Mdex has launched the brand new function of boardroom lockup.

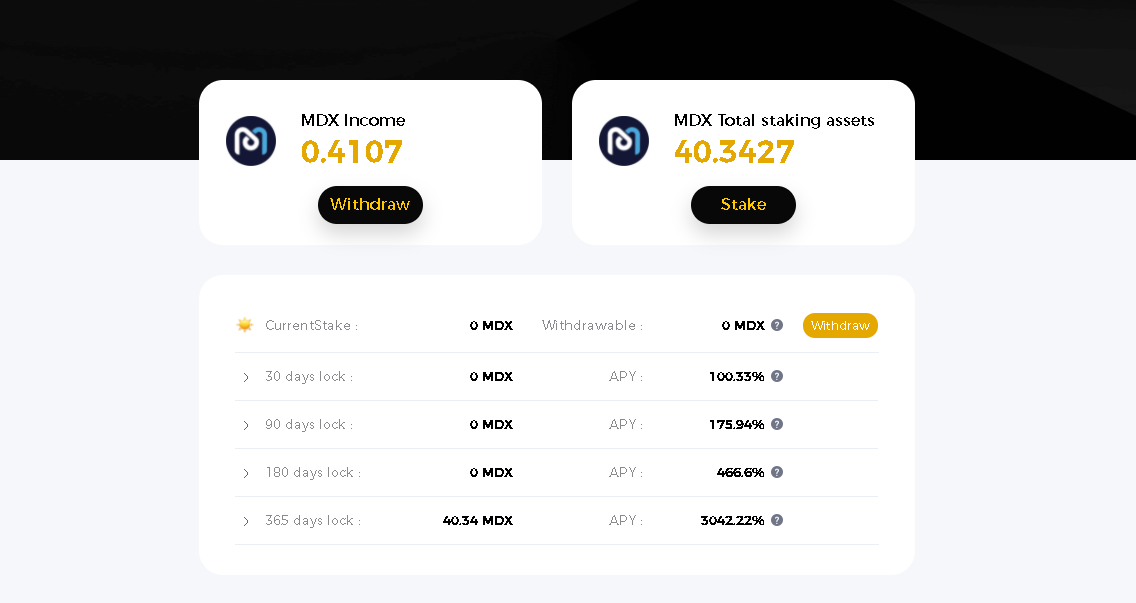

Users can choose to lock up their assets for 30 days, 90 days, 180 days, or 365 days, during which the MDX tokens can’t be withdrawn.

In order to bring benefits to users who have supported the Mdex project for a long time, the fixed-term lockup function gives higher returns to users compared with demand lockup pools.

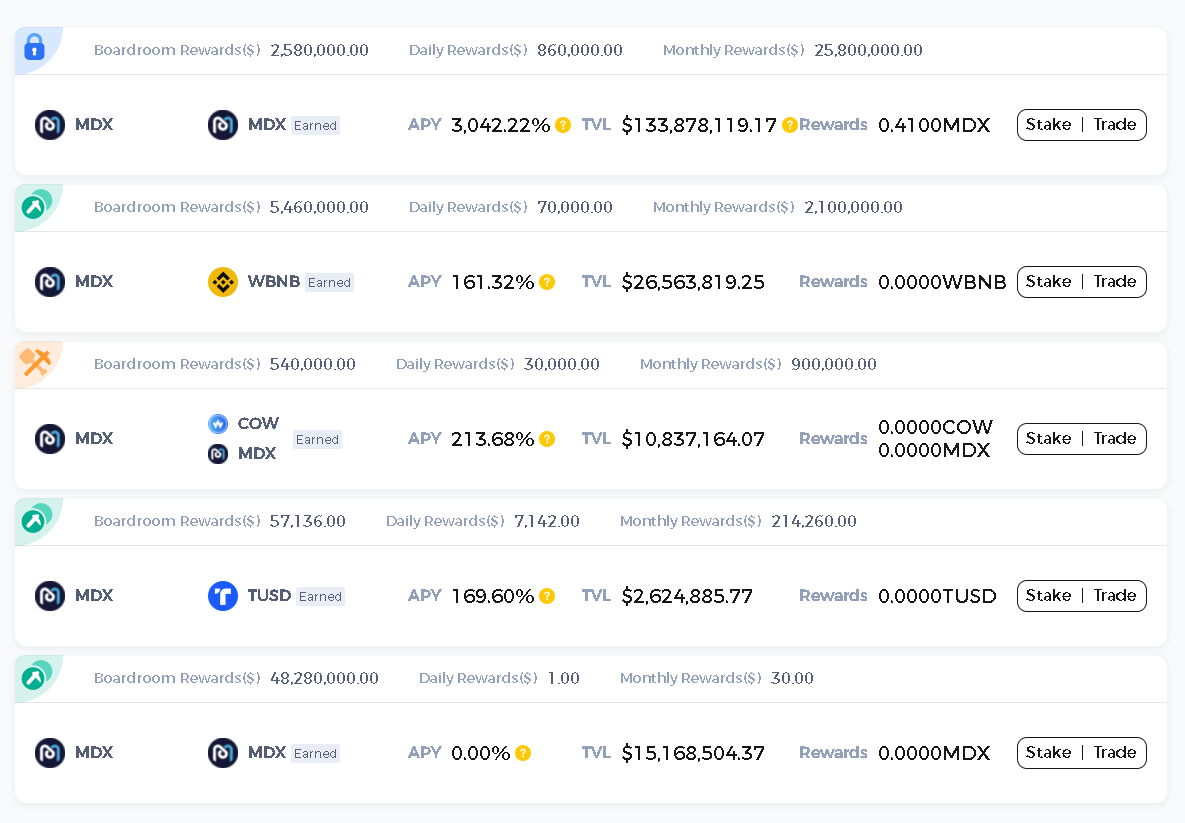

For 365-day lockups, the APY is as high as 3042.22%, far exceeding the APY of 466.6% for 180-day lockups and ranking on top among all dual-token minings. Besides, it is mining without impermanent loss.

High TVL in the boardroom lockup pools

After the launch of the new function, the TVL of the fixed term lockup pools has reached $133 million, exceeding the total figure for the remaining 4 pools combined. This high volume reflects the confidence of Mdex users and the community in Mdex, and shows the strong cohesiveness of the Mdex community.

Currently, the demand lockup pools can provide users with more diversified mining revenues, including BNB, stablecoin TUSD, and dual mining returns for COW and MDX, while at the same time guaranteeing there is no liquidity loss.

A detailed comparison of the returns of different fixed-term pools reveals that only the 180-day and 365-day lockup pools yield higher returns than the rest of the demand pools. Therefore, we can infer that most participants choose to lock their positions for over 180 days.

Despite higher APY, lockup pools with fixed terms have the disadvantages of opportunity loss of liquidity and less diversified returns than other pools of the same type.

The inconveniences caused, however, have not deterred the Mdex community and users from being enthusiastic about the new function future, suggesting their strong support of MDEX. This confidence also indicates that Mdex cares more about the long-term value than the short-term returns.

DAO and more innovative rules to empower higher yields

After the fixed-term lockup pools are launched, we can expect that a significant portion of MDX will be locked up. This lockup, together with its previous halving, will further reduce the number of MDX in circulation.

Fixed-term lock pools have the opportunity to bring more direct benefits to users in the future. For example, the rules and rewards for demand mining pools can be incorporated, which means that perhaps users of fixed-term lockup pools can also enjoy the benefits of multi-tokens, multi-mining. The specifics will be determined by DAO governance.

According to the MDEX’s LightPaper, transaction fees will only constitute one part of MDEX platform income in the future, and all revenues will be used to benefit MDX holders through rewards, the repurchase and burn mechanism, etc.

This means that Mdex’s revenue at IMO, as well as the proceeds from a range of innovative derivatives to be launched, such as leveraged transactions, options transactions, and prediction markets, will give higher returns to users who lock up their positions in the boardroom.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.