Strategists at Bank of America predict that Bitcoin’s remarkable rise, which took it from around $17,000 at the start of 2023 to over $30,000 today, may not be over.

The strategists recently assessed the bullish trend based on transfers between cryptocurrency exchanges and individual wallets, according to Bloomberg

Bank of America Analysis Based on Bitcoin Outflows From Exchanges

In the week ending April 4, a net $368 million worth of Bitcoin was transferred to individual wallets, according to a note from BofA’s Alkesh Shah and Andrew Moss. They emphasize that when investors plan to hold their coins, they move them from exchange wallets to personal wallets, potentially reducing sell pressure.

According to the bank strategists, the outflow from exchanges may have been sparked by worries about the U..S regulatory crackdown on digital-asset platforms.

The weekly figures narrate a different story. For the week ending April 7, inflows of $57 million were reported in CoinShares’ Digital Asset Fund Flows Report. The analysis indicated a low-volume week; however, sentiments were favorable. Interestingly, the BTC dominated 98% of all inflows with $56 million.

However, one has to look at the macro factors that could impact the value of crypto assets in 2023. Some economists contend that riskier investments could benefit from forecasts of future Federal Reserve interest rate reduction. And Bitcoin could be a likely beneficiary when the banking crisis has only recently shaken the traditional market.

Until April 10, Bitcoin traded above $29,000 before breaching the important $30,000 threshold. It stayed in proximity to the crucial level until Thursday. BTC’s price increased by 24% in a month, despite losing over a quarter of its worth over the previous year. Nevertheless, the price of Bitcoin is still 56% under its all-time high of $69,000, achieved in November 2021.

How Macro Factors Could Impact BTC

The most recent and largest market event is Ethereum’s Shapella upgrade. It was recently executed and was the biggest upgrade after the Merge. BofA strategists predict increased volatility due to the significant market event that enabled the withdrawal of staked ETH.

However, even though they do not anticipate the event to trigger selling pressure directly, they expect greater volatility due to diminished liquidity, derivatives activity, and exchange inflows.

Meanwhile, on-chain indicators are bullish at the time of writing. 2% of Bitcoin owners are breaking even at the current price, according to IntoTheBlock, while 74% are ‘in the money.’ The concentration parameter is also positive, signifying that whales and investors are increasing their positions.

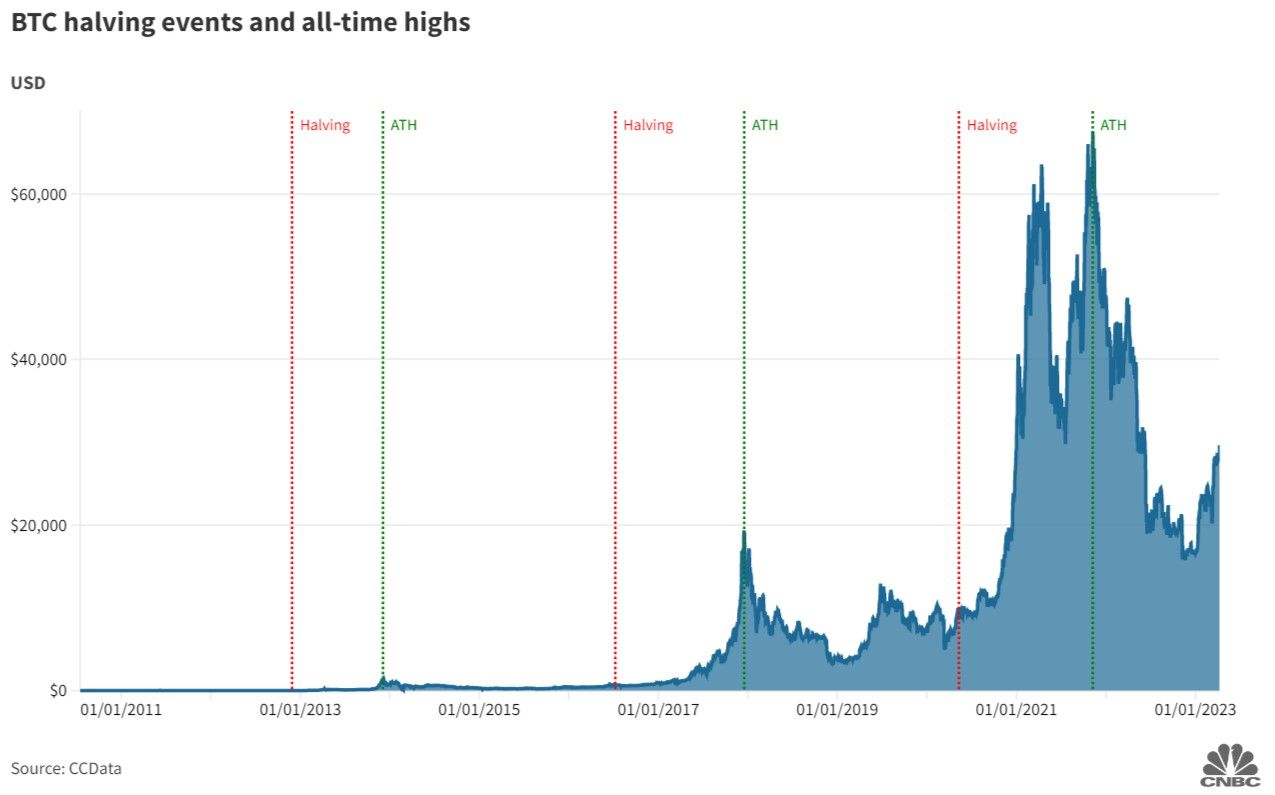

Most importantly, Bitcoin is almost a year away from its next “halving.” The estimated date of the halving of Bitcoin, which happens roughly every four years, is April 2024. Additionally, the period leading up to the event has generally booked a positive trend for BTC.

Vijay Ayyar, vice president of corporate development at Luno, told CNBC that a cyclical “bottom” is developing for Bitcoin ahead of its halving.

Jamie Sly, a CryptoCompare analyst, claimed that while the precise timing and magnitude of returns after halving can vary, it appears that investors frequently accumulate Bitcoin in the run-up to it.

Sly considered the 500-day accumulation period ahead of any Bitcoin halving. According to the analyst, it would indicate that we are only 142 days into the current cycle. This is considering that the market bottomed in November 2022 when BTC hit $15,760.