Legislators of both major parties demand to know more about how terrorists misuse digital currencies’ anonymity and lack of oversight for evil ends. And how to fight the scourge more effectively.

On Thursday, the US House of Representatives considered a bipartisan draft bill that would establish an Independent Financial Technology Working Group to Combat Terrorism and Illicit Financing.

The Financial Technology Protection Act of 2023 is the newest version of a bill introduced in past sessions. It is an attempt to grapple with emerging financial technologies, like crypto, as they affect national security and financial stability.

Bipartisan War on Terrorists

The bill’s new version, co-sponsored by Senators Kirsten Gillibrand (D-NY) and Ted Budd (R-NC) and Representatives Zach Nunn (R-IA) and Jim Himes (D-CT), aims to establish a working group. It will study the actual and potential use of cryptocurrencies and other emerging technologies by terrorists and criminals, Nunn told CoinDesk, according to a Yahoo news report on Thursday.

The new group will consist of officials from across government agencies and departments. Including the Central Intelligence Agency, the Federal Bureau of Investigation, the Justice Department, the Secret Service, the Financial Crimes Enforcement Network, and the State Department. Plus five individuals appointed by the Under Secretary for Terrorism and Financial Intelligence to represent financial technology companies, financial institutions, and research organizations.

They will perform independent research on digital assets, including crypto, and propose regulations. The working group will also submit annual reports to the Secretary of the Treasury.

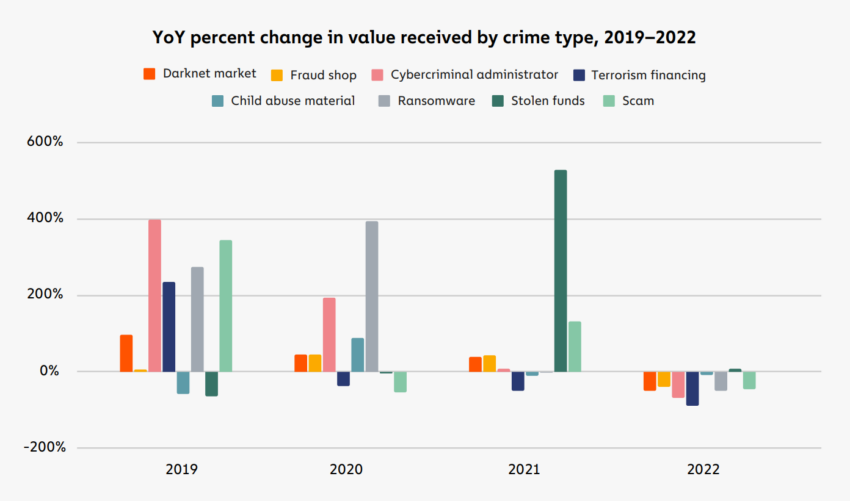

With crypto crime on the rise, Congress is paying more attention to the interplay of finance, tech, and crime. Last year, illicit transaction volume hit an all-time high of $20.6 billion. Terrorism financing also increased from the year before. Although not as much as in 2021.

Terrorism Linked To Crypto

As recently as three years ago, approximately 5% of terrorist incidents had connections to crypto or digital assets. That number is more like 20% now, according to a senior UN figure in a recent Bloomberg interview.

Crypto mixers like Tornado Cash have been in trouble recently for obscuring financial links to organized crime. These crypto mixers work by combining multiple users’ cryptocurrency transactions to obscure the source and destination. Sinbad.io, ChipMixer, and Blender are all mixers that have come under fire for laundering funds for North Korea. However, crackdowns on their use could present privacy risks.

Crypto-related illicit activity accounts for less than 1% of total volume. Despite an increase this year, the trend is downward.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.