After extensive consideration, the Bank of Russia has taken a position on the launch of a central bank digital currency (CBDC). What does a digital currency mean for Russia, and for that matter, the rest of the world? BeInCrypto asked the experts.

Crypto fiat: the way of the future

Tatyana Maksimenko, an official representative of cryptocurrency exchange Garantex, thinks that sooner or later all central banks will create digital currencies.

“On the one hand, it will simply become a must. On the other, it will be a fully organic development. Thanks to developments in technology, we now have the tools to effectively implement a national cryptocurrency,” Maksimenko said.

The crypto ruble, in her opinion, will give the Central Bank of Russia more transparency. It will also allow banks to offer cheaper options. Maksimenko clarified:

“First and foremost, there is the issue of borrowers. With a CBDC, they will be able to get cheaper lines of credit. In Russia, where borrowing interest is very high, this is an urgent undertaking.”

Maksimenko also noted that a CBDC would make the life of regulators much easier because of the ease of tracking transactions. She believes, this will help avoid any “holes” in the balance sheets of banks. A regulator will notice problems as they come about, rather than waiting until they require multi-billion dollar fixes and long-term sanctions.

The inevitability of digital currency

A financial consultant and the director of E.M. Finance, Evgeniy Marchenko, for his part, said that the electronic money was simply a consequence of the times. The digitization of the entire world, he says, will force us to search for new solutions in banking. Introducing an electronic ruble could be the factor that transforms the field.

“[The Russian] Central Bank has already started talk about a digital currency. The plan is for the electronic ruble to have a unique, digital serial number and to become a universal form of payment. It will be available to anyone with a wallet in any country,” Marchenko told BeInCrypto.

The finance director noted that launching an electronic ruble by the Central Bank would require a completely different financial infrastructure.

3 advantages of a digital ruble

CEO of the Investonomics project, Andrei Khodosok, also sees the advantages of a new national cryptocurrency in the Russian Federation. Russia, in his opinion, needs the crypto ruble because it will provide the country with three opportunities:

The first global advantage of the crypto ruble will be freedom from Western financial technology. For example, at present, one threat used to pressure Russia is the removal of SWIFT, an international monetary transactions service.

“Everyone knows that if something like that would happen, it would create a huge problem. The crypto ruble is not afraid of that. It doesn’t need SWIFT, it doesn’t need verification centers, confirmations, or transactions. An independent Russian payment system, the crypto ruble, would be a completely unique payment system. And that would be just one reason to use it,” said Khodosok.

The second important reason for creating the crypto ruble is a potential decrease in corruption, according to Khodosok.

“Crypto ruble payments will be extremely transparent. You will be able to track any transaction, and all wallets will be verified. This will heartily limit corruption, which will reflect positively on the efficacy of the Russian government and will be good for Russian society in general,” he explained.

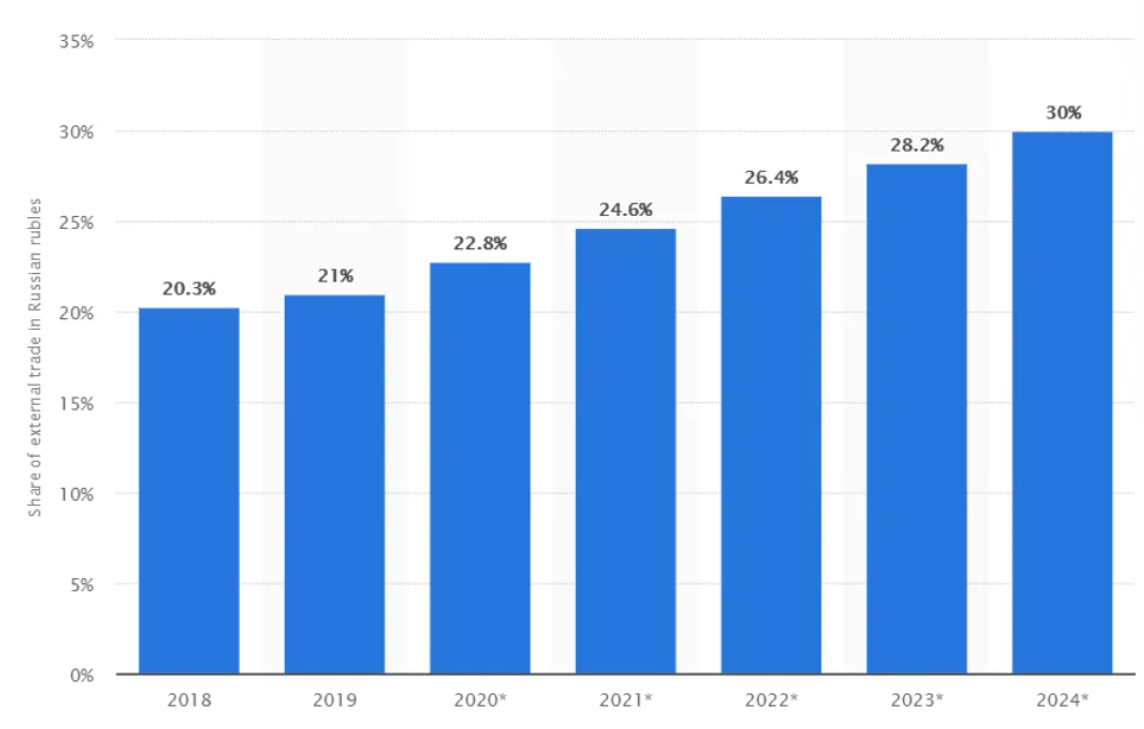

The third reason is that a digital ruble will expand the territory where the ruble can be used.

“Crypto enthusiasts throughout the world will have yet another convenient tool. But, in contrast to ordinary cryptocurrency, the Russian crypto ruble will be guaranteed by the Russian government. This will separate the crypto ruble from competitors. This protection involves crypto exchanges, crypto traders, and other companies that need to protect their crypto reserves. As soon as the Russian crypto ruble launches, it will find a wide audience and be used throughout the world,” the expert added.

As a result of these considerations, Khodosok came to the conclusion that Russia needs the crypto ruble and that it will be good for the country both politically and in society.

Getting priorities straight

An entrepreneur, financier, and member of the Association of Professional Directors, Nikolai Neplyuev, for his part, pointed out that, at this point in time, the crypto ruble is more a question of privilege than a rational economic step. He explained:

“The fact is that a reform like this is time-consuming and unprofitable. According to experts, the realization of such a project would require at least two years and more than 4 trillion rubles ($52 billion, at press time). However, we are currently experiencing an international economic crisis, the problem of the pandemic is still not solved, we continue to see economic damage, and the Russian budget is still in a deficit. Thus, the introduction of the crypto ruble seems like an over-the-top luxury.”

Likewise, Neplyuev noted that creating an electronic national currency comes with a huge number of unavoidable risks. The current direction of cryptocurrencies is relatively new and there are many hidden dangers that have not yet been studied in practice.

Additionally, the current advantages are relative and hypothetical, and they predict neither a huge economic explosion or even a concrete, measurable upside. That’s why Neplyuev is sure that for now the development of the crypto ruble is impractical.

Still, in the future, he says, it will be an important issue to take up in order to meet global economic demands. At this point, China is developing their own cryptocurrency. The United States has also taken up this issue, but is still far from realizing a solution. Likewise, an alternative crypto dollar is being considered in the form of Facebook’s Libra.

“Russia will adjust its activity while looking at these other projects and after solving more pertinent problems,” the expert concluded.

Recently, BeInCrypto reported that the crypto ruble was being developed at the state-owned Sberbank, Russia’s largest bank.

This article was translated from BeInCrypto’s Russian language domain. To read the original, click here.