Once just another meme coin riding the Solana summer hype, Useless Coin (USELESS) has become anything but that for early traders; many are now clocking six-figure profits.

But as the token’s price stalls around $0.28 and smart money starts thinning out, the question becomes: how long can this meme float before the sell pressure wins?

Top Wallets Already In Profit And Might Be Eyeing the Exit

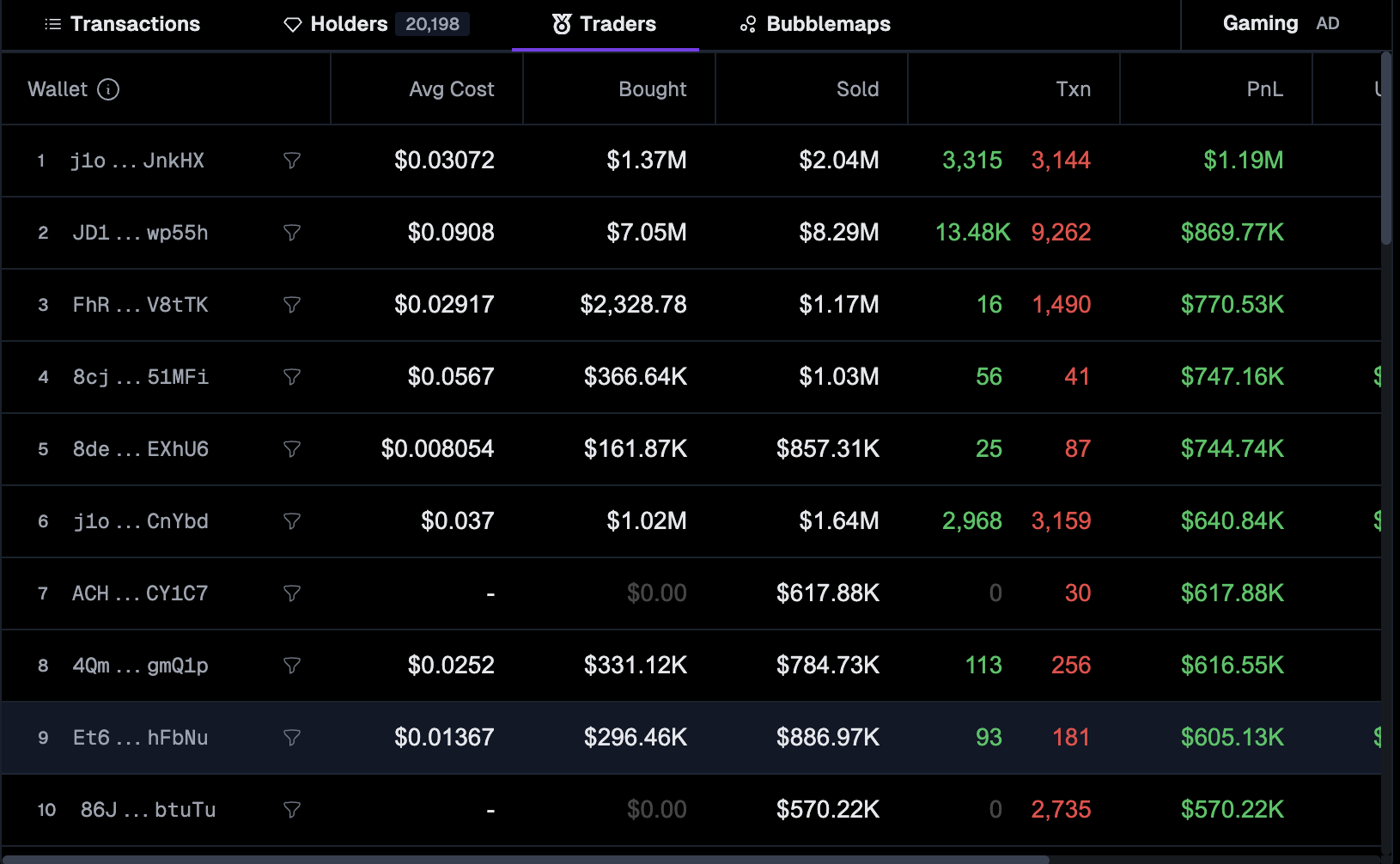

According to the GeckoTerminal Traders tab, 9 of the top 10 wallets are deep in the green. One address has flipped over $1.19 million in realized gains, with another clocking $869,000, and so on down the list. Even wallets that didn’t start big have turned five-figure buys into monster flips.

This isn’t just “some profit.” These wallets bought USELESS early; average entry prices range from $0.008 to $0.09, and have now unloaded millions. With most already exiting a majority of their positions, the risk of further USELESS price dumps from remaining bags is high.

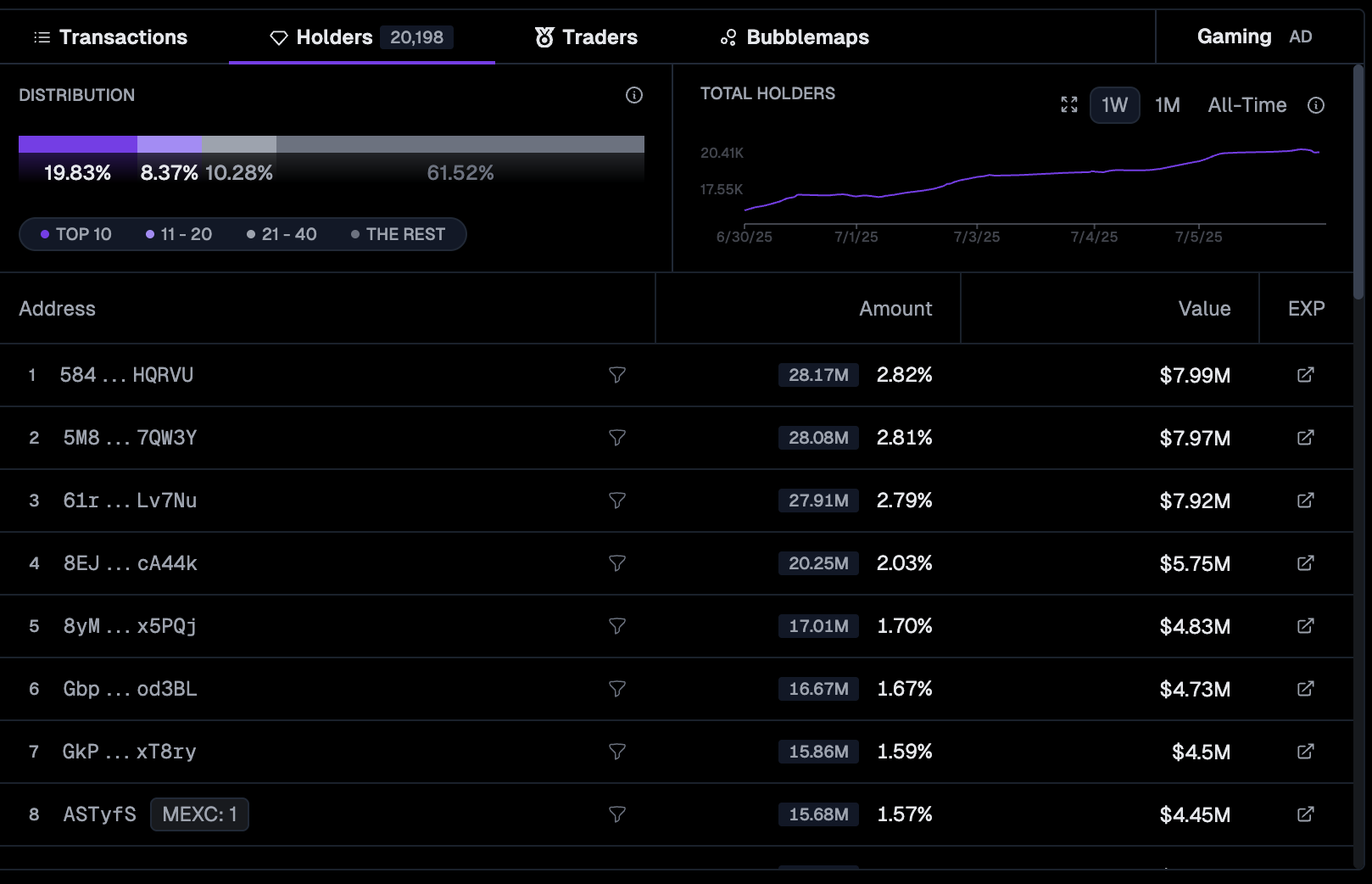

Distribution Suggests Whale Control

Looking at the holder concentration chart, nearly 20% of the total token supply is held by the top 10 wallets. The top address alone controls 2.82% ($7.99 million). This kind of token concentration is prone to aggressive sell-offs.

Sell Volume Spikes As Price Slides Under VWAP

At the time of writing, the live transaction feed is a bloodbath. Sell after sell is hitting the books, with only the rare green candle in between. A retail dump of 3,461 USELESS ($982.84) and another of 1,223 tokens ($347.60) both occurred just recently.

On the price chart, USELESS recently broke down from a rising triangle, a classically bearish structure. The rejection at the upper trendline, coupled with a failure to hold Volume-Weighted Average Price (VWAP) support ($0.2844), now opens up room toward the $0.2615, $0.2339, and $0.2235 levels.

VWAP, or Volume-Weighted Average Price, shows the average price at which traders bought the token, adjusted for volume; losing this level signals weakening buyer control.

OBV Divergence Confirms Weakening Momentum

The final hint? On-Balance Volume (OBV). Despite price consolidating near highs, OBV has been bleeding sideways, a clear sign that real demand isn’t keeping up. The volume profile is showing strength only during sell-offs, barring a single July 7 candle, while buy-side volume weakens.

OBV, or On-Balance Volume, measures whether more volume is flowing into or out of a token. When OBV stalls while the price stays elevated, it usually means early buyers are quietly offloading.

Fibonacci Levels Put Breakdown Risk Around $0.25

The Fibonacci retracement was drawn from $0.3047 (recent high) to $0.2218, which marked the lowest wick before the bounce began. This point was chosen because it was the last major drop before buyers stepped in; a clean local bottom that confirms the full extent of the move.

By anchoring it here, we get clearer retracement zones, with $0.2870 (0.786 Fib) now acting as immediate resistance. If that fails, the price could slide toward $0.2630 (0.5 Fib) or even $0.2414 (0.236 Fib).

This structure helps map out the risk levels if the breakdown deepens. With rising sell volume and fading support, USELESS looks vulnerable below $0.28.

Fibonacci levels are used to map likely retracement zones during corrections, with 0.5 and 0.236 often acting as key support lines.

Useless Coin traders might still meme, but the data shows serious wallets are exiting. With deep profits booked, sell volume rising, and OBV confirming weakness, the chart points to one thing: a breakdown might already be in motion.