Worldcoin’s (WLD) price is on a bullish path propelled by one of the most influential cohorts, the whale addresses.

This investors’ accumulation has enabled WLD to recover recent losses with the help of investors potentially.

Worldcoin Investors Accumulate

Worldcoin’s price is above the $5 mark but still attempts to break past a crucial resistance level. However, the whales could be the altcoin’s savior, as the large wallet holders have consistently added WLD to their holdings.

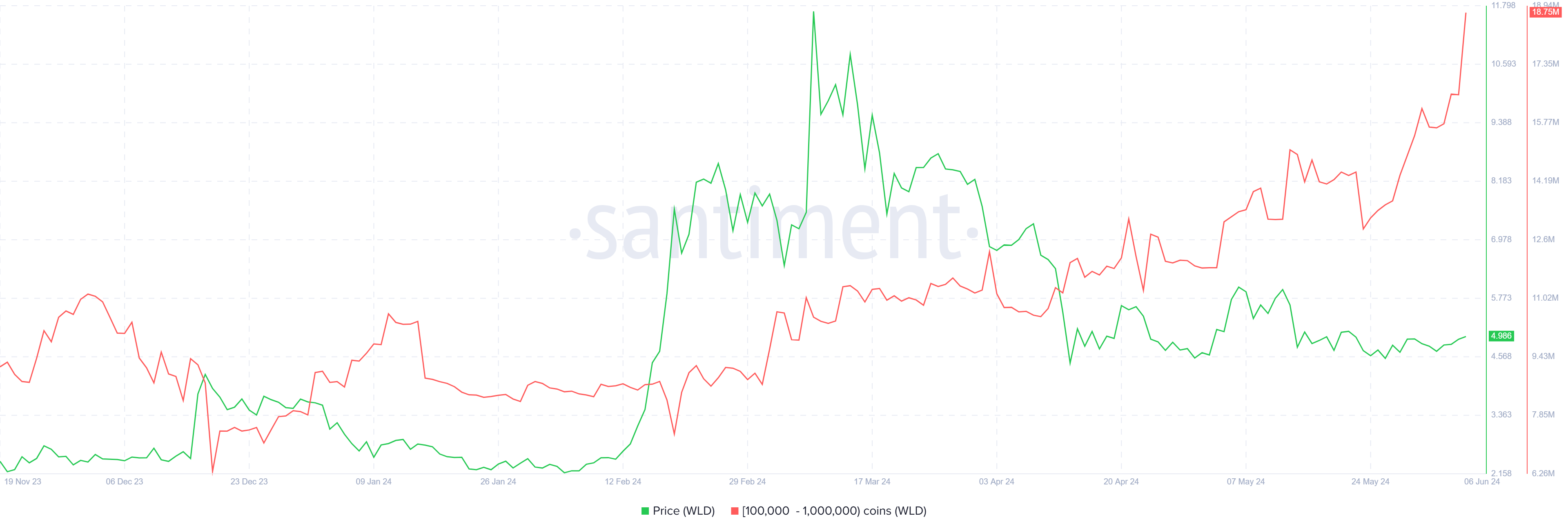

In the past two weeks, addresses holding between 100,000 and 1 million WLD have bought over 6 million WLD. This supply, worth nearly $30 million, proves investors are optimistic about a price rise.

Thus, they are accumulating now to reap profits once Worldcoin’s price breaks out.

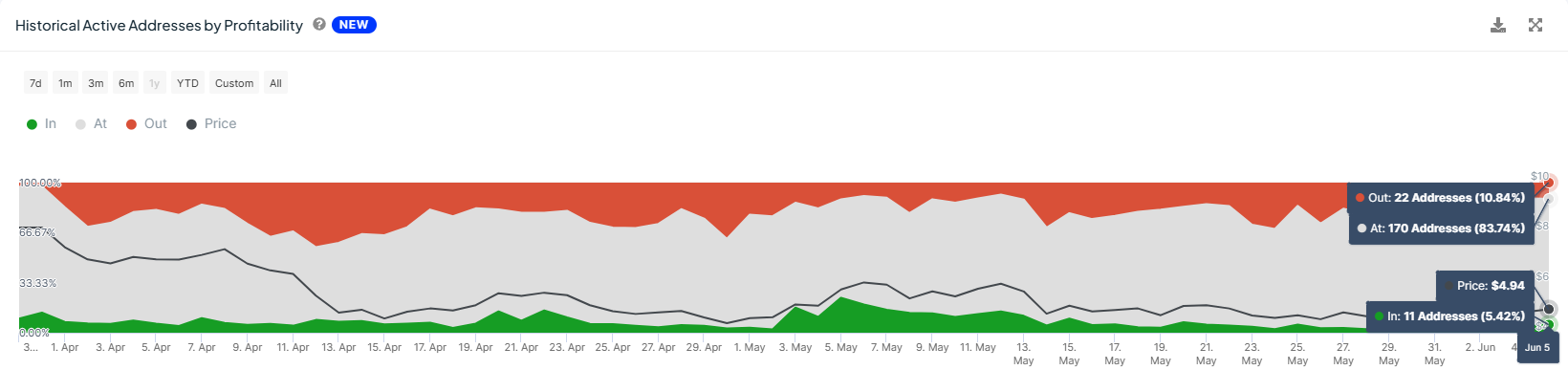

This sentiment is shared by retail investors and is also evident in their behavior. Upon distributing the participation, i.e., active addresses, by profitability, we can observe that the potential for selling is rather low.

In the case of WLD, less than 6% of all addresses conducting a transaction on the network are in profit. Generally, a dominance of this cohort hints at profit booking, but currently, WLD holders are HODLing overselling.

Read More: How to Buy Worldcoin (WLD) and Everything You Need to Know

Worldcoin’s price could capitalize on this as accumulation and minimal selling create the perfect atmosphere for a rally.

WLD Price Prediction: Rise and Shine

Worldcoin’s price recently bounced off the support at $4.53 after failing to breach the resistance at $5.14. This barrier has been unbroken since mid-May, making it crucial in initiating recovery.

With the help of the investors’ bullishness, WLD could breach this resistance and flip it into a support floor. This would enable a rise to $5.64, which is the next major barrier for the altcoin.

Read More: Worldcoin (WLD) Price Prediction 2024/2025/2030

However, a failed breach would keep Worldcoin’s price consolidated between $5.14 and $4.53. A fall to the latter would also increase the potential for a breakdown, invalidating the bullish thesis.