The Bitcoin (BTC) price decreased considerably on Feb. 25, losing all of its gains from a brief rally during Feb. 23 and 24.

Nevertheless, Bitcoin is still expected to bounce back above $50,000 and complete the second part of its correction.

Bitcoin Indicators Show Weakness

The daily chart shows that despite the ongoing bounce that began on Feb. 23, Bitcoin was rejected yesterday, and is currently very close to the Feb. 23 lows.

BTC is trading between the 0.382 and 0.5 Fib retracement levels at $47,153 and $43,677 respectively.

Technical indicators in the daily time-frame are very close to turning bearish. The MACD histogram has nearly turned bearish, the RSI is close to falling below 50, and the Stochastic oscillator has nearly made a bearish cross (red arrow).

If these were to occur, it would likely confirm that the daily trend is bearish.

Trading Range

The six-hour chart shows that BTC was rejected by the $51,500 area on Feb. 25. This is the 0.5 Fib retracement level of the most recent downward movement.

Currently, BTC is trading near $46,000, which is the support area of this range.

While the MACD has not shown any reversal signs, there is a bullish divergence developing in the RSI alongside a possible double-bottom pattern.

The two-hour chart also shows a bullish divergence, visible in both the RSI and the MACD.

Furthermore, it seems that BTC has returned to validate a descending resistance line from which it broke out from prior.

Despite the ongoing decrease, a bounce to the upside seems to be the most likely scenario.

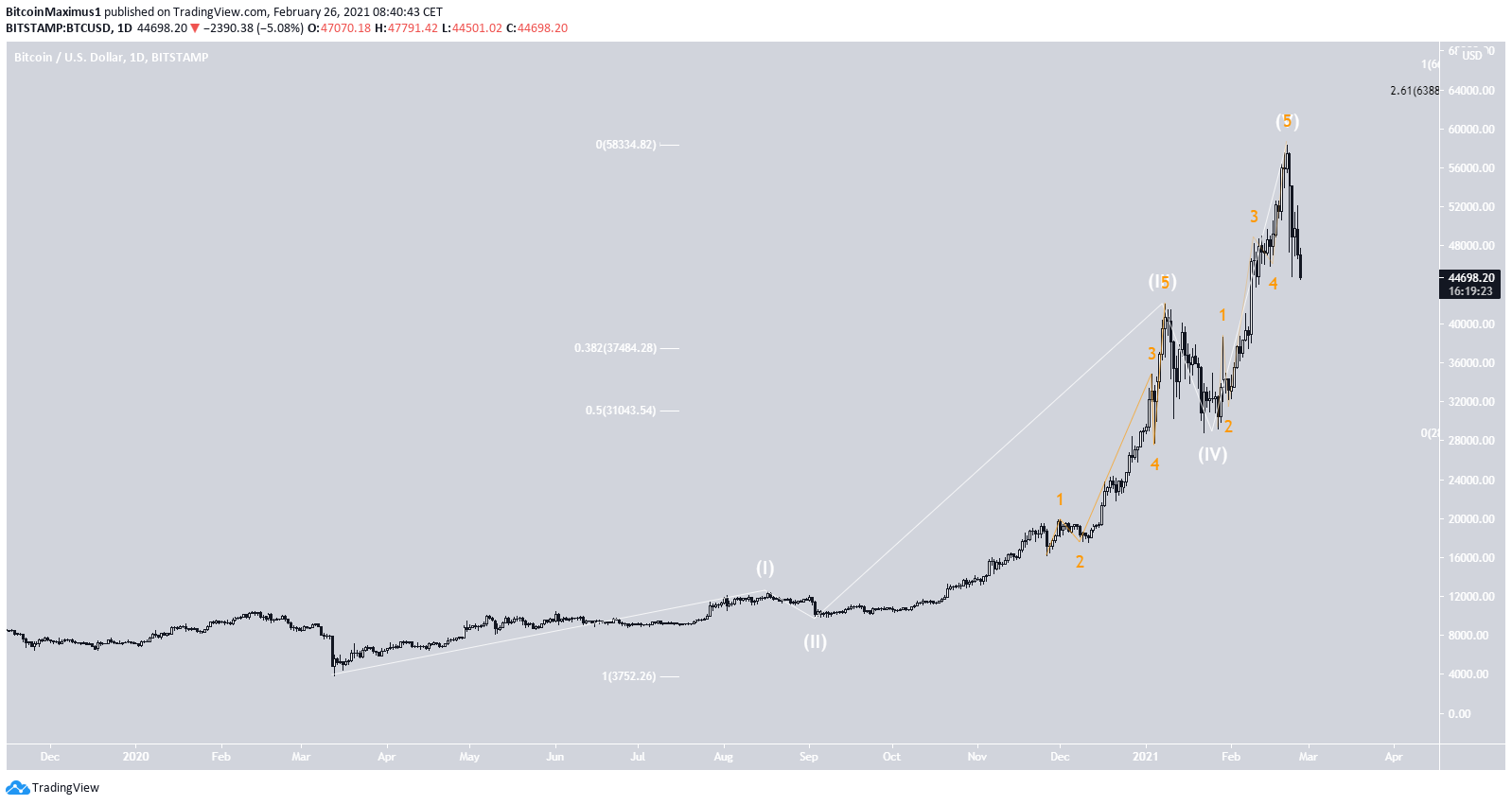

BTC Wave Count

The wave count suggests that BTC is in a corrective wave four (orange) of a bullish impulse that began on Jan. 30, 2020.

BTC is likely in sub-wave B (black) of this correction.

At the current time, we cannot accurately determine the bottom of the C wave. This is because the pattern could develop to be either a regular, irregular, or running flat correction, or even a triangle.

As long as BTC does not reach the wave one high at $38,620 (red line), this remains the most likely scenario.

The longer-term count still suggests that the BTC trend is bullish, and the price will eventually reach another high.

Nevertheless, if the invalidation level is reached, it would suggest that the upward move for BTC that began on Mar. 2020 has ended, and BTC is in a long-term correction for the entire movement measuring from the $3850 bottom.

Conclusion

Bitcoin is expected to bounce near the current levels and move back above $50,000 to complete the second portion of its correction.

A decrease below $38,640 would invalidate this scenario

For BeInCrypto’s previous Bitcoin (BTC) analysis, click here!

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.