Neiro on Ethereum (NEIRO on ETH) price has surged an impressive 85% in the last seven days following a buying spree by crypto whales who capitalized on an earlier price dip. These large holders, known for their market-moving influence, have been accumulating NEIRO at lower price levels, driving a strong rebound.

The surge comes amid heightened attention to meme coins. With whales in control and market sentiment shifting, here’s what could be next for NEIRO on ETH.

Whales Drive Neiro Ethereum Higher, Profit-Taking Drops

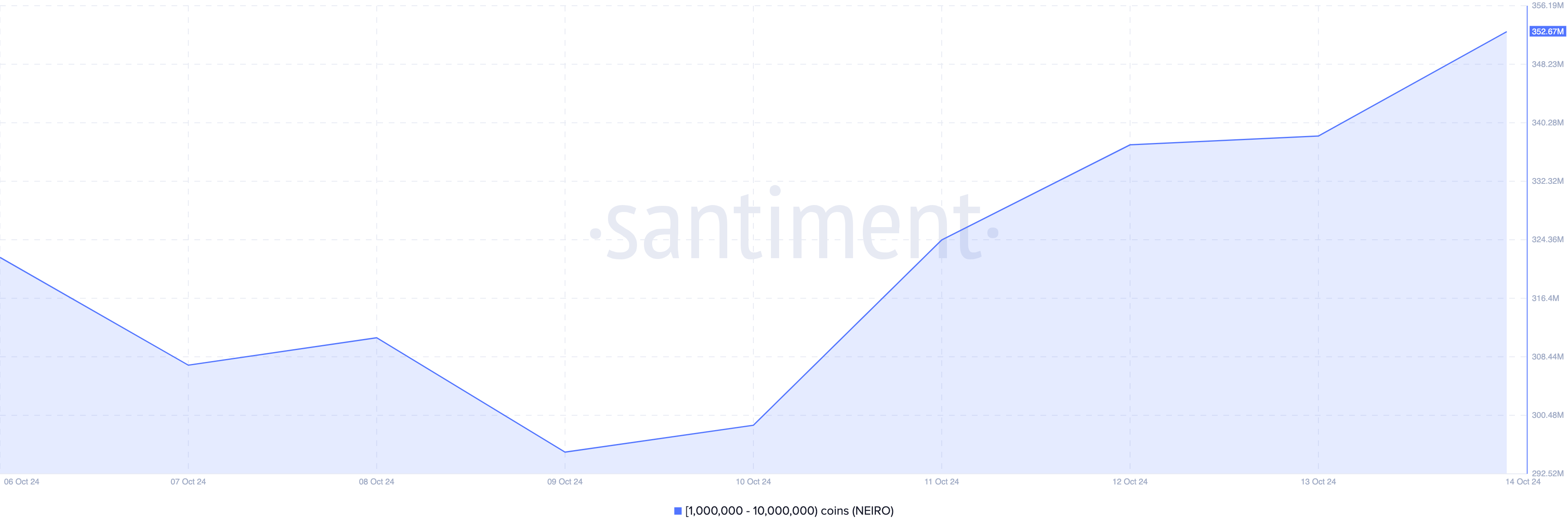

On October 9, the balance of addresses holding between 1 million and 10 million Neiro Ethereum was 295.48 million. As of this writing, that figure has increased to 352.67 million, meaning crypto whales bought about 57 million tokens within the last five days.

SpotOnChain, a leading on-chain analytics provider, provided a breakdown of some of these purchases. In a post on X, it disclosed that GSR Markets, a liquidity provider, bought 40.4 million NEIRO on Ethereum, representing roughly 4% of the meme coin’s circulating supply.

Additionally, Vida, founder of a prop trading firm, accumulated 4.06 million tokens when the price was still lower. These purchases contributed to NEIRO’s price surge, pushing it much higher than its value last week.

Read more: What Are Meme Coins?

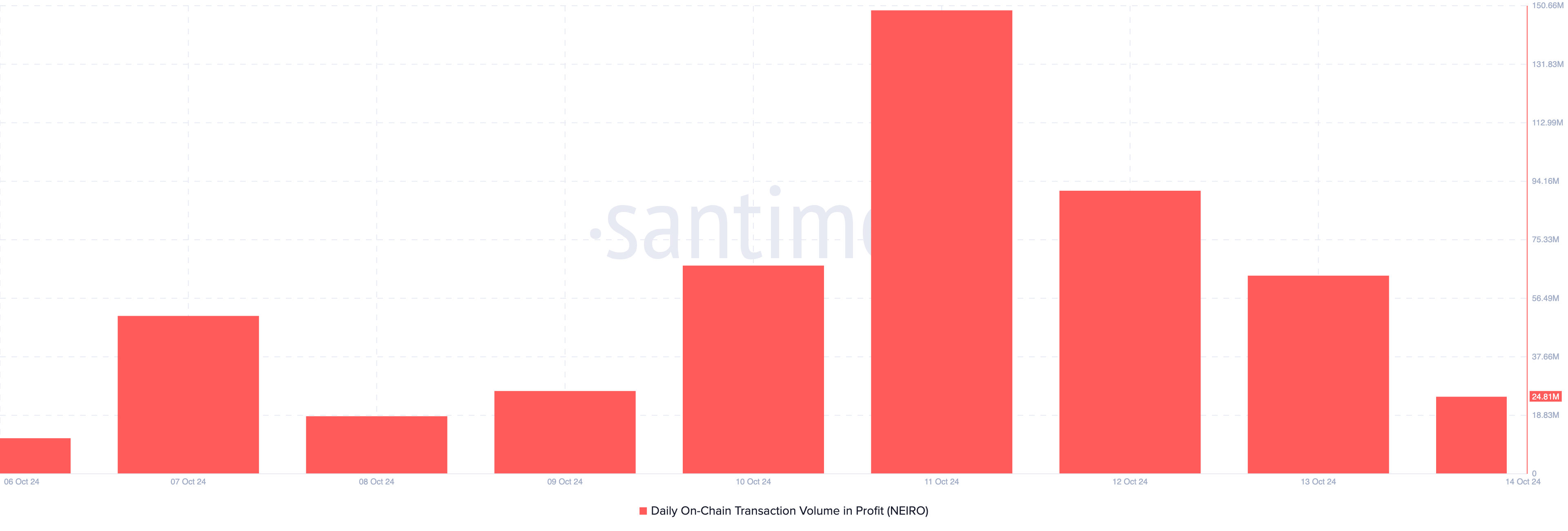

Despite the significant price increase, the daily transaction volume in profit has been decreasing. Santiment data shows that the volume in profit on October 11 was almost 150 million. One day later, it dropped below the 100 million market, and has continued like that till the time of this writing.

This consistent drop in profit-taking suggests that Neiro Ethereum holders would rather be diamond hands by keeping the meme coin instead of selling it for short-term gains.

NEIRO on ETH Price Prediction: Bulls in Control

According to the 4-hour chart, the meme coin is close to rising above the 38.2% Fibonacci retracement level. Rising above this level, which is the support floor, suggests that NEIRO on ETH’s uptrend is solid and could continue.

Beyond that, BeInCrypto looked at the Bull Bear Power (BBP), which compares the strength of buyers to that of sellers. When the BBP rises and flashes a green histogram bar, buyers (bulls) are in control.

Conversely, when the BBP falls, and the histogram bar is red, sellers (bears) are dominant. Since the daily chart shows the former, NEIRO’s price could rise to $0.16.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

In a highly bullish condition, with meme coins leading the market, the value could hit $0.20. However, if sellers take over, this rally might continue. Instead, the meme coin’s value could sink to $0.092.