Citizens of many South American countries have helplessly watched their national fiat currency plummet in value against the US Dollar this year amid corruption and socioeconomic turmoil. Some cryptocurrency ATM manufacturers are offering a way out.

Many countries in South America have been on an economic downward spiral stemming from political corruption, poor economic governance, and cases of hyperinflation that have caused large percentage devaluations of their national currencies.

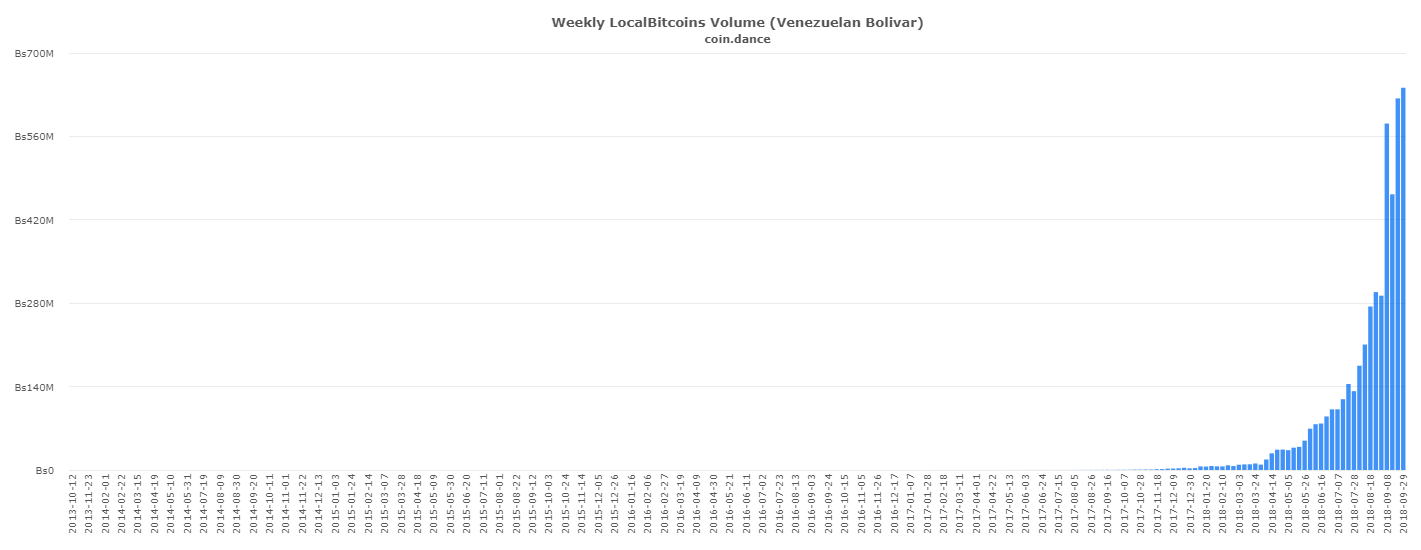

The worst cases of devaluation are the Argentine Peso — which has slipped 125 percent against the value of the US Dollar this year — and the Venezuelan Bolivar, which lost more than 45,000 percent against the US Dollar since the beginning of 2018. Now, the bolivar is essentially less valuable than the paper it is printed on.

With there being nowhere else to turn, many have looked to cryptocurrency as a safe haven and way out of the turmoil.

Where’s The Exit?

Manufacturers of cryptocurrency ATMs like Athena Bitcoin and Odyssey Group have taken note of the situation in South America and want to allow a simple and convenient option for those who are open to the idea.

Bitcoin ATM companies aim to place nearly 2000 new ATMs in Argentina by this time next year. Citizens of Argentina or Venezuela who are skeptical of Bitcoin because of its 65 percent correction this year can’t argue that 65 percent is still less than 125 percent — and abundantly less than 45,000 percent. People seem to agree, as evidenced by Bitcoin volumes in both Argentina and Venezuela. According to Coin Dance, Bitcoin volumes have skyrocketed to all-time highs in both countries at the time of writing this article. Do you think Bitcoin ATMs will be successful as a means of safeguarding individual citizens’ money in South America? Let us know your thoughts in the comments below!

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored