XRP price has maintained a positive start to Q2 2023. Having fiercely defended the $0.50 support for the first half of April, can the reinvigorated whales and long-term holders push the rally above $0.60?

On April 13, the Ripple (XRP) team announced the launch of its institutional Crypto Liquidity Hub. The move could see XRP capitalize on its recent price gains as institutional traders turn to the hub for their cross-chain liquidity and cross-border payments solutions.

On-chain data reveals that the positive price performance and product updates have appeared to have buoyed the confidence of crypto whales and long-term XRP holders.

XRP Whales Have Started Buying Again

Following the sell-off that followed the XRP price spike on March 21, crypto whales appear to have begun accumulating again.

The Santiment chart below shows that crypto whales holding 10 million to 100 million XRP have added 30 million coins between March 24 and April 14.

The newly added 350 million are worth $182 million at current market value. When whales invest significant sums within a short period, it drives up demand and inspires confidence among other investors.

Similarly, the recent accumulation wave observed among long-term XRP holders is another critical bullish signal.

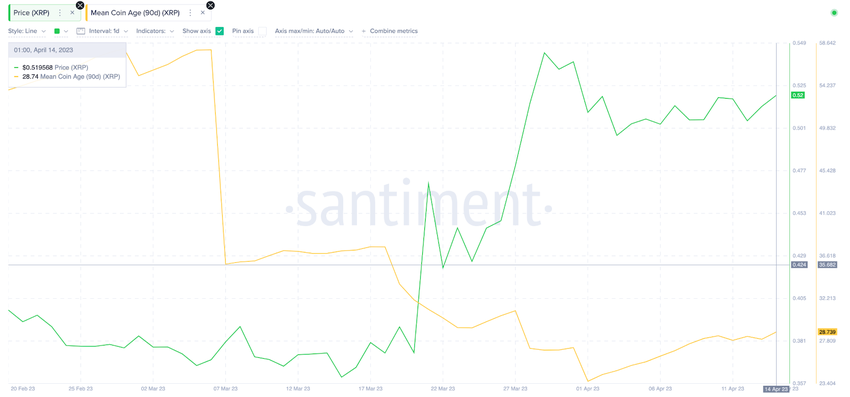

According to Santiment, Mean Coin Age on the XRP ledger network has entered an uptrend in recent weeks. After a network-wide sell-off in late March, the Mean Coin Age has been on the rise since April 1.

The chart below shows how it increased by 21%, from 23.64 to 28.84, between April 1 and April 4.

Mean Coin Age gauges the sentiment among long-term holders by multiplying the total coins held on a network by the number of days spent in their current addresses. After tapering off in late March, the rising Mean Coin Age signals that long-term investors are now positioning for future gains.

XRP Price Prediction: Can the Bulls Push For $0.60?

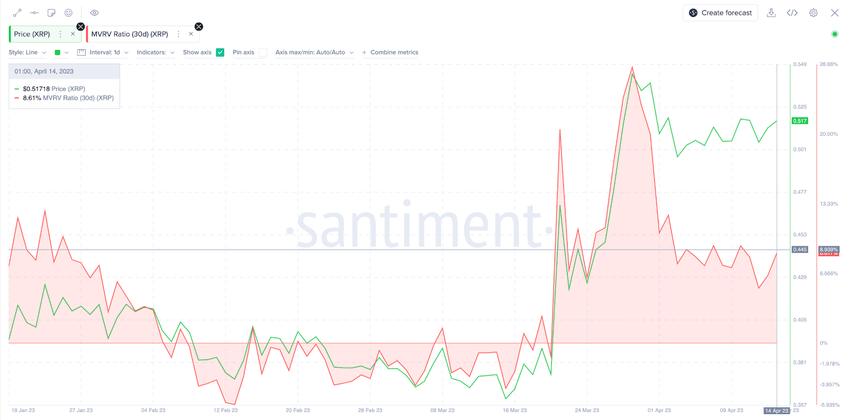

Considering the on-chain MVRV data provided by Santiment, XRP price could rise to $0.60 before facing significant resistance.

The Market Value to Realized Value (MVRV) data identifies potential buy/sell zones by evaluating the average price at which current holders acquired an asset.

The chart below shows that most BNB holders are currently sitting on profits of about 8%.

The historical MVRV data and price trends show holders will likely sell around the 12% zone. This means that once the price nears $0.55, XRP could experience some pushback

But if it breaks from that resistance, the bulls can drive the rally toward $0.62 before holders enter a sell-off frenzy.

Conversely, the bears could cross out the bullish narrative if XRP price drops below the $0.49 support. However, the holders could look to end the sell-off here and hold on to their 5% profits.

Yet, that support level gives way, XRP could experience expect a larger drop toward $0.45 before holders choose to cut their losses at 2%.