Today, Professor Hilary Allen published an article in Foreign Affairs making the case for banning cryptocurrency in the United States. Allen cited a long list of exploits, crypto exchange collapses, and technical inefficiencies in the blockchain ecosystem. Her conclusion: The risks of blockchain technology far outweigh the rewards, and the U.S. government should ban it altogether. But is such a move in the public’s interest?

Historically, bans on new technologies have had mixed results. Outright bans can be a way to fight issues like climate change. For example, bans on petrol-powered cars can drastically reduce fossil fuel emissions in real-time.

However, many bans have unintended consequences. An outright ban on 3-D printed gun blueprints could threaten innovation in other open-source, peer-to-peer applications.

So far, the $1.24 trillion crypto industry has fostered new banking solutions that are efficient, secure, and accessible to everyday people. Artists once ignored by the traditional art world have made careers (and fortunes) in NFTs. And Decentralized Autonomous Organizations are growing in popularity as an alternative to traditional governance.

The ins and outs of blockchain are definitely not easy to understand or regulate. Yet the solutions it enables justify asking governments to accept the technology. With some time and effort, it is possible to fix crypto’s imperfections and encourage more people to reap its many benefits.

The Dark Side of Anonymity

One of the features of blockchain technology is the option to keep your identity private. That’s partly why one of the earliest uses for Bitcoin was buying illicit substances on the dark web.

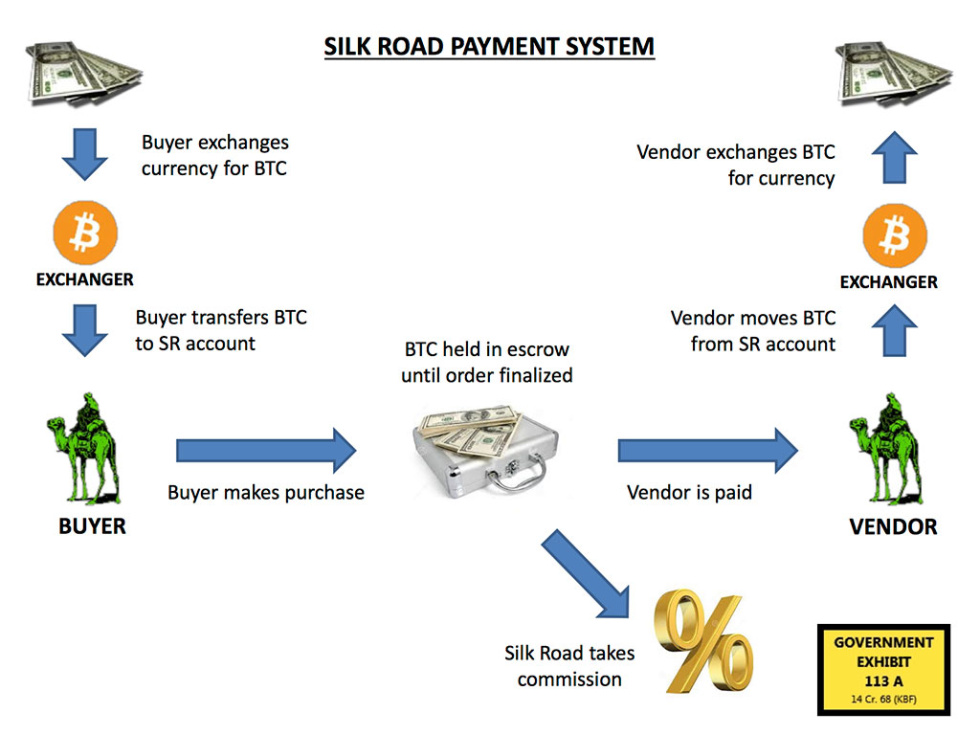

Silk Road was originally set up so that people could trade goods and services without sharing any information about themselves. However, the lure of anonymity allowed users to buy drugs, and guns, and allegedly even hit men, all without a trace.

In recent years, countries, including China, Egypt, Bangladesh, Algeria, Iraq, and Tunisia, have banned cryptocurrency entirely.

However, it has not stopped people from using or interacting with cryptocurrencies. And more importantly, it hasn’t solved the routing problem. Sex trafficking, money laundering, and the sale of illicit substances are still rampant in places where crypto has been banned for years.

Safety and Security

While cryptocurrency offers anonymity, it also functions on an immutable, transparent ledger. Each and every transaction is visible and unalterable. Even if you can’t find a specific user, you can certainly identify and locate a crypto wallet address. Then, authorities can track these accounts and look for identifiable patterns.

Or, the United States can follow the Dominican Republic in creating a state-sponsored metaverse that encourages adoption and gives support and opportunities to its citizens. Just today, the Dominica Metaverse Digital Citizen program, or DMDC, announced that it is launching a soulbound token that citizens can mint after completing KYC verification.

The relevant government agency can hold citizens’ personal information off-chain. And their ability to participate in activities they qualify for (such as entry to specific online groups or events) is on-chain. This compromise has the potential to lead to much better results in crypto literacy and safety rather than an outright ban on crypto.

FTX Is Not Typical

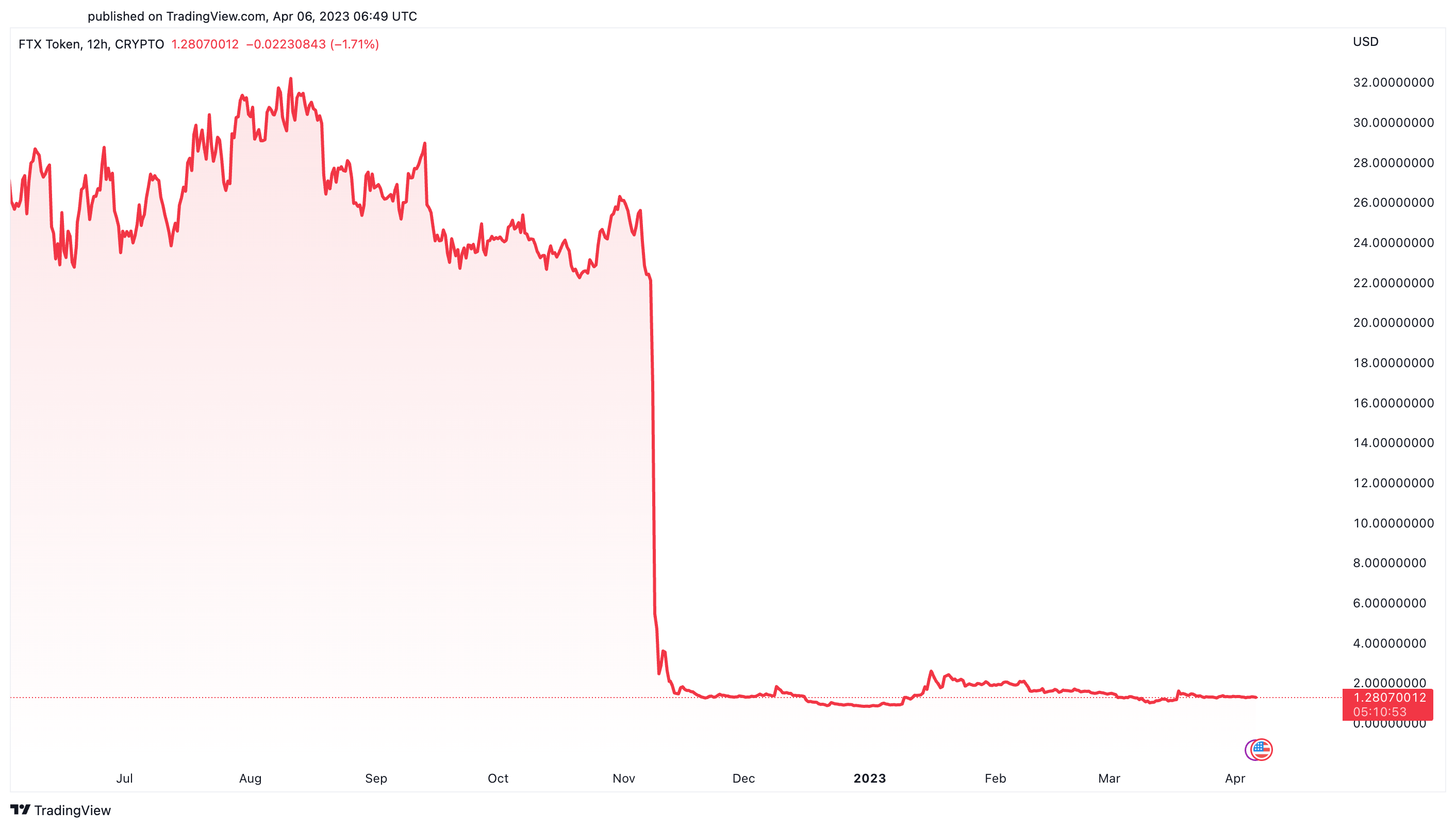

Sam Bankman-Fried had the entire world at the edge of their seats as he tried and failed to save his crypto exchange from the grips of bad trades and risky leverage. Crypto enthusiasts watched with a mix of amazement and despair as SBF fled, “Fast and Furious”-style, out of the U.S.

But what most critics get wrong are the reasons for FTX’s failure, as well as the possible solutions.

First and foremost, FTX was not based in the U.S. It was offshore, meaning the exchange was outside the purview of the SEC and other government agencies. A crypto ban would not have stopped this collapse.

Secondly, the SEC aimed to regulate specific currencies, not the entire exchange. And third, SBF made several mistakes that any MBA student could have deciphered with ease.

No one in crypto defends SBF’s actions. Most crypto natives view the fall of FTX as an ugly blemish on an industry that wants to build a better world for everyday individuals.

Many prominent voices in the space, including Coinbase Co-founder and CEO Brian Armstrong, have come out publicly to advocate for more regulation. They want the government to ensure that these kinds of events do not happen again.

Regulation Will Fail

Network decentralization is one of the crypto world buzzwords that have yet to be truly achieved. Many crypto industry players want to create decentralized systems. But as is often the case with power and money, human beings are inclined to abuse them once accrued. Those who aim for decentralization know this on some level.

That’s why blockchain technology, in its most theoretical form, relies on code instead of the decision-making of human beings. But even Bitcoin, perhaps the most decentralized network in the world, requires maintenance from a small group of leaders.

To be clear, decentralization is not a panacea to the woes that inspired its inception. The Great Financial Crisis of 2008 remains a fateful tale of how centralized players can take advantage of the masses. But several examples of power grabs, hacks, and 51% attacks have crippled organizations native to the blockchain as well.

But the GFC also illustrates that regulation is not a panacea for financial crimes, mishaps, and human greed. After all, the United States regulated the banks, mortgage-backed securities, and rating agencies involved.

How Decentralization Could Work

The goal that inspired Satoshi Nakamoto to establish Bitcoin as a decentralized network was to combat the kind of unilateral decision-making that enabled the U.S. Treasury to pay off the debts of Wall Street’s bad bets without holding the culprits accountable and printing billions of dollars in the process.

A decentralized organization would require its members to reach a consensus, making sure that each member had a vote. This would allow for a truly democratic way of handling crises. Furthermore, once the founders of a group write the rules of engagement into code, there is no way for people to alter these rules.

If banks, or in the future, crypto exchanges, are liable for their losses and they know that the government won’t bail them out, that might actually curtail risky bets and incentivize a more stable and secure financial strategy.

Catching Up

To zoom out for just a second: The U.S. government has yet to catch up to the pitfalls of the internet age. Companies like Facebook, Google, and Apple consume our personal data and use it to, at best, sell us products and, at worst, encourage information bias or keep us engaged on their channels through conspiracy theories and propaganda.

But instead of tackling that, the United States has focused on breaking up monopolies in big tech. This approach is not only ineffective but fails to address the issues at hand. Our data, our content, and many other personal aspects of our lives are no longer our own.

Is it really any wonder that a new industry has cropped up to tackle it?

Up until now, the U.S. government, and by extension, many pundits in the debate over the risks and rewards of blockchain, have approached the industry with tolerance. They have tried to find ways to make crypto fit their view of how the world works. They see blockchain as a more complicated version of something old rather than something entirely new.

This is why attempts at regulation thus far have failed so miserably. And why some are inclined to take the easy way out and ban crypto rather than trying to find ways to support it.

The Case to Embrace, Not Ban, Crypto

Blockchain technology has the potential to create a new world in which individuals own their personal data, have access to a worldwide currency not impacted by the decisions of a few individuals, and opt into a system that shares their values.

John Jacques Rousseau stated that “civilization is a hopeless race to discover remedies for the evils it produces,” and proponents of blockchain have made it their mission to use technology to disrupt systems that no longer work.

The blockchain industry may not be perfect. But at least the driving force behind it is the desire to make the next chapter of human history better than the last.

Now it’s up to politicians and regulators to help negate bad actors, protect consumers, and come up with creative solutions that ensure that the crypto industry grows sustainably and ethically. Crypto is not a fad that will soon disappear. So the U.S. can either ban crypto and get left behind or embrace it and lead the charge toward adoption.