The state of Virginia’s Bureau of Financial Institutions will convene a work group to study blockchain technology, digital asset mining, and cryptocurrency. The workgroup will create a roadmap to expand the state’s digital asset industry following new proposed crypto regulations that will prevent exchanges from being accused of offering unregistered securities.

The Virginia Senate Committee on Commerce and Labor has tasked the state’s Financial Institutions Bureau to expand on a new crypto bill proposed by a Senate member.

Bill Proposes Study Group on Crypto Assets

According to the amendment, the Bureau must convene a group to study mining, blockchains, and crypto assets. The group must comprise five members of the House of Delegates, five members of the Senate, two nonlegislative citizen members who know about blockchain, and one nonlegislative citizen representing local government.

The group must conclude meetings by Nov. 1, 2024, and present their findings to the Governor next year. Their presentation will take place on the first day of the 2025 Regular Session of the General Assembly.

Read more: What is Cryptocurrency Mining?

The new bill is an amendment to the one filed by Senator Saddam Azlan Salim in January. The bill exempts cryptocurrency mining companies from registering as money transmitters.

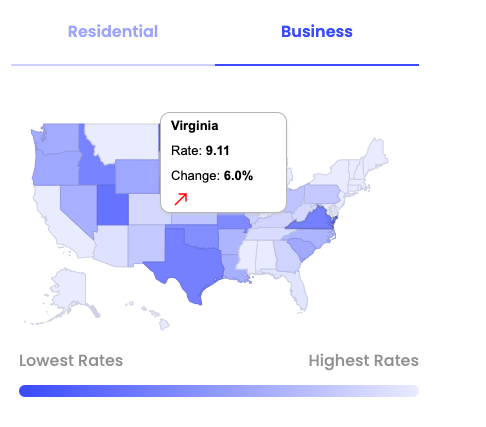

Energy tracking service Energy Bot says that Virginia has the fifth-lowest energy costs for businesses. Miners could, therefore, find a haven there.

The bill also says that crypto exchanges would be exempted from securities registrations. In addition, crypto payments would attract low taxes.

Read more: Is Crypto Mining Profitable in 2023?

Since 2018, Fairfax County in Virginia has invested pension funds for some government employees in three crypto investment funds. Rather than investing in crypto directly, the Venture Capital Investments product invests in promising infrastructure projects. The absolute return fund profits from the volatility in crypto assets, while the high-yield, fixed-income investments want to benefit from crypto returns while the industry matures.

Yellen Advocates for Stablecoin Regulation

While states scramble for crypto dollars, the federal government planted a stake in the ground for crypto regulation yesterday. US Treasury Secretary Janet Yellen asked Congress to govern spot trading of cryptos that are not unregistered securities.

“The Council is focused on digital assets and related risks, such as from runs on crypto-asset platforms and stablecoins…Applicable rules and regulations should be enforced, and Congress should pass legislation to provide for the regulation of stablecoins and of the spot market for crypto-assets that are not securities.”

Previously, Jeremy Allaire, the CEO of USDC stablecoin issuer Circle, said he is optimistic about the US passing stablecoin regulation this year. Stablecoins are assets pegged one-to-one with fiat currencies.

BeInCrypto has contacted the Virginia State Department for comment but has yet to hear back at the time of publication.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.