Celsius has distributed $2.5 billion to about two-thirds of select creditors, partially fulfilling the bankruptcy restructuring plan it shared in October 2023. However, the process has not been without controversy, as some users have raised concerns about how the distribution is being handled.

The Celsius Network, once one of the largest crypto platforms, declared bankruptcy in 2022. The firm voluntarily halted withdrawals in July of that year after the market crash triggered by the collapse of the Terra Luna ecosystem.

Celsius Distributes $2.5 Billion Via Coinbase and PayPal

Celsius exited Chapter 11 bankruptcy in February, completing its reorganization plan, which involved distributing over $3 billion in cryptocurrency and fiat to creditors.

Recent updates from the bankruptcy administrator reveal that the firm has distributed more than $2.53 billion to around 251,000 creditors through platforms like Coinbase and PayPal. This distribution represents approximately 93% of the total value based on January 16 prices.

The firm initiated payouts in January, with approximately $1.7 billion (65%) distributed within the first two weeks. The distributions increased to around 80% (nearly $2 billion) a month later.

Read more: Top 5 DeFi Lending Platforms

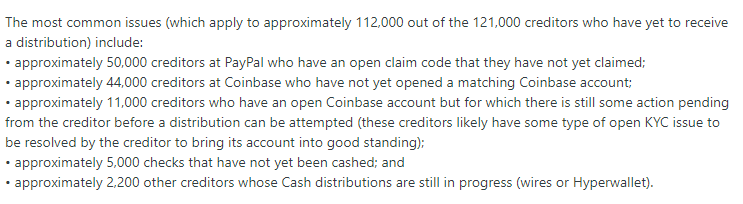

Currently, nearly 121,000 qualified creditors have yet to claim their payouts, with an average claim of approximately $1,500. Among these, nearly 64,000 are owed less than $100 each, while another 41,000 have claims ranging from $100 to $1,000.

Approximately 12,000 creditors are still awaiting their share from the bankruptcy distribution. The bankruptcy administrator cites two main reasons for the delay: some claims are held back, while others are missing essential information.

Despite the progress, some users have expressed frustration with the distribution process, describing it as overly complicated and lacking transparency. Delays in payouts have also been a source of concern.

“I have still been under manual review on Coinbase for 9 months now. Countless documents and emails and yet still no verification. They have not even responded to my last email for a month. I guess I am going to have to ask for a wire transfer,” one user complained.

While comments on Reddit suggest customer dissatisfaction, the bankruptcy proceedings may end soon as only a handful of distributions remain.