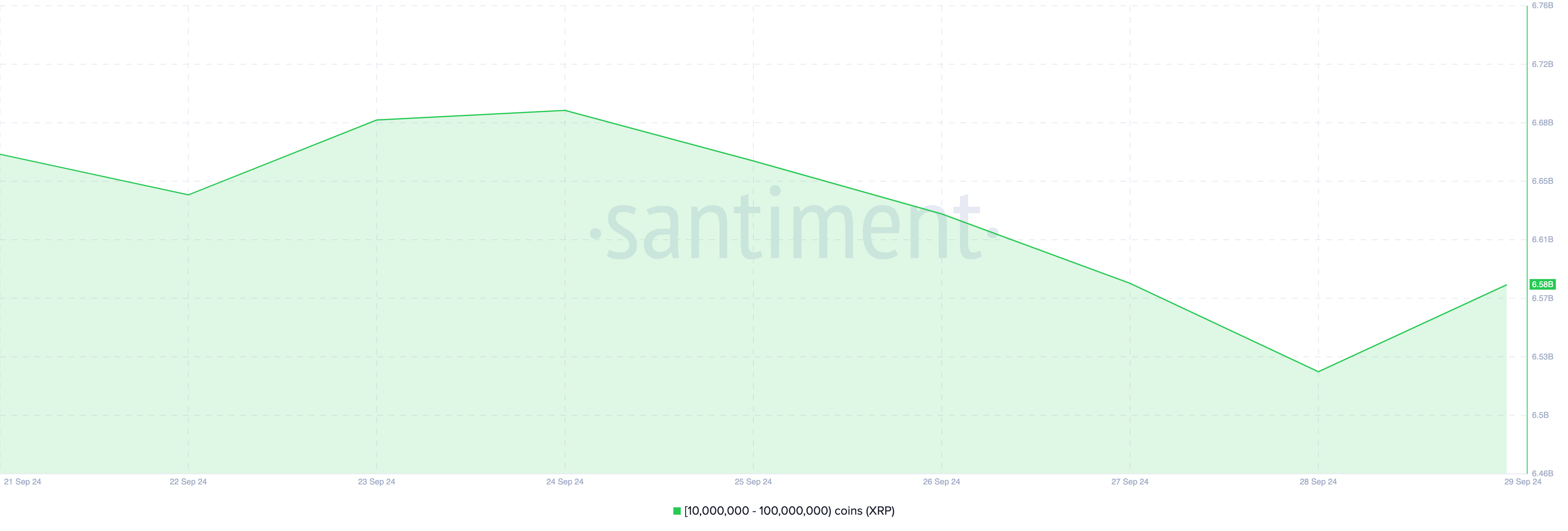

Irrespective of the crucial catalyst, data from Santiment shows that crypto whales are buying XRP again. As seen below, these whales purchased 60 million tokens, valued at $37.20 million, between yesterday and today. Based on this action, it appears that whales are gearing up for a potential XRP price increase as Q4 approaches.

XRP Price Prediction: Ready for Breakout

From a technical perspective, the lack of volatility around the token has kept XRP’s price from reaching $0.70 earlier. However, the daily chart shows that it might now have a higher chance of hitting that value.

For instance, a look at the Ichimoku cloud, which typically tracks support and resistance, shows that the indicator is below the price. When the Ichimoku cloud is positioned below the price, it signifies support, indicating that the cryptocurrency may have a solid foundation to push higher. Conversely, when the cloud is above the price, it acts as resistance, suggesting a potential decline in value.

In XRP’s case, the cloud’s being below the price implies strong support, potentially driving the value higher than $0.62. With support at $0.59, XRP’s price might breach the resistance at $0.63.

Read more: How To Buy XRP and Everything You Need To Know

After that, the next level for the altcoin to reach could be around $0.69, potentially moving up to $0.72 before October ends. However, if XRP experiences a notable decline in whale activity in the next months, this prediction might not come to pass. Instead, XRP’s price could decrease to $0.57.

However, Pellicer, commenting on the cryptocurrency’s price, noted that it might experience increased volatility, which could push it out of the current tight trading range

“We anticipate increased volatility for XRP as these developments unfold. The success of the RLUSD stablecoin and its DeFi integration could potentially drive XRP towards new yearly highs, contingent on broader market conditions and regulatory outcomes,” the analyst said.