The Algorand price saw an almost 50% pullback in November, closing the month near $0.244. The battered price action may need some push from ALGO investors.

The Algorand price action has been mostly depressing for investors. The ALGO price is down by over 92% from its June 2019 all-time high of $3.24.

In fact, Algorand was one of the few coins that stayed relatively quiet even during the 2021 year-end bull run, failing to make a new all-time high. With the Algorand price trading at $0.244 at press time, ALGO investors are looking for a push.

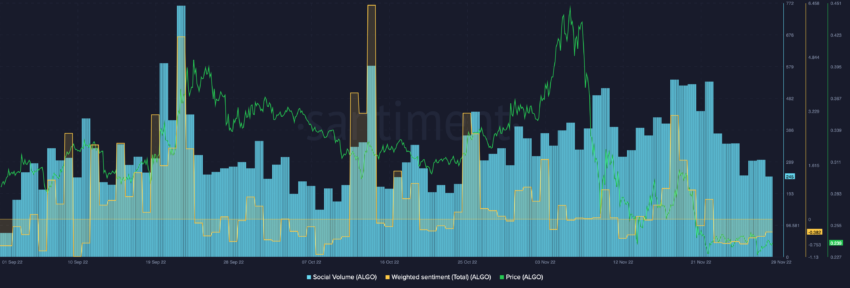

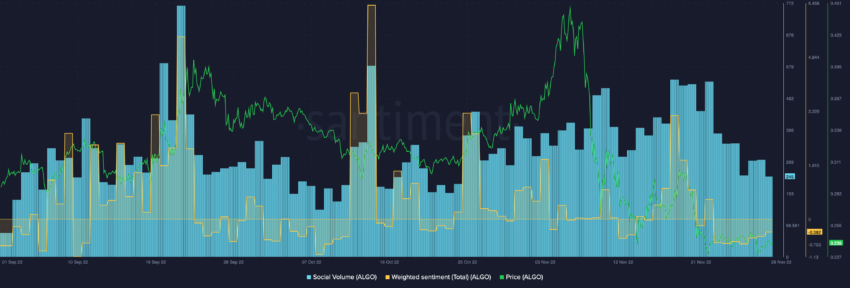

Algorand Social Metrics Still Bearish

Despite Algorand raising some hype on crypto Twitter with its ongoing Decipher event, social metrics showed no major changes. ALGO social volumes have been dipping since Nov. 22.

While the Algorand price oscillated near the $0.245 long-term support level, weighted social sentiment presented low interest in the coin. The weighted sentiment treaded in negative territory, suggesting lower demand for ALGO in the derivatives market.

Funding rates for Algorand flipped positive, but open interest saw no major rise.

Open interest in the perpetual market was around $23.9 million, down 1.24% in the past day. With low interest in ALGO in the perpetual market, spot market investors were the coin’s only hope for a recovery.

What’s Needed for a 2023 Price Recovery?

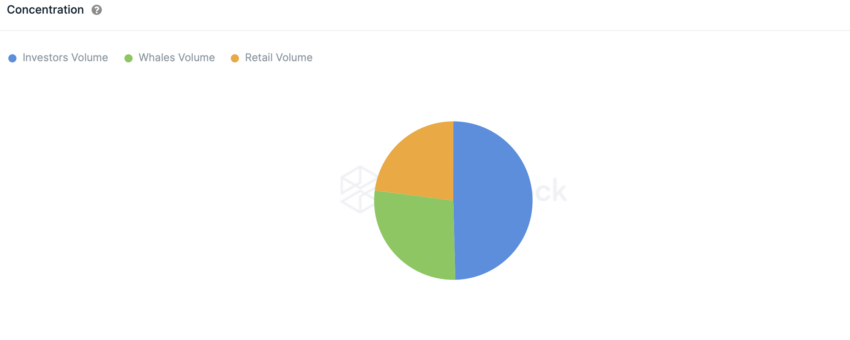

Looking at the ownership by concentration for Algorand, it was clear that investors were the leading cohort.

In the last 30 days, however, the ALGO investor count dropped by over 5%. Retailer addresses saw a 1.83% rise, while whales remained the same.

For the ALGO price to regain momentum, investors would need to aggressively buy the dip at these levels.

Notably, the Algorand price was last seen at these prices in November 2020, which gives investors a good reason to jump back on the boat or accumulate. However, for the moment, trade volumes saw no major uptick despite the low prices.

One positive signal was the strong uptick in development activity. This suggests developmental progress and could boost investors’ confidence. If demand sees a rise in the near future, a price uptick can be expected.

For now, the $0.244 support offered some respite, but a retest of the lower $0.200 area can be expected if prices fall through support. In the case of a bullish reversal, Algo could target the next resistance level near $0.30.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.