VeeFriends’ sales experienced a steep fall in volume during July due to a lack of investment appetite for non-fungible tokens (NFTs).

VeeFriends is one of the most successful NFT projects by all-time sales. As of Aug 8, the NFT had a combined sales volume of more than $550 million.

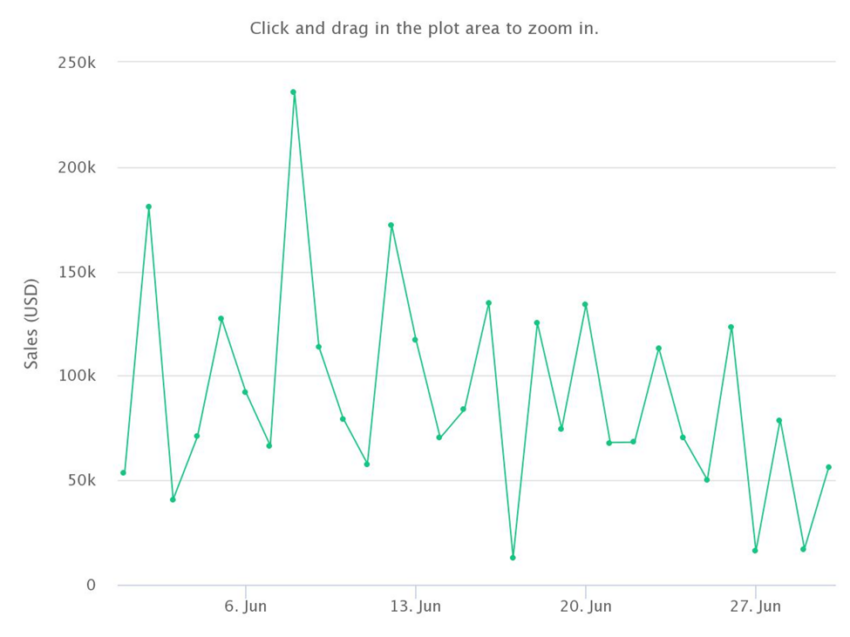

VeeFriends sales stood at approximately $1.8 million by the end of July, according to data from CryptoSlam.

Although this figure may seem high when compared to the volume recorded by The Sandbox, sales remained far below Axie Infinity, NBA Top Shots, CryptoPunks, Otherdeeds, Bored Ape Yacht Club (BAYC), and its sister project Mutant Ape Yacht Club (MAYC).

With that said, July’s sales were a 35% drop from June. In June, VeeFriends sales were about $2.7 million.

Why the crash in sales?

When analyzing the number of unique buyers from July, the dip in sales volume led to the waning transaction counts, with 120 unique buyers, and 162 transactions.

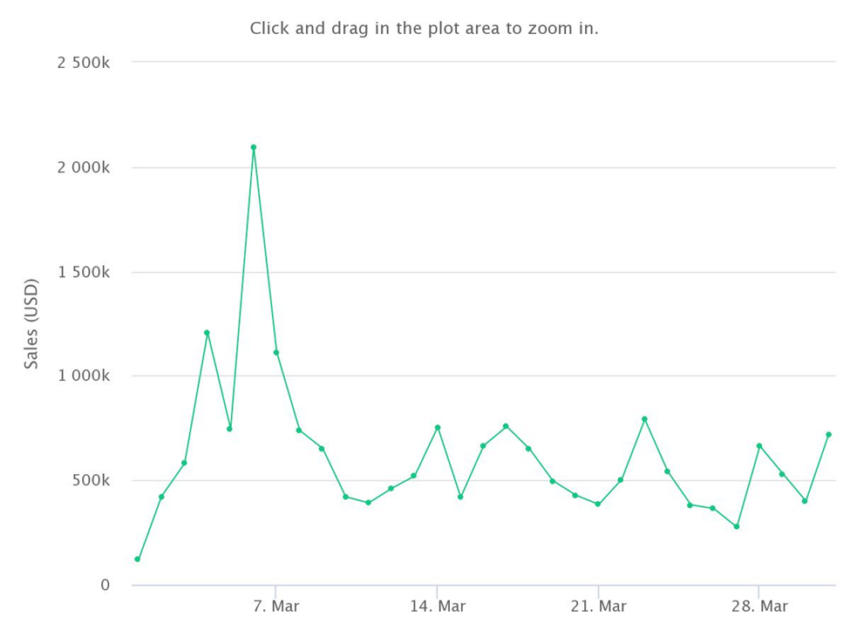

In contrast to March 2022, when VeeFriends reached a yearly high, unique buyers stood at 290, and this corresponded to 392 transactions. In March, the NFT had a sales volume of around $19.2 million.

By generating less than $2 million in sales for the first time, the digital collectibles reached a new low in 2022, which was $17 million below volume from March.

Average sale value also plummeted to new lows within the period. There was a 77% decline in average sale value from $48,975 in March to $10,891 in July.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.