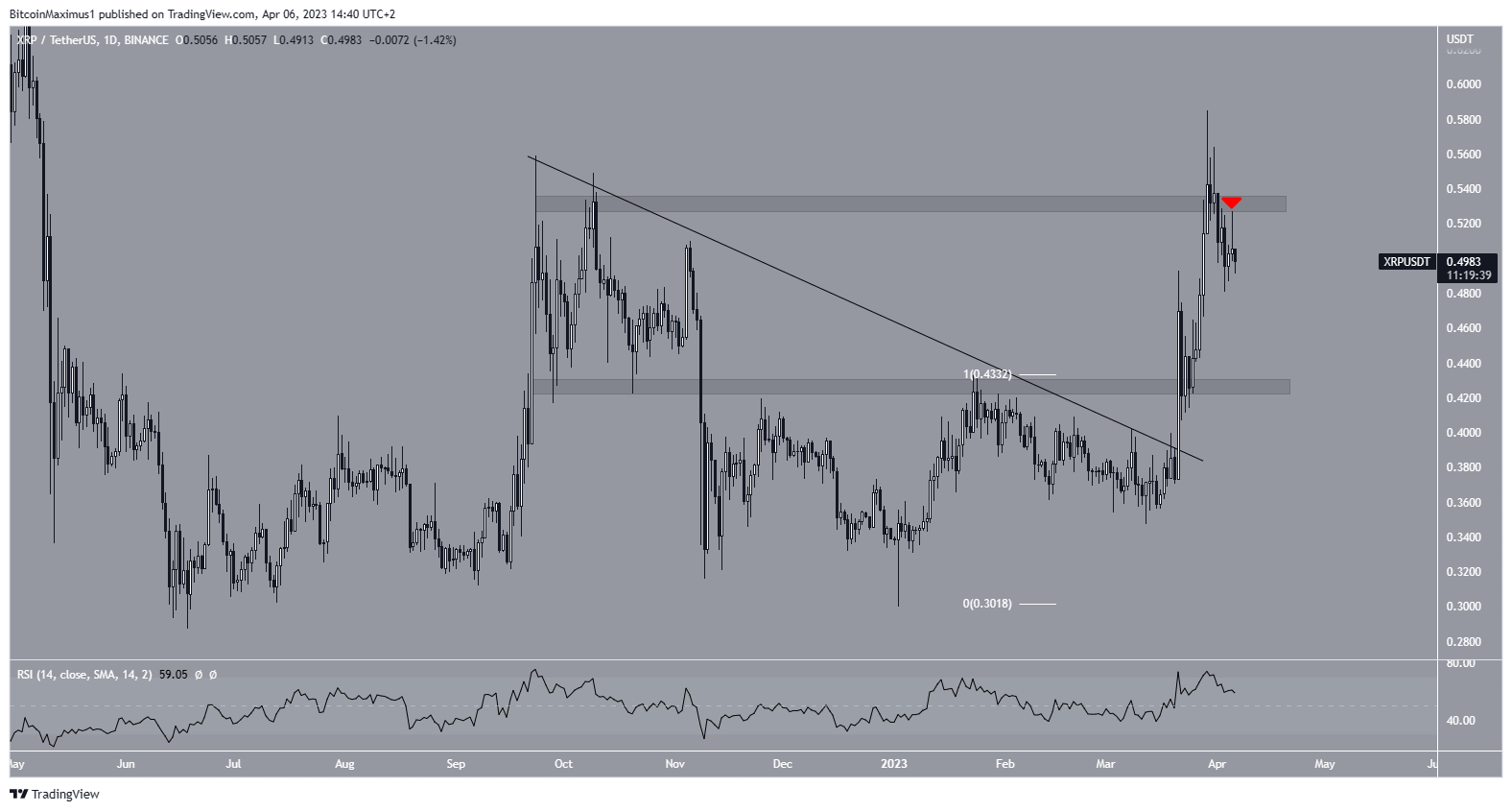

The technical analysis from the daily time frame shows that the XRP price has been consolidating recently after reaching its yearly high on March 29. The consolidation began after a rejection from the $0.530 resistance area. However, there are indications the price could resume its upward movement soon.

XRP had surged rapidly since breaking out from a descending resistance line on March 21, leading to the aforementioned yearly high. Although the price fell below the $0.530 area shortly after, there was no bearish divergence in the RSI. Nevertheless, the area again rejected the XRP price on April 5, creating a long upper wick.

If the digital asset breaks out, it could increase to the next long-term resistance level at $0.650. On the other hand, if the price is rejected, it could drop to the nearest support level of $0.425.

A closer look at the price movement and wave count from the 12-hour time frame suggests that the XRP token price is currently in wave four of a five-wave increase (white). This gives a bullish XRP price prediction for April, indicating it could break out from the $0.525 resistance area and move toward $0.650. Besides being a horizontal resistance area, this is the 2.61 extension of wave one (white).

The most likely pattern for completing the corrective wave is a short-term symmetrical triangle. The XRP price bounced at the confluence between the triangle’s support line and the 0.382 Fib retracement support level (black) on April 3 (green icon). So, it is possible that was the low point of the correction, and a breakout will soon follow.

However, if the price drops below the wave one high of $0.433 (red line), this scenario would be invalidated, and the price could fall toward the $0.350 support level.

To conclude, the most likely XRP price forecast is an increase toward the $0.650 resistance area, but a drop below $0.433 could trigger a fall toward $0.360.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.