Ki Young Ju, CEO of CryptoQuant and a prominent figure in crypto analysis, has publicly declared that the traditional Bitcoin cycle theory is no longer valid.

This bold statement also serves as his admission that his previous predictions are now outdated. It reflects a profound shift in the market’s nature compared to the past.

Why Has the Traditional Cycle Theory Collapsed?

Ki Young Ju’s earlier Bitcoin cycle theory was built on two pillars: buying when whales accumulate and selling when retail investors enter.

He used these two factors as the foundation of his past predictions — including his earlier call in March that the bull cycle had ended.

However, as market dynamics shifted, he acknowledged that this theory no longer fits. He even apologized, expressing concern that his prediction might have affected someone’s investment decisions.

The key difference that led him to abandon the theory lies in how whales behave. In the past, whales distributed Bitcoin to retail investors. But now, he realizes old whales are selling to newly emerging long-term whales.

This shift has caused the number of holders to increase — surpassing the number of traders.

Bitcoin’s institutional adoption has surpassed not only his expectations but also those of many analysts. This has resulted in a market environment unlike anything seen in Bitcoin’s history, making comparisons challenging.

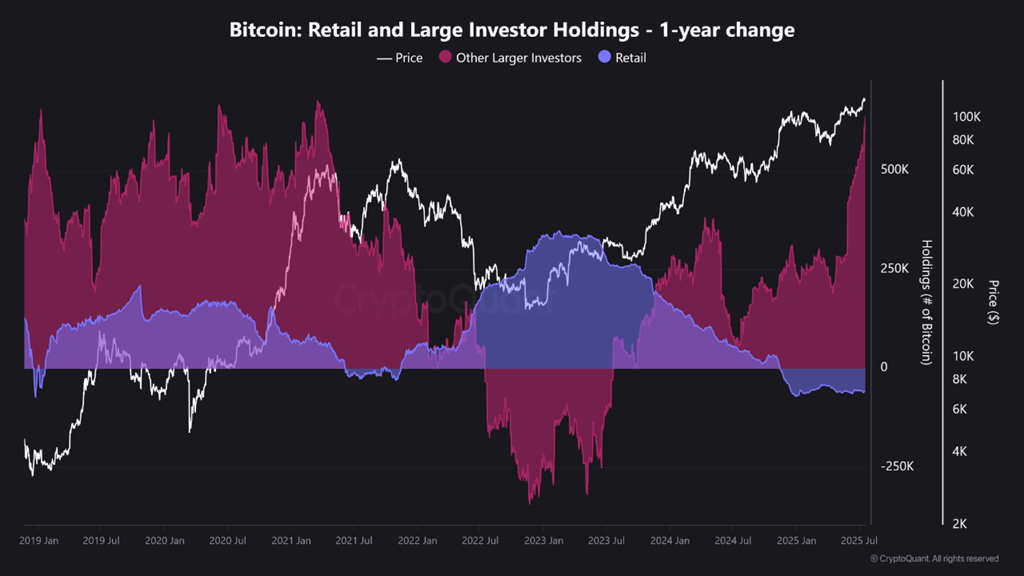

Recent analysis on CryptoQuant backs up his argument. Analyst Burakkesmeci noted that on-chain data clearly shows this is not a classic “retail investor frenzy,” unlike previous cycles.

Charts reveal that since early 2023, retail investors have been selling BTC, and their holdings have steadily declined. In contrast, institutions, funds, and large wallets — including ETFs — have been actively accumulating Bitcoin.

“This cycle looks nothing like the madness of 2021. There is no mass euphoria, nor is social media overflowing. Quiet and smart money is currently on stage — and most people are still watching from the sidelines,” Burakkesmeci said.

However, this new market environment also makes forecasting much harder.

In previous cycles, investors recognized bear markets by the panic among retail holders. But now, a pressing question arises: What would a bear market look like if institutional investors start to panic instead?

That may be the biggest challenge for risk managers today.