Virtual Protocol, a decentralized platform for creating and monetizing AI agents, has seen a sharp uptick in user activity over the past few days. This has fueled a surge in demand for its native token, VIRTUAL.

According to on-chain data, the number of unique wallets holding Virtual Protocol’s AI agent tokens has increased significantly across the Base and Solana networks. This has driven a rally in the VIRTUAL’s price, which has climbed 161% over the past week.

VIRTUAL Token Rockets to 2-Month High

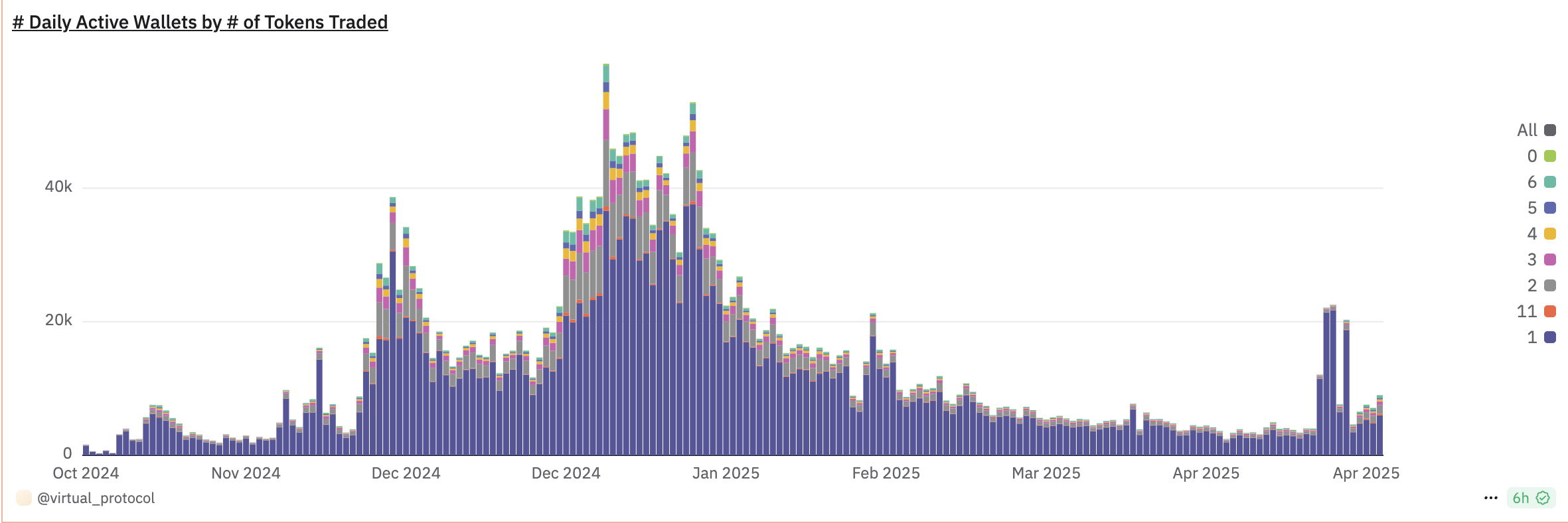

According to Dune Analytics, the number of unique active wallets holding Virtual Agents’ tokens across the Base and Solana blockchains has jumped by 95% in the past five days.

This spike in wallet activity highlights growing user engagement with the platform’s AI agent ecosystem, as more participants join to create, deploy, and interact with decentralized AI services.

Buying pressure on VIRTUAL has intensified as users seek to acquire Virtual Agents and participate more actively in the protocol. Over the past week, the token’s price has climbed by 161%, reflecting the heightened demand.

Today alone, VIRTUAL is up 18%, making it the top gainer across the cryptocurrency market. As of this writing, it trades at a two-month high of $1.46, with technical indicators pointing to further price rallies.

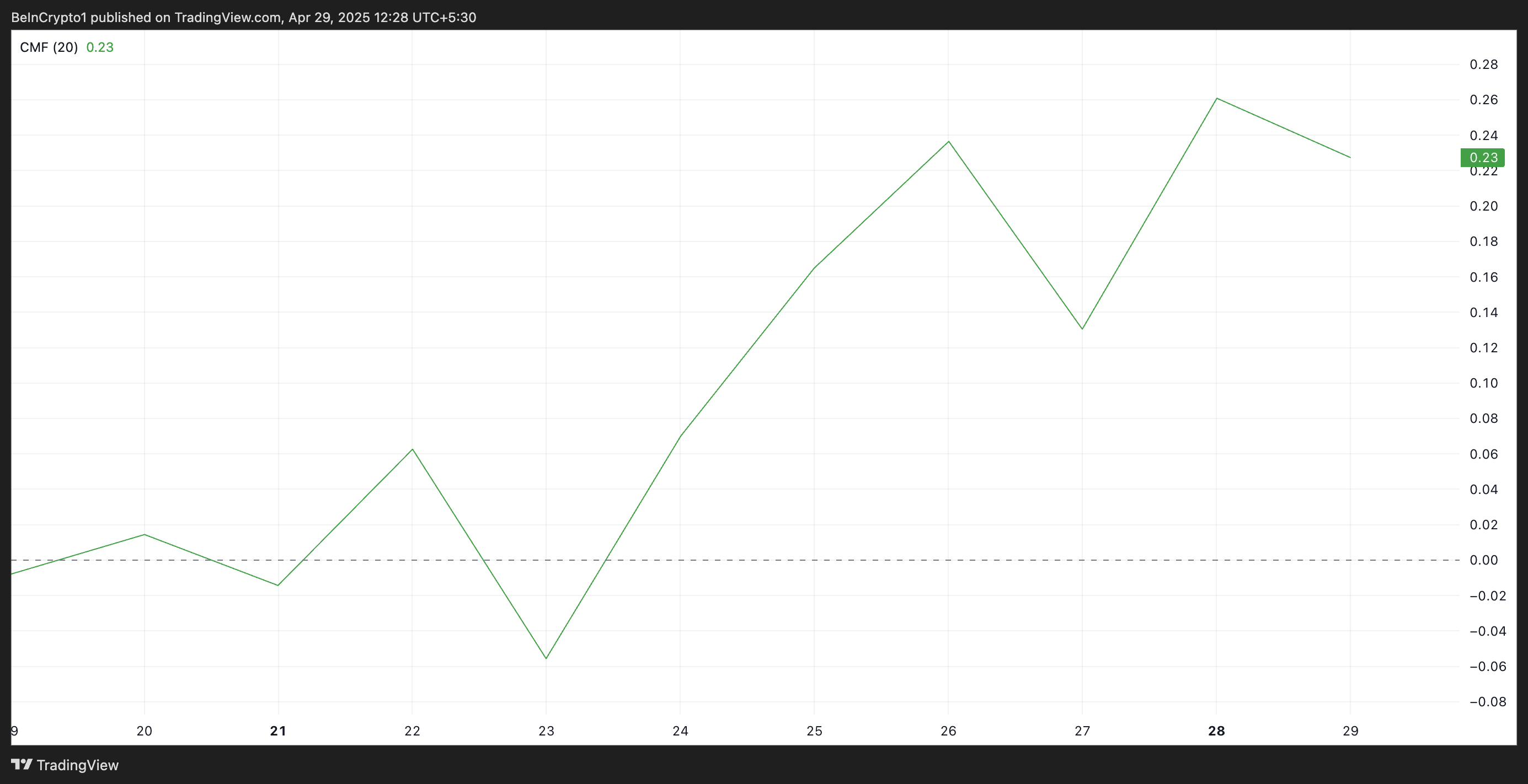

Readings from VIRTUAL’s Chaikin Money Flow (CMF) indicator, which tracks capital accumulation into an asset, confirm the high demand for the altcoin. At press time, this momentum indicator is above the zero line and in an upward trend at 0.23.

When an asset’s CMF is above zero, buying pressure exceeds selling activity among market participants. This trend, coupled with VIRTUAL’s rising price, is a significantly bullish signal, hinting at an extended rally where the token could record new multi-month highs.

Triple-Digit Rally Signals Possible Run to $2.25

VIRTUAL’s triple-digit spike over the past week has pushed its price above the key resistance of $1.44. If demand strengthens and the bulls retain market control, the altcoin could extend its current gains and climb toward $2.25, a high it last reached on January 31.

However, caution may be warranted in the short term. Technical indicators such as the Relative Strength Index (RSI) show that VIRTUAL currently trades in overbought territory. As of this writing, the momentum indicator is 83.92, indicating that the altcoin is significantly overbought and is due for correction.

If profit-taking activity commences, VIRTUAL could lose some gains, fall below $1.44, and target $0.96.