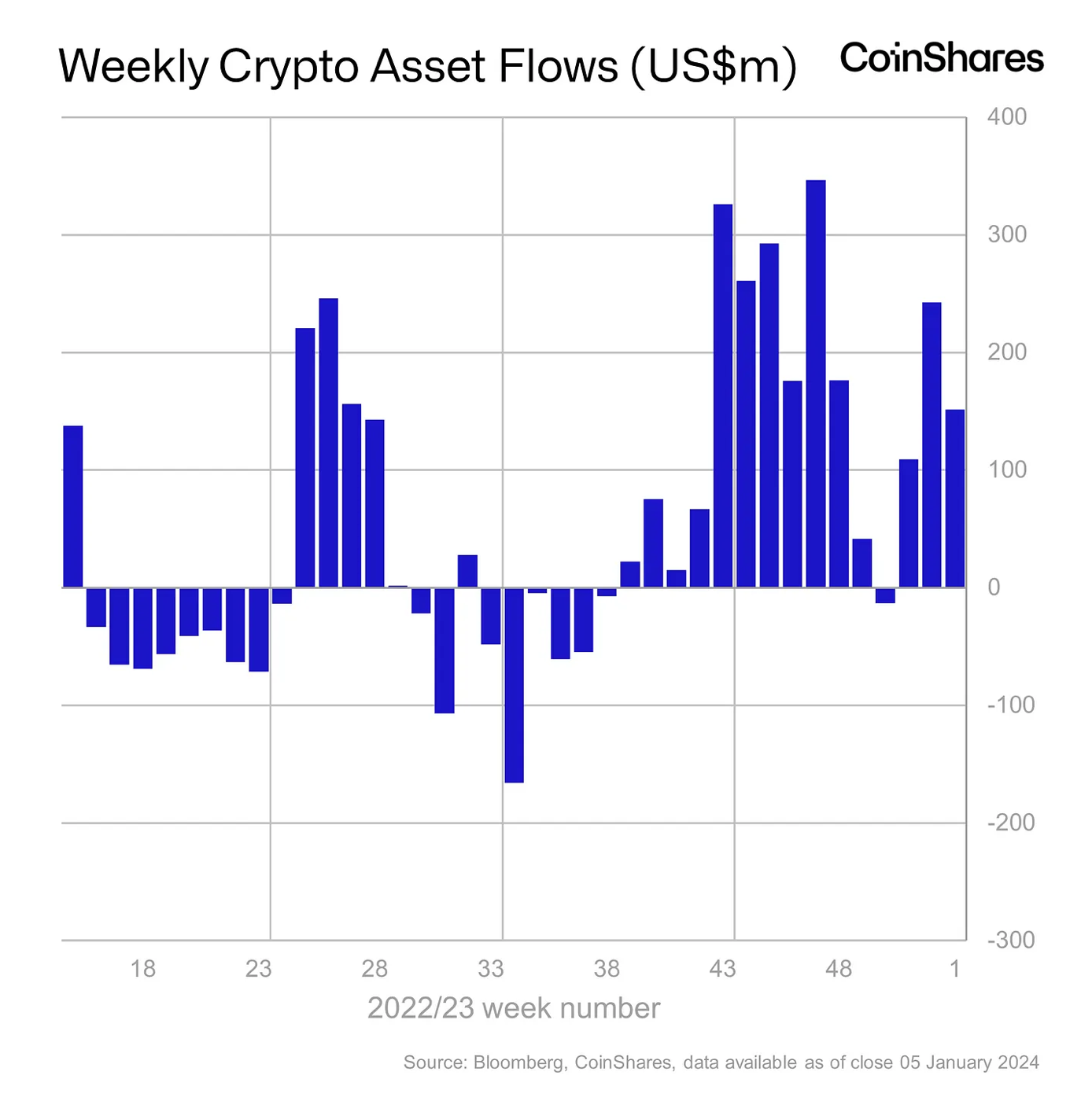

Crypto inflows totaled $151 million in the first week of 2024, with Bitcoin leading the way with $113 million in the past nine weeks.

Bitcoin inflows accounted for around 3.2% of the assets under management by investment companies ahead of expected inflows from spot Bitcoin exchange-traded funds (ETFs).

ProShares ETFs saw the biggest inflows of all major crypto investment companies at $72 million. It was followed by Coinshares Digital Securities, which brought in $18.6 million.

Will ETH Inflows Benefit From Crypto ETF Filings?

Crypto-related equities also saw a healthy start to the year, welcoming $24 million of new money amid hype around Bitcoin exchange-traded funds. Inflows since the conclusion of the Grayscale vs. SEC lawsuit now total $2.3 billion.

Read More: The Best Crypto Liquidity Providers in 2024

Ethereum, the second-largest cryptocurrency by market capitalization, ushered in $29 million. Several investment companies, including ARK Invest and VanEck, have filed to launch Ethereum spot ETFs, which could boost inflows later this year.

The opposite end of the market saw Bitcoin short-sellers pulling $1 million from the market in the first week of 2024. Solana investors pulled $5.3 million from crypto funds.

The inflows in the first week of 2024 augur well for the rest of the month. In January last year, investments in crypto products totaled around $210 million. ProShares saw the largest inflows of $40 million, while the Valkyrie Bitcoin Miners ETF recorded a 100% gain.

Bitcoin ETF Applicants Jostle for Crypto Inflows

Standard Chartered estimated that anticipated Bitcoin ETFs could see $34 billion in inflows. The bank used the performance of the US-based SPDR Gold Shares ETF launched in 2004 to arrive at the estimate. The bank’s upside estimate is closer to $130 billion.

Spot Bitcoin ETF applicants, who expect a response from the US Securities and Exchange Commission soon, also offer predictions. VanEck expects $1 billion of inflows in the first few days after an ETF approval and $2.4 billion “within a quarter.” James Seyffart of Bloomberg Intelligence speculated what BlackRock’s alleged cash injection into new ETFs could mean for flows.

“My main thing is. I wouldn’t be all that surprised either way. I could see blackrock funneling massive massive amounts of capital into the ETF on like day 1 or two. I have my over/under for net flows at $10 billion in year 1,” James Seyffart of Bloomberg Intelligence stated.

Read More: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Galaxy Digital, who is partnering with Invesco to operate its ETF product, estimates ETFs will spur $14 billion worth of inflows in the first year of its launch. The Mike Novogratz-led company predicted the total addressable market size of US Bitcoin spot ETFs will be $24.4 trillion. Bitwise Asset Management thinks the ETF market could be worth $72 billion in five years.