VanEck, a leading New York-based fund group managing approximately $100 billion in assets, spearheads a significant debate on the approval process for spot Ethereum exchange-traded funds (ETFs) in the United States.

The firm, which first filed for a spot Ethereum ETF in 2021, advocates for the Securities and Exchange Commission (SEC) to honor the order of filings.

VanEck Requests SEC to Uphold First-Come, First-Serve Order Basis

Matthew Sigel, VanEck’s head of crypto research, has voiced concerns about the SEC’s current approach. The SEC currently permits multiple firms to launch their financial product, such as ETFs, simultaneously, regardless of when they filed. The regulator followed this approach and allowed the launch of all the spot Bitcoin ETFs on January 11.

“We were first to file and we expect to be first to respond to comments and first out the door. When you filed used to mean something, and it should again,” Sigel stated in an X space.

Read more: Ethereum ETF Explained: What It Is and How It Works

Moreover, Sigel contends that respecting the filing queue is a matter of fairness and essential for maintaining orderly market practices.

“It creates an uneven playing field for issuers who filed earlier and had to wait longer. Those who filed months ago had to keep their applications updated and compliant for a longer period, incurring more costs and legal fees compared to later filers,” Sigel argued.

This issue comes to a head as the SEC’s 240-day review period for VanEck’s latest ether ETF bid concludes today. This is just a day before the commission is scheduled to make a decision on similar proposals by Ark Invest and 21Shares.

Notably, until last week, VanEck CEO Jan van Eck anticipated potential rejection for their spot Ethereum ETF. He noted that despite being pioneers, both VanEck and Ark Invest are likely facing rejection.

However, the tides have changed since the beginning of the current week. This is because Bloomberg ETF analysts Eric Balchunas and James Seyffart recently upgraded the chances of approval for spot Ethereum ETFs from 25% to a hopeful 75%.

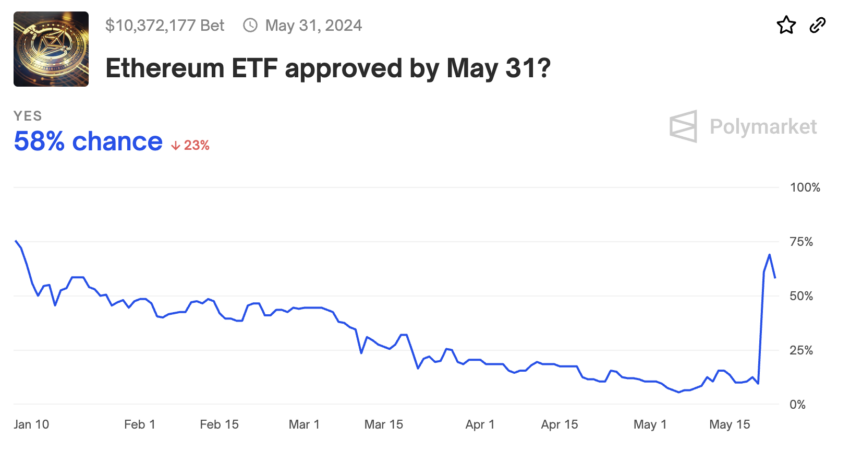

Similarly, prediction platforms like Polymarket have shown a significant increase in the odds of approval, which rose from 10% to 58% last week.

Read more: How to Invest in Ethereum ETFs?

Additionally, the SEC has requested revisions to the spot Ethereum ETF proposals from Nasdaq and Cboe, a move seen as a crucial step towards potential approval. This development indicates a possible reconsideration of the regulatory stance towards Ethereum ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.