London’s Southwark Crown Court sentenced Jian Wen, a former fast food worker, to six years and eight months in prison. The court convicted her of laundering about 150 Bitcoin (BTC) linked to a broader $5.6 billion fraud in China.

This case highlights a major breakthrough in the fight against crypto-related crimes.

How Wen Helped in Bitcoin Laundering?

Wen, 42, transitioned from living in the modest basement of an East London Chinese takeaway to owning a luxurious six-bedroom mansion. She consistently denied her involvement, claiming she was merely following orders from Yadi Zhang, alleged to be the architect of the scheme.

The scheme transferred large sums of stolen money from China, then converted them into Bitcoin and laundered them through various assets across the UK, Europe, and Dubai. Influenced by an extensive array of digital evidence, including thousands of WhatsApp messages between Wen and Zhang, the jury convicted Wen after a nearly two-month trial.

Read more: 15 Most Common Crypto Scams To Look Out For

Wen’s transformation, marked by her high-profile shopping sprees at luxury stores, illustrates her dramatic lifestyle change. She funded this lifestyle with the proceeds from the laundered Bitcoin, which totaled over 61,000 BTC at the time of seizure, now valued at over $4 billion.

During the sentencing, Judge Sally-Ann Hales emphasized the sophisticated and well-orchestrated nature of the crime.

“I am in no doubt that you knew what you were dealing with,” the Judge said.

Nonetheless, Wen’s defense portrayed her as a victim manipulated by Zhang. She believed Zhang was a legitimate jewelry, Bitcoin, and property businesswoman.

This case forms part of a wider crackdown on crypto laundering. For example, the United States recently convicted Roman Sterlingov, founder of the crypto mixer Bitcoin Fog, for similar offenses.

He faces up to 20 years in prison. His operation, which obscured the origins of illicitly obtained Bitcoin, handled transactions worth nearly $400 million, mainly for darknet markets.

Read more: 4 Best Bitcoin Mixers and Tumblers in 2024

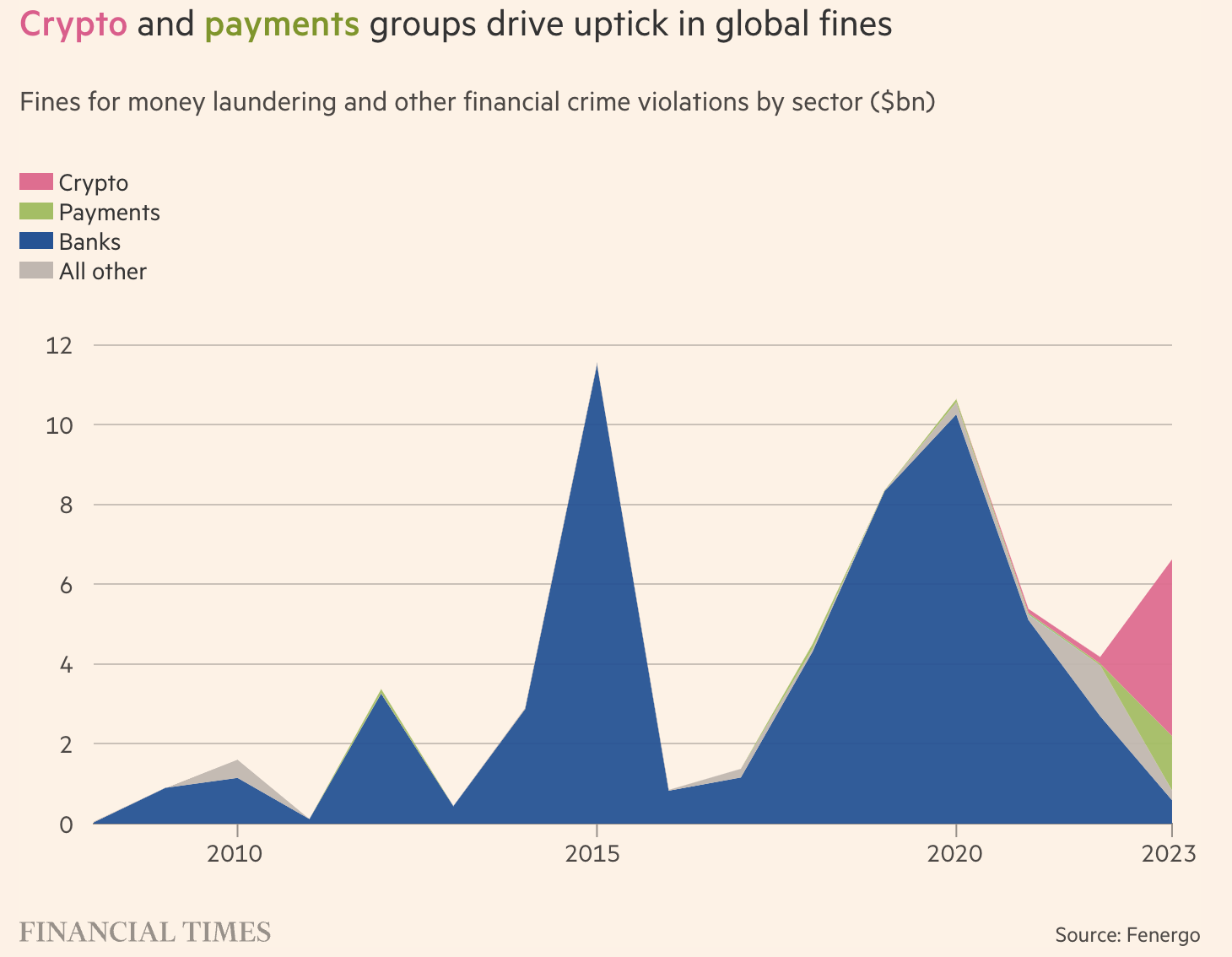

Authorities have increased their scrutiny of crypto, making the crackdown a component of a global initiative to regulate it. In 2023, digital payment and crypto companies faced fines totaling nearly $5.8 billion for anti-money laundering failures.

Among them, Binance faced a $4.3 billion fine, highlighting the financial and regulatory impacts of cryptocurrency operations.