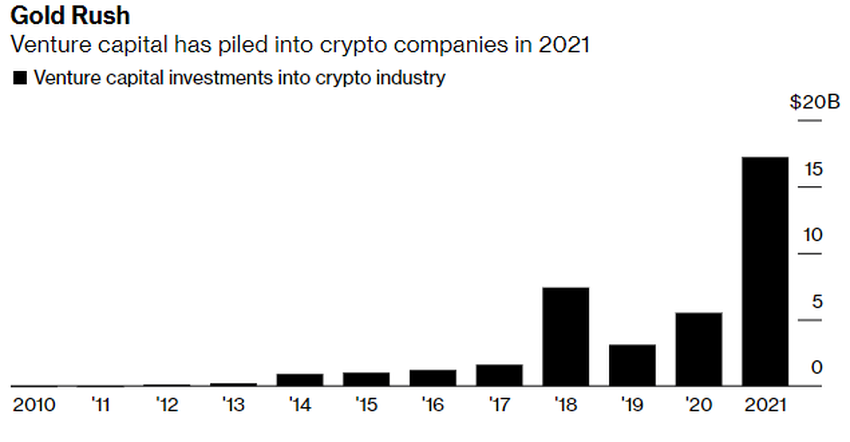

Venture Capital funds have invested a yearly record into the crypto market, eclipsing over $17 billion in 2021 already.

According to market data company PitchBook, firms have been extremely active in terms of their investments into the crypto market.

2021 has seen an estimated $17 billion invested already. While the previous yearly record saw 2018 bring in a total of $7.4 billion. 2021 has essentially managed to bring in the combined investment amount of all previous years combined from 2010.

Crypto deals in 2021

The largest deal in 2021 alone saw a staggering $10 billion from Block.One invested in crypto exchange Bullish Global. The exchange also raised an additional $300 million in a funding round.

The single deal broke the record for crypto investments for the year on its own.

$380 million invested in crypto wallet company Ledger sees the company take the second biggest investment in 2021. The investment comes from 10T Holdings, which operates as a mid to late stage growth equity fund that invests in private companies operating in the digital asset ecosystem.

“I’m of the opinion that everyone will own crypto, it’s just a matter of what price they get in,” said Ian Rogers, Ledger’s chief experience officer. “We’re still at the protocol phase, we know that there’s something here, you just can’t picture what it’ll exactly look like. For Ledger, we’re definitely not at the selling an iPod at Target moment yet.”

Other notable crypto investments include $350 million invested in BlockFi and Dapper Labs, $300 million invested in Paxos and Blockchain.com.

Thirst for crypto exposure continues

2021 has seen an accelerated interest within the crypto space as companies look to gain exposure to the market. Andreessen Horowitz has previously announced it would be looking to launch a $1 billion crypto investment fund following the huge success of its investment in Coinbase.

Galaxy Digital also took steps earlier this year to acquire BitGo, an independent digital assets infrastructure provider. The acquisition is said to be worth $1.2 billion. Furthermore, Goldman Sachs recently announced its partnership with Galaxy Digital in offering bitcoin futures trading through the company and its latest acquisition.