When Bitcoin first started to emerge into the mainstream collective consciousness, it was frequently positioned as a threat to traditional finance. Bitcoin proponents pointed to the high fees charged by intermediaries such as banks and online payment providers, predicting that decentralization would be their downfall.

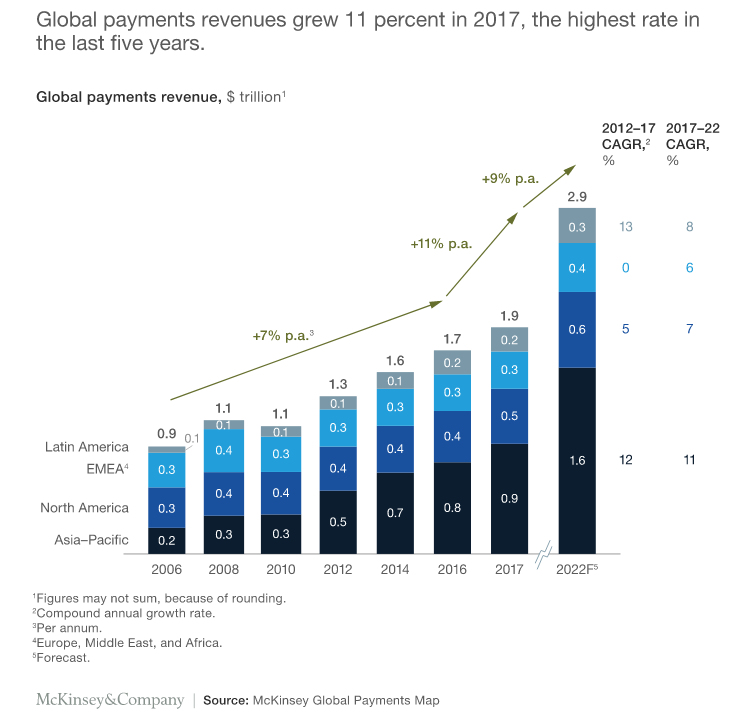

Figures from the global payments industry would suggest that this hasn’t turned out to be the case. According to McKinsey, revenues are set for a further 9% growth per annum by 2022.

Rather than running scared of cryptocurrencies, banks such as JP Morgan have adopted the concepts for their own ends. Many of the big payment providers are also making strides into the cryptocurrency sector. Furthermore, the signs are evident that this will continue in the future.

Rather than running scared of cryptocurrencies, banks such as JP Morgan have adopted the concepts for their own ends. Many of the big payment providers are also making strides into the cryptocurrency sector. Furthermore, the signs are evident that this will continue in the future.

PayPal Remains Cryptic on its Future in Crypto

Among the online payment providers, PayPal one of the most dominant players. Earlier this year, the company was one of 28 to announce its participation in the Facebook-led Libra cryptocurrency project. Despite the fact that it was the first of many to pull out in October, it seems that we can expect more developments from PayPal. However, the jury’s out on whether this will be in the cryptocurrency or broader blockchain space. Signals from the firm have been somewhat cryptic. According to a recent interview with CEO Dan Schulman: “We think there’s a lot of promise to blockchain technology. It’s intriguing to us, but it really needs to do something that the traditional rails can’t do […] We think a lot of the neat stuff that can happen on blockchain is around identity, for example.” Does this mean we can expect a blockchain-based identification system from PayPal any time soon? Schulman remained tight-lipped.Merchant Services a No-Go, Institutional Adoption Seems Likely

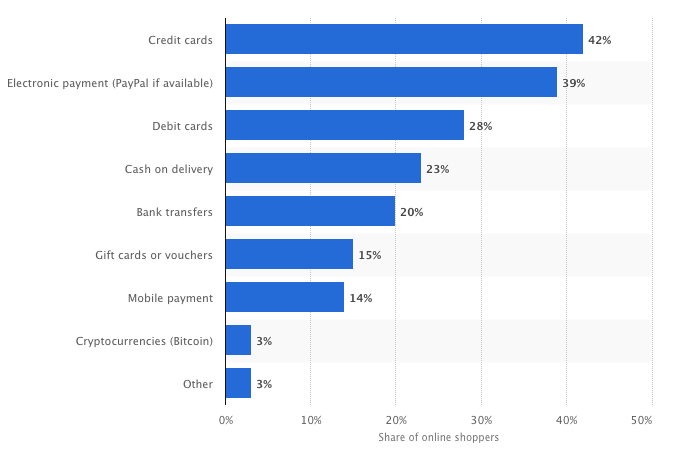

One way that payment firms could help to accelerate cryptocurrency adoption is through merchant services. PayPal already has a significant stake in this business, enabling anyone to accept payments via PayPal on their website and capturing significant market share. So far, none of the big payment firms have ventured into the cryptocurrency payment sector, leaving crypto-specific services such as BitPay or Coinbase Commerce to corner the market. According to Schulman:

“[Cryptocurrency] is still very volatile, and therefore, we don’t have much demand for it by merchants because merchants operate on very small margins. […] Until it becomes less volatile, it won’t be a currency that is widely accepted by merchants on the web.”

This shouldn’t be taken to mean that PayPal has little interest in cryptocurrencies overall. Reports recently emerged that the company has participated in a $4.2 million investment in TRM Labs, which provides compliance solutions for financial institutions. This would appear to indicate that PayPal is indeed committed to a future in which cryptocurrencies operate alongside traditional payment methods.

So far, none of the big payment firms have ventured into the cryptocurrency payment sector, leaving crypto-specific services such as BitPay or Coinbase Commerce to corner the market. According to Schulman:

“[Cryptocurrency] is still very volatile, and therefore, we don’t have much demand for it by merchants because merchants operate on very small margins. […] Until it becomes less volatile, it won’t be a currency that is widely accepted by merchants on the web.”

This shouldn’t be taken to mean that PayPal has little interest in cryptocurrencies overall. Reports recently emerged that the company has participated in a $4.2 million investment in TRM Labs, which provides compliance solutions for financial institutions. This would appear to indicate that PayPal is indeed committed to a future in which cryptocurrencies operate alongside traditional payment methods.

A Gateway for New Users

Skrill is another example of a payment company that’s branched out into the cryptocurrency space. The UK-based firm has long been a competitor to PayPal since its launch as Moneybookers in 2001. However, it’s recently diverged with an easy-to-use and accessible cryptocurrency buy-and-sell service. Skrill has partnered with a cryptocurrency exchange so that users can purchase Bitcoin, Ether, and other cryptocurrencies via its general interface. Along with ad-hoc transactions, it also offers some basic trading features such as an automated buy or sell order based on price movements. Furthermore, Skill could help to accelerate user adoption of cryptocurrency with its peer-to-peer cryptocurrency payments service. With this feature, an existing Skrill crypto enthusiast could onboard friends and family to digital assets without them needing to set up an exchange account. Given that one of the biggest barriers to individual cryptocurrency adoption is often cited as the overcomplicated user experience, this service could prove to be an important bridge to the general public.Adoption is the Goal

In contrast to Schulman’s reticence on the topic of cryptocurrency, Skrill’s CEO, Lorenzo Pellegrino, has shown great enthusiasm for the topic. In an interview with CEO World, Pellegrino stated: “[Cryptocurrency] could potentially be the next evolution of [money,] one of the most fundamental of human creations – although it would be careless to say this is guaranteed. Overall, however, it does excite me, and that’s why I am so keen to further aid its adoption with our companies.” Among other payment companies, the approach to cryptocurrencies has been mixed. Like Skrill, competitor firm Revolut has been enthusiastic about providing new digital asset services to its customers. Others are less optimistic. Scott Galit, CEO of US-based online payment provider Payoneer, has previously expressed skepticism about the future of cryptocurrency. One thing is clear. As the generation of financial services that sits between traditional banks and cryptocurrencies, payment providers are in a unique position to help connect their existing user bases to digital assets. Furthermore, the Libra project has generated more hype around cryptocurrency than there’s ever been in the history of the concept. How the payment companies approach this unique challenge will be intriguing to watch over the next few years.Disclaimer: This article is a guest submission and was not authored nor edited by BeInCrypto. We have chosen to publish it because we feel it may be of interest to our readers, who are advised to always do their own research. BeInCrypto is not responsible for the accuracy of any claims made in this article.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Advertorial

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

Advertorial is the universal author name for all the sponsored content provided by BeInCrypto partners. Therefore, these articles, created by third parties for promotional purposes, may not align with BeInCrypto views or opinion. Although we make efforts to verify the credibility of featured projects, these pieces are intended for advertising and should not be regarded as financial advice. Readers are encouraged to conduct independent research (DYOR) and exercise caution. Decisions based on...

READ FULL BIO

Sponsored

Sponsored