Eight years after Tether issued its first USDT token on Oct. 6, 2014, the company could claim to have seen it all: allegations of price manipulation, regulatory legal fights, and repeated FUD (fear, uncertainty, and doubt) attacks.

Through it all, USDT continued to grow, becoming the world’s largest stablecoin with over $68 billion in assets. USDT, also known as Tether, is a cryptocurrency that its founders say is 100% backed by liquid assets such as cash or Treasury bills.

Stablecoin pioneer

USDT is pegged one-to-one against the U.S. dollar. That means it could theoretically remain stable even during periods of volatility – hence the name stablecoin. The invention by Tether has become an important aspect of the crypto ecosystem.

“To date, stablecoins have served as a necessary offramp that has been used by traders to move quickly in and out of positions and provide a stable unit of account for settling crypto payments,” Paolo Ardoino, chief technology officer of Tether, told Be[In]Crypto.

“Tether holds a strong, conservative, and liquid portfolio. Its quarterly assurance attestations by independent accountants [prove] all tethers are fully backed and reserved. Those reserves have also been stress-tested. Importantly, it has never refused a redemption to a customer.”

Originally known as “Realcoin”, USDT was founded eight years ago by Brock Pierce, Craig Sellars, and Reeve Collins. The first USDT tokens were issued on Oct. 6, 2014, on the Omni layer on top of the Bitcoin blockchain. Now, it is spread across 14 chains.

According to Coinmarketcap, Tether spawned a stablecoin market now valued at more than $148 billion. Itself, USDT reached a total of $450,000 coins in circulation within one year from launch, and then $7 million a year later, the company said in a blog post.

By end of 2018, the total number of issued USDT hit the equivalent of $2 billion, rising 2,900% to more than $60 billion by end of 2021. Tether has become the primary stablecoin against which the majority of crypto assets are traded in both spot and futures markets.

Most derivative products in decentralized finance, or DeFi, are priced against USDT. In terms of daily trading volume, tether dominates. It accounted for over 76% of the $39 billion traded in the previous 24 hours, per data compiled by CoinGecko.

“Tether was created by a coalition of crypto enthusiasts who have a deep understanding of what Bitcoin and the crypto community need in order to thrive and its main role is to make the crypto economy more efficient,” Ardoino told BeInCrypto.

“Because of this, we have been best positioned to create a financial system that democratizes access to financial services including everything from banking the unbanked to being a tool for market participants.”

USDT reserves questioned

While Tether USDT’s growth looks impressive, both the company and the stablecoin it made have become prime targets of criticism. It has been under pressure to be more transparent about the reserves backing USDT.

Advocates argue that disclosure would help investors better understand potential risks and determine how auditors are interacting with the company. Critics believe USDT might not be backed by the reserves it claims to have.

Pseudonymous Twitter user “Bitfinex’ed” has led the crusade against Tether, accusing the firm of creating “Tethers out of thin air” via the crypto exchange Bitfinex. Tether is owned by a Hong Kong-based company called iFinex, which in turn owns Bitfinex exchange.

Tether has repeatedly refuted the allegations. The company is working with a Cayman-based accounting firm called MHA for a full audit of its reserves. Tether has so far only produced attestations – a snapshot of a company’s balance sheet on a given date.

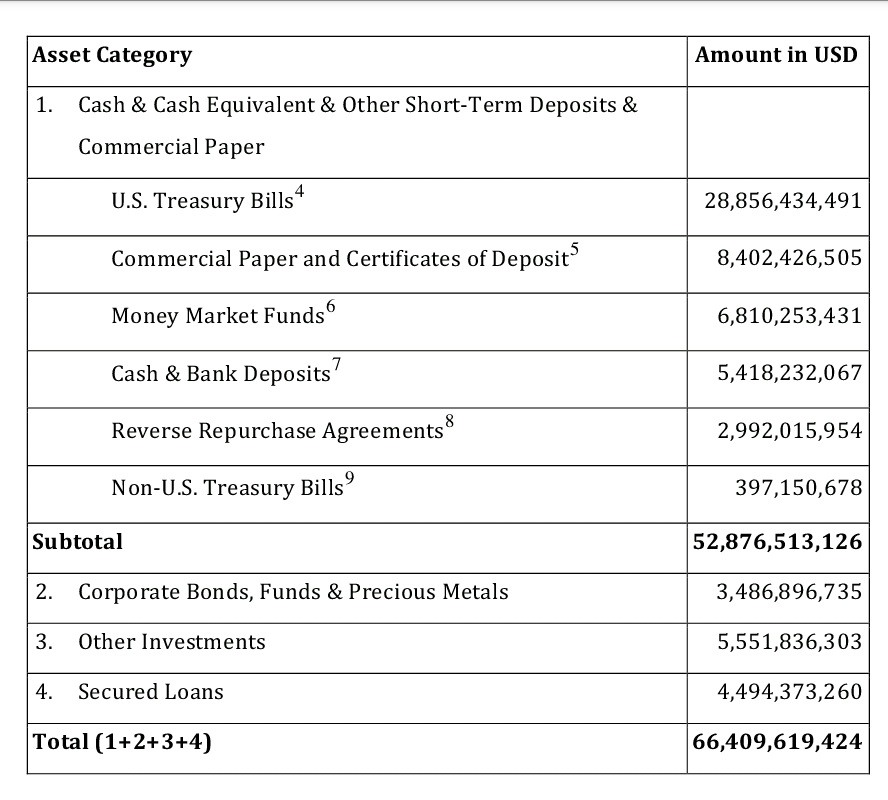

According to its latest auditor’s update in June, Tether USDT reserve is made up of $28.86 billion in U.S. Treasury bills, $8.40 billion in commercial paper, $6.81 billion in money market funds, and $5.42 billion in cash. The remainder is held in other assets such as corporate bonds.

The reserve is equivalent to the value of USDT the firm had in circulation at the time, which totaled $66.41 billion. Paolo Ardoino, the Tether CTO, said commercial paper holdings have since declined to $50 million and U.S Treasury bills now account for nearly 60% of reserves.

“Tether has maintained its stability through multiple black swan events and highly volatile market conditions and, even in its darkest days,” Ardoino averred. “Tether has never once failed to honor a redemption request from any of its verified customers.”

Verified users include exchanges and other corporate clients.

Ardoino was referring to the high-profile collapse of the Terra blockchain in May. Amid the chaos, USDT temporarily lost its parity to the dollar, dropping to $0.95, as investors exited the stablecoin in panic. Over $7 billion was redeemed within 48 hours.

“Unprecedented redemptions highlight hard facts on our stability after Terra’s crash this year. Tether continued to honor redemptions normally,” he told this publication.

Regulatory scrutiny

As a new asset that challenged the status quo, Tether was always going to land itself in the crosshairs of regulators that are steeped in tradition.

In 2019, Tether’s parent company iFinex was sued by New York Attorney General Letitia James on allegations of mixing up to $1 billion in corporate and customer deposits, later lost or stolen. It settled in an $18.5 million deal involving a ban on trading.

Tether has also been investigated by the U.S. Commodity Futures Trading Commission on account of the reserves backing its USDT stablecoin. It paid more than $41 million in fines for inaccurately reporting that USDT was 100% backed by the U.S. dollar.

In fact, the stablecoin was 100% backed by a combination of the dollar and other non-fiat assets, James alleged. Tether has been further accused of market manipulation. According to research by Griffin and Shams, Bitcoin prices rose each time Tether minted new tokens in a bear market.

The company rubbished the allegations and later academic studies cleared Tether of wrongdoing. However, with the demise of Terra, stablecoins have come under increased attention from regulators. Ardoino said Tether was cooperating fully with regulators.

“Stablecoin regulation will provide much-needed clarity for larger corporates, institutions, and fintech companies to enter the crypto market,” he explained.

“As this takes shape, we envision it will open up the gateways for more products to be introduced to the market, and a better way to do business.”

Looking ahead

Paolo Ardoino told Be[In]Crypto that “Tether is focused on being a catalyst for the freedom of communications, freedom of money, and equality in access.”

“We look forward to continuing to emphasize these messages by bringing digital dollars to the real world. Tether has its sights set on reaching retailers and shops in the future,” he said.

“We believe that Tether tokens are set to outpace traditional credit and debit card solutions because they are cheaper, faster, and more transparent.”

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here