During the week of April 13-20, the Bitcoin (BTC) price reached a weekly close of $7120. This was the highest weekly close since the rapid decrease on March 12.

Weekly Outlook

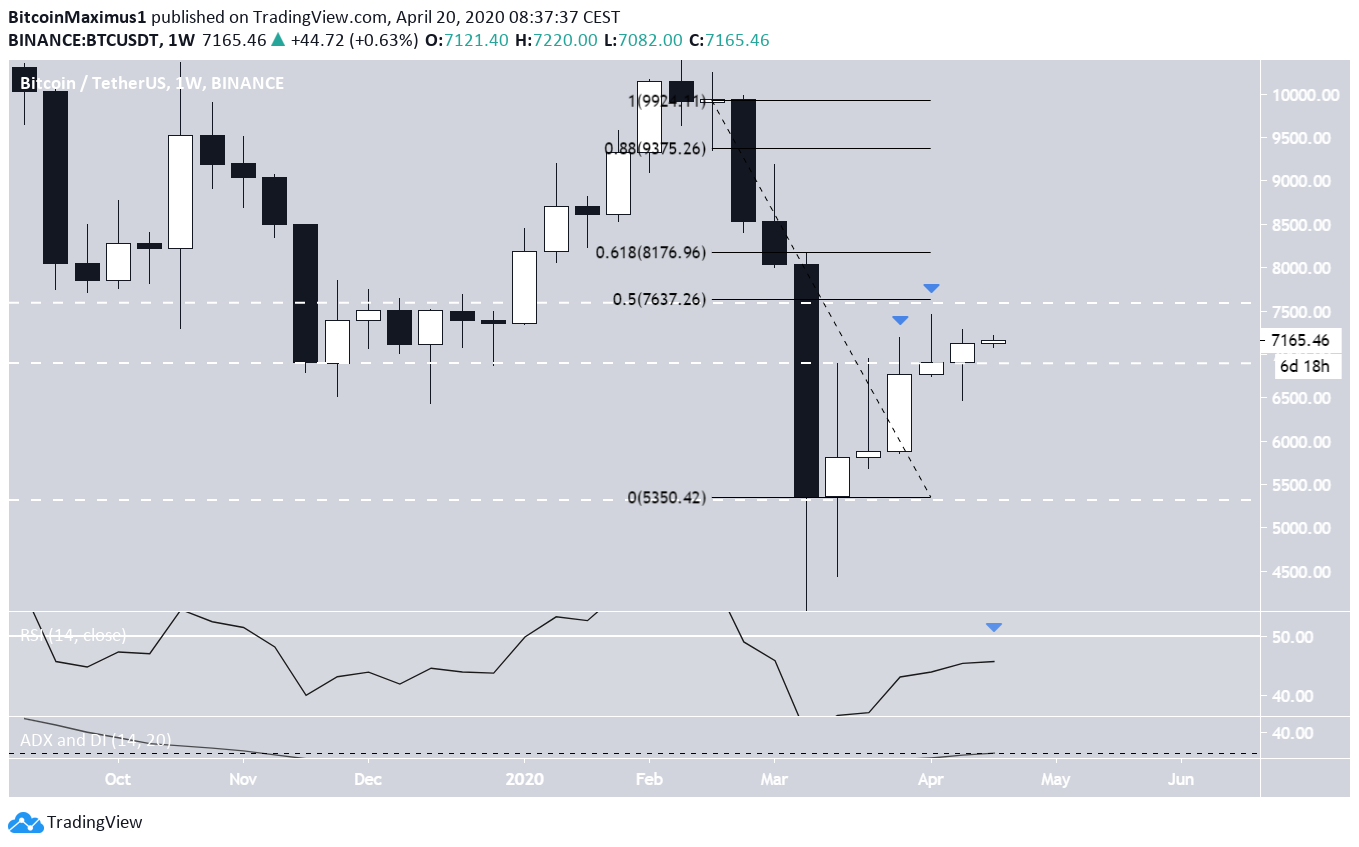

In the weekly time-frame, the Bitcoin price has finally reached a close above the $6900 area — something it had been unsuccessfully trying to do for the past four weeks. However, it still has not cleared the entire wick resistance from these weeks. The next closest resistance level is found at $7600. At the moment, the price was trading inside a strong resistance area, found between $6900-$7600. There is a pronounced lack of resistance/support above/below these areas. Therefore, whenever the price leaves this area, whether that is in the form of a breakout or a breakdown, it could trigger a rapid movement in either direction. As long as the price is trading inside this area, both possibilities remain.

Trading Range

A lower time-frame chart shows that the Bitcoin price has already broken down from an ascending wedge and validated it as resistance afterward. In addition, it gives us a trading range, between $5700-$6900. Once the price broke down from the wedge, it re-entered the range, implying that it is heading towards the range low. However, on April 16, it reversed the trend and created a bullish engulfing candlestick, breaking out above the resistance area. One indicator which gives a slightly bearish scenario is the Bollinger Band. The price has twice moved above the upper band and reversed afterward. At the time of writing, it was in the process of doing so once more, a movement that could indicate the price will fall back inside the range once more. Furthermore, the volume has been consistently decreasing since the beginning of the wedge and was not significant enough during the April 16 breakout.

Short-Term Movement

In the short-term, the price is trading inside an ascending channel and has flipped the $7120 area as support. Combining this with the longer-term analysis, the most likely scenario seems to be continued trading inside this channel followed by an eventual breakdown.

Top crypto platforms in the US

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored