The price of Bitcoin has been on an upward trajectory, recently surpassing the $52,000 mark, achieving its highest value since December 2021.

Data from ViaBTC indicates that with less than two months until Bitcoin’s fourth halving event, numerous investors anticipate this milestone to spark another bull market. The past six months have witnessed a consistent rise in Bitcoin’s price.

Anticipating the imminent Bitcoin halving, some miners are preemptively upgrading to more efficient mining rigs or relocating to regions with cheaper electricity to navigate the challenges ahead. Yet, this strategic move presents a conundrum for those operating on tight budgets.

Opting to upgrade necessitates selling Bitcoin, potentially at lower prices, risking the loss of significant gains in the bull market. Conversely, holding onto their Bitcoin without upgrading risks diminishing their competitive edge post-halving, thereby forfeiting potential mining profits amidst the bull run.

How should miners navigate this quandary? ViaBTC introduces a solution by integrating traditional financial strategies into the crypto space—ViaBTC Crypto Loan services tailored for miners. This innovative approach offers miners a nuanced financial strategy, enabling them to leverage their crypto holdings as collateral for loans. This way, they can upgrade their operations while still participating in the market’s upside, effectively maximizing their mining profits.

What are Crypto Loans?

Crypto Loans is a bespoke financial instrument crafted by ViaBTC specifically for its pool users, designed to offer flexible solutions for liquidity challenges. This service caters to miners who are bullish on the long-term prospects of their cryptocurrency holdings yet require immediate liquidity to manage day-to-day operational costs.

By pledging their cryptocurrency assets, miners gain access to loans from ViaBTC, enabling them to bridge short-term financial gaps. Upon improvement of their financial standings or identifying an opportune moment for sale, they can settle the loan and reclaim their pledged digital assets.

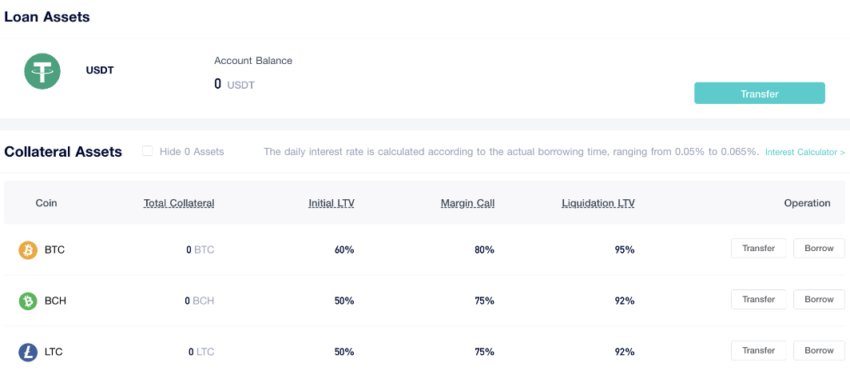

The service accommodates Bitcoin (BTC), Bitcoin Cash (BCH), and Litecoin (LTC) as collateral options, providing USDT as the loan currency. This arrangement affords miners a strategic avenue to retain their cryptocurrency investments while adeptly navigating short-term financial needs.

How does Crypto Loans Maximize Profits?

ViaBTC Crypto Loans as a strategy for profit maximization comes into play notably during bullish market trends. Consider the scenario of miner Bob on October 15, 2023, deliberating whether to liquidate Bitcoin for new mining equipment. Owning 5 BTC, each priced at approximately $27,000, he required 81,000 USDT for the equipment upgrade. Traditionally, selling 3 BTC would procure the necessary funds, leaving him with 2 BTC and 81,000 USDT for operational liquidity.

Opting instead for ViaBTC Crypto Loans service, Bob could leverage his 5 BTC at a 60% initial LTV, securing 81,000 USDT. By February 21, 2024, with Bitcoin’s value climbing to $52,000, Bob decides to settle the loan. This strategic move, allowing him to sell 3 BTC for an approximate total of 156,000 USDT, leaves him with a surplus of roughly 69,520.35 USDT after repaying the 81,000 USDT principal and 5,479.65 USDT in interest over 129 days, plus the 2 BTC he retained.

This approach starkly contrasts with direct selling, demonstrating how ViaBTC Crypto Loans shields miners from missing out on potential market upswings, securing Bob an additional nearly 70,000 USDT in profits and showcasing the method’s prowess in profit maximization during favorable market conditions.

How to Use Crypto Loans?

ViaBTC Crypto Loans streamlines the process for rapid loan approval and disbursement, enhancing the efficiency of funds utilization. This service offers notable flexibility in repayment schedules through daily interest accrual, without fixed deadlines. It also allows for on-demand loan applications and repayments, aiding in the fluid management of finances to accommodate shifts in mining or investment strategies.

Steps for utilizing the service:

1. Asset Transfer: Miners should transfer assets intended for collateral from their mining to their loan account and proceed with the loan application.

2. Asset Freeze: ViaBTC freezes an amount of assets based on the loan request and a predetermined Initial LTV, like 60% for BTC.

3. Loan Disbursement: Upon approval, the loan sum is deposited into their loan account, ready for immediate use or withdrawal for operational liquidity.

4. Repayment and Redemption: Borrowers can repay the loan and interest with USDT. Post-repayment, ViaBTC releases the collateral. Alternatively, borrowers may opt for ViaBTC to sell the collateral for loan settlement, with any excess USDT credited to their account. For the delegation, selling amount and price are up to you.

Given the volatility of cryptocurrency markets, collateralized lending carries risks, including potential forced liquidation if the cryptocurrency’s value drops significantly. The system alerts users as current LTV ≥ Margin Call LTV, recommending vigilance with notifications and possibly using the auto pledge feature to mitigate loss risks.

For miners at the onset of a bull market, utilizing ViaBTC Crypto Loans stands as a strategic choice to not miss out on potential market rallies. This approach not only facilitates holding onto cryptocurrencies in anticipation of value appreciation but also ensures the availability of operational liquidity. By adeptly analyzing market trends and employing financial instruments judiciously, miners are positioned to optimize their investment gains and capitalize on favorable market conditions.

Disclaimer: This text is for informational purposes only and should not be interpreted as financial advice.

Disclaimer

This article contains a press release provided by an external source and may not necessarily reflect the views or opinions of BeInCrypto. In compliance with the Trust Project guidelines, BeInCrypto remains committed to transparent and unbiased reporting. Readers are advised to verify information independently and consult with a professional before making decisions based on this press release content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.