Dogecoin price has been at the mercy of larger market momentum and DOGE whales that continue to push for gains.

It has been over 10 days since the FTX collapse brought down the global crypto market. As most altcoins attempt to recover from the steep losses, Dogecoin (DOGE) price is still stuck at the lower price range.

Even though, DOGE whales continue to accumulate Dogecoin with the aim of pumping price, there’s only so much momentum whales can create. So, what should DOGE holders expect from price action going forward?

Dogecoin Whales Accumulate

Dogecoin price charted a multi-month high amid retail euphoria stemming from Elon Musk’s acquisition of Twitter. However, the gains were short-lived, and the DOGE price quickly pulled back by almost 50% in the following week after the collapse of FTX.

It wouldn’t be an overstatement to say that the DOGE price has been a rollercoaster ride for traders and investors, but whales remain undeterred.

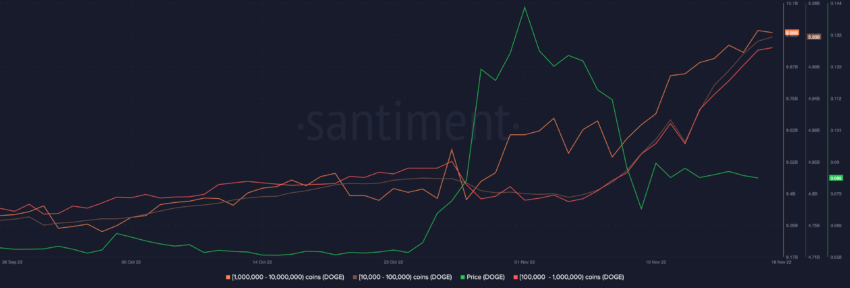

Data from Santiment showed that the top three Dogecoin whale cohorts had started to accumulate DOGE despite the bearish price action.

Dogecoin addresses holding one million to 10 million coins increased their balance from 9.26 billion DOGE to 9.99 billion DOGE since Oct. 2. Addresses holding 10,000 to 100,000 coins filled their bags from 4.76 billion to around 5 billion at press time.

On the other hand, addresses with 100,000 to one million addresses also increased holdings from 7.72 billion to 7.99 billion in the same amount of time.

Dogecoin Price Action Still Retail Driven

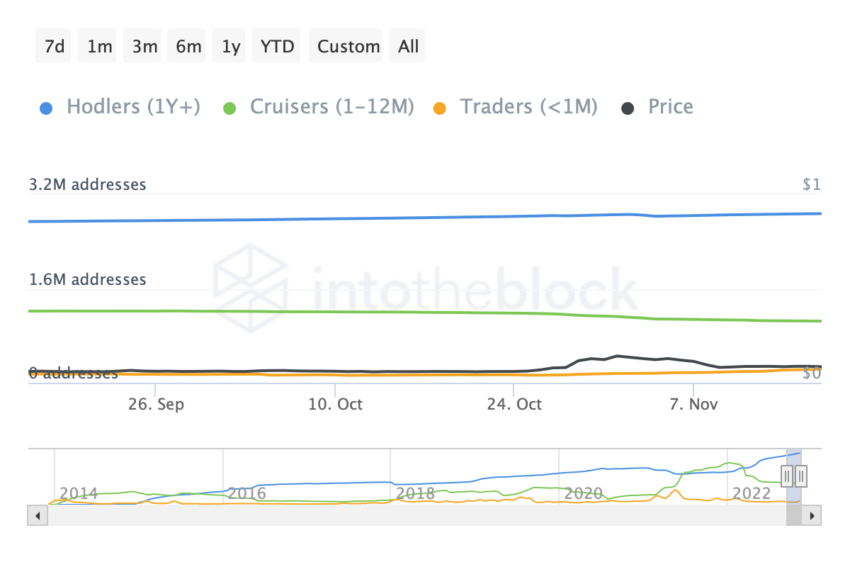

Even though DOGE whales have been pretty active, price action was largely retail-driven. The same could be seen in the sheer of trader addresses. IntoTheBlock data suggested that trader addresses have risen by 71.65% in the 30-days.

Holders noted no major rise, while cruiser addresses had dropped drastically by 12%.

With the tone of the larger market still bearish weighted sentiment continued to be negative while trade volume flatlined.

That said, negative short-term and long-term MVRVs showed that holders realized losses, and a price pump in the near term could lead to profit-taking.

At press time, DOGE price traded at $0.08553, noting a mere 0.85% spike on the daily chart. However, going forward, DOGE price would need more than just retail and whale support.

If DOGE bulls are able to push the price for gains, Dogecoin could see some bullish action till the $0.10 mark. But, with technical data looking rather bearish, DOGE could continue the range-bound momentum or take a fall to the lower $0.080 mark, which can act as a support for the meme coin.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.