XRP has recently been facing a downtrend, with the altcoin dipping below key support levels. However, it seemingly established a bullish pattern that appeared poised for a breakout.

Yet, the overvaluation of XRP has made this breakout unlikely. As the altcoin’s price surges, concerns about its sustainability are mounting.

XRP is Highly Overvalued

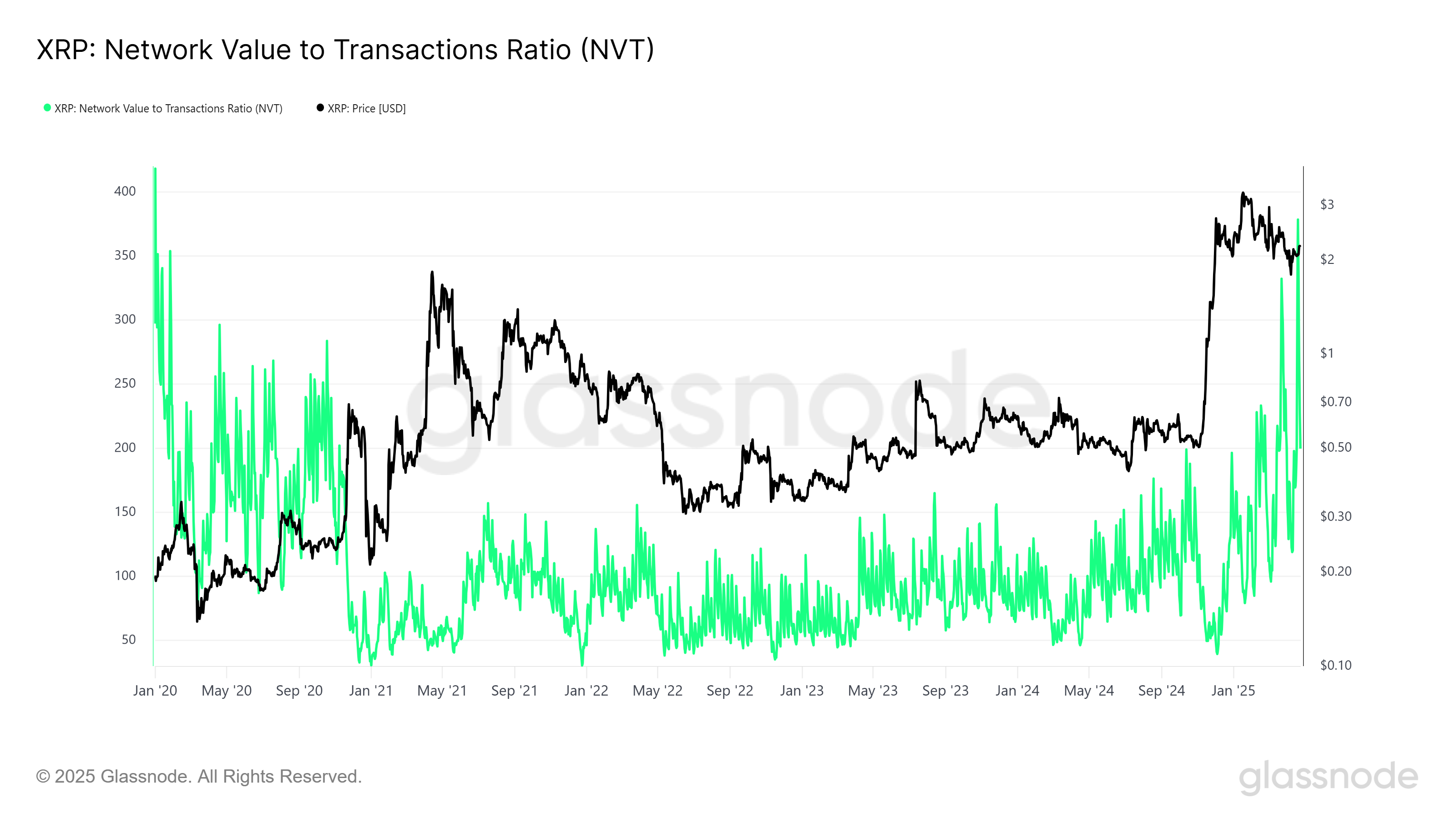

This week, XRP’s network value-to-transaction (NVT) ratio spiked to a five-year high, signaling an overvaluation. The NVT ratio is a critical indicator that compares a cryptocurrency’s market capitalization to its transaction volume. When the NVT ratio increases sharply, it suggests that the network value is outpacing actual transaction activity.

This condition has historically been associated with an upcoming correction in price. The last time the NVT ratio reached similar levels was in January 2020, just before XRP experienced a significant price downturn. The surge in NVT suggests that the market is becoming overheated, with expectations of a cooldown.

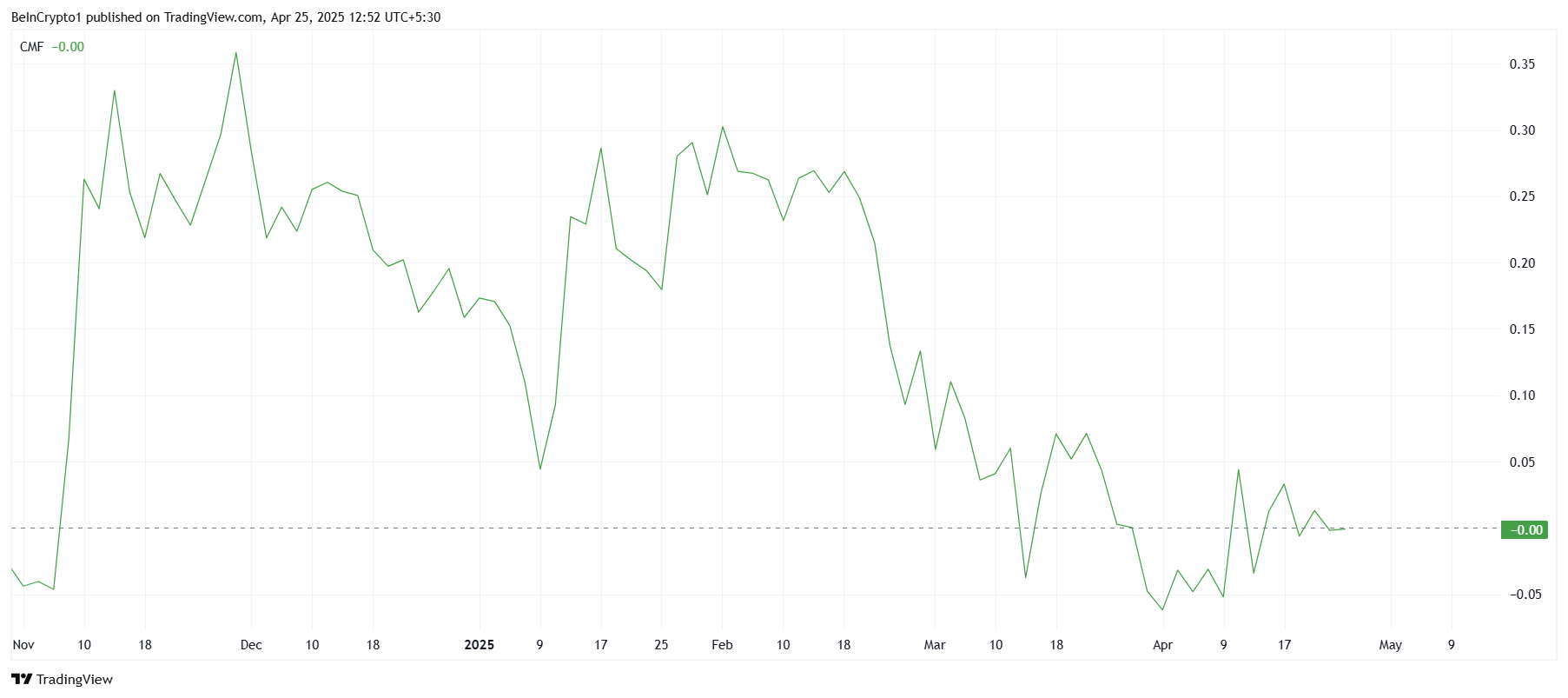

Despite XRP rallying 22% in the past two weeks, technical indicators paint a more concerning picture. The Chaikin Money Flow (CMF) indicator has displayed a significant spike, often suggesting that money flows into the market. However, a closer look at the volume of inflows reveals that substantial buying activity has not supported the price increase.

Instead, hype and speculation drive the price surge more than genuine investor interest.

With this in mind, XRP’s rally may be more of a short-term anomaly rather than a sustainable upward trend. As the market cools down and the hype subsides, the altcoin will likely struggle to maintain its recent price levels. The overvaluation condition remains a significant risk, potentially leading to a price correction.

XRP Price Faces Bearish Cues

XRP is currently trading at $2.19, showing a 22% increase in the last two weeks. The altcoin appears to be preparing for a breakout from a three-month-old descending channel. However, this breakout faces challenges, as the overvaluation condition and broader market indicators suggest that the rally may not last.

Given the potential bearish factors, even if XRP manages to break out, the rally could be short-lived. The price could retreat to $2.02, or possibly lower to $1.94, if the breakout fails to hold. The combination of overvaluation and weak buying momentum could quickly reverse any gains.

On the other hand, if XRP does manage to sustain its breakout, securing $2.40 and $2.56 as support levels could provide the necessary foundation for further price growth. Such a move would invalidate the bearish outlook, allowing XRP to push higher and continue its ascent.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.