On July 29 at 16:18 UTC, Arkham Intelligence’s on-chain data revealed the movement of approximately 28,000 Bitcoin (BTC) from the Silk Road DOJ Confiscated Funds to new addresses.

This US government transfer, worth roughly $2 billion, has caused a stir among the crypto community.

The US Government’s $2 Billion Bitcoin Transfer Sparks Debate

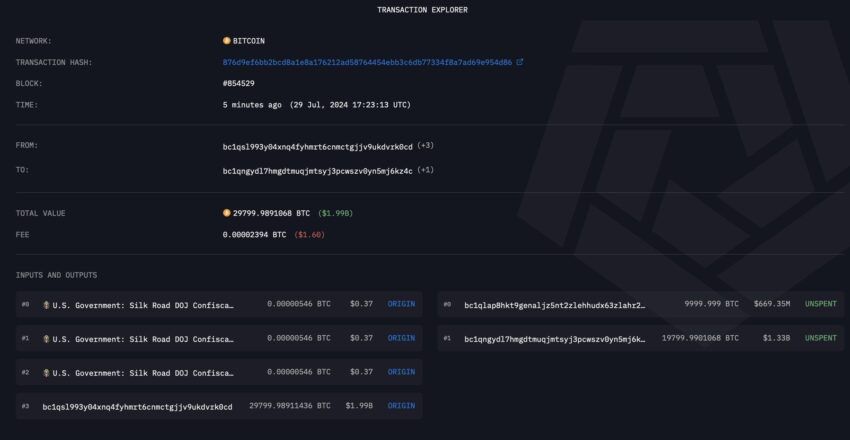

According to Arkham, initially, the US government transferred those Bitcoins to address ‘bc1qs.’ Around one hour after this transaction, these assets were split between two addresses. The first received 10,000 BTC, valued at $669.35 million, while the second got 19,800 BTC, worth $1.33 billion.

Arkham Intelligence suggested that the first address likely represents an institutional custody service deposit. Despite this substantial transfer, the US government’s crypto portfolio still holds over $12 billion in Bitcoin.

Read more: Who Owns the Most Bitcoin in 2024?

This transaction’s timing is noteworthy. It occurred just two days after former President Donald Trump revealed plans to prevent the government from selling its Bitcoin holdings if he returns to office. Trump’s announcement has fueled speculation about the potential for the US to leverage Bitcoin as a reserve asset under his leadership.

The transfer sparked varied reactions. Tyler Winklevoss, co-founder of the Gemini crypto exchange, pointed out the timing on X (formerly Twitter).

“On Saturday, Trump pledged to never sell any of the US government’s bitcoin. Two days later, the Biden-Harris Administration moves $2 billion of Silk Road Bitcoin. Great look and a great way to reset with our industry,” he commented, adding a clown emoji to highlight his skepticism.

Read more: 7 Best Crypto Exchanges in the US for Bitcoin (BTC) Trading

Economist Peter Schiff suggested that Trump’s announcement might have prompted the current administration to act swiftly. He indicated that if Trump had truly planned to use seized Bitcoin to establish a US ‘strategic’ reserve, he would have kept his intentions secret until he officially took office.

“Now that the Biden administration is wise to his plan, they’ll make sure to sell every satoshi before Trump takes office,” Schiff remarked.

BitGet Research Chief Analyst Ryan Lee views the recent moves in the cryptocurrency market as predictable.

“According to Coinbase data, 25% of Americans hold crypto assets. It is expected that before the official voting, both political parties will release various news about BTC and other crypto assets to attract voters. BTC prices may rise due to such news, potentially reaching previous highs. It is estimated that BTC’s fluctuation range in August will be $62,000 to $73,000,” he told BeInCrypto.

BeInCrypto reported in April that a government wallet sent nearly 2,000 BTC to a Coinbase Prime hot wallet. Additionally, the US Marshals Service, which manages and sells seized assets, recently announced a $32.5 million payment to Coinbase for custodial services.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.